Sydney, Nov 15, 2017 AEST (ABN Newswire) - Cassini Resources ( ASX:CZI) and its joint-venture partner Oz Minerals (

ASX:CZI) and its joint-venture partner Oz Minerals ( ASX:OZL) have announced the results of a scoping study for the West Musgrave nickel-copper-cobalt project in Western Australia. Highlights of the announcement include the following.

ASX:OZL) have announced the results of a scoping study for the West Musgrave nickel-copper-cobalt project in Western Australia. Highlights of the announcement include the following.

- Annual throughput - 10 Mtpa (previously 4 Mtpa).

- Average LOM nickel production - 20,000 to 25,000 tpa.

- Average LOM copper production - 20,000 to 25,000 tpa.

- Life of mine (LOM) C1 cost payable nickel - US$2.00 to $2.30 per lb.

- Life of mine (LOM) AISC payable nickel - US$2.90 to $3.30 per lb.

- Oz Minerals is proceeding to the next stage of the earn-in agreement, whereby Oz Minerals can acquire 51% of the project by spending $19 million within 18 months.

Analyst comment: this is a significant step forward for the West Musgrave project, as the increase in the size of the processing facility (10 Mtpa) moves it into major mining operation territory.

Without Oz Minerals' involvement (earning up to a 70% interest), it's unlikely Cassini would have considered a project of this size, given the capital constraints (Capex: $730 to $800 million). However, with Oz Minerals on board this capital risk has been significantly reduced.

Standout results from the study include the exceptionally low operating costs (LOM C1 cost payable nickel: US$2.00 to $2.30 per lb), driving a very healthy annual EBITDA (TSI av. years 1- 5: US$250 million pa - 100% project). Interestingly, we note that on a copper-equivalent basis, the LOM C1 cost payable Cu is US$0.20 to $0.40 per lb, making West Musgrave potentially Oz Minerals' lowest-cost operation.

We also note that despite the increase to the processing facility's capacity, the study outlined an initial 8 year mine life. Given this mine life excluded the inferred resource from the Nebo & Babel deposits (565,000 t of contained nickel and 635,000t of contained copper) as well as the Succoth deposit (943,000 t of contained copper), which are both likely to be included in future studies, it's conceivable that once production commences, West Musgrave may continue operating for more than 30 years.

The information in this email should not be the only trigger for your investment decision. We strongly recommend you seek professional financial advice whenever making financial investment decisions.

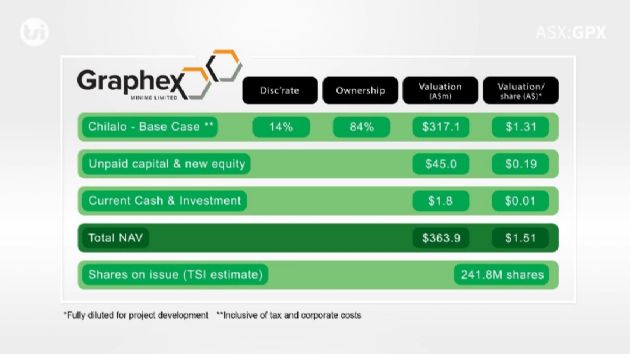

Valuation: we increased our valuation for Cassini to $0.34/share (previously $0.20/share).

This valuation was determined using a DCF with a 10% discount rate. We do, however, note the limitations of the DCF method of valuation for long-life, major mining operations such as this, since it does not fully account for its long-term value. Nevertheless, we consider DCF the most appropriate means of determining a valuation for Cassini at this stage.

To view the video, please visit:

http://www.abnnewswire.net/press/en/90891/Cassini

About Cassini Resources Ltd

Cassini Resources Limited (ASX:CZI) is a base and precious metals explorer and developer. The Company's flagship West Musgrave Project, located in Western Australia was acquired from BHP Billiton in 2014 and hosts a number of nickel and copper deposits as well as providing significant exploration upside.

Cassini Resources Limited (ASX:CZI) is a base and precious metals explorer and developer. The Company's flagship West Musgrave Project, located in Western Australia was acquired from BHP Billiton in 2014 and hosts a number of nickel and copper deposits as well as providing significant exploration upside.

About The Sophisticated Investor

The Sophisticated Investor is a new equity investment tool which seeks to assist investors in becoming more informed in their investment decision making. We show and tell investors about a company in a series of short, informative videos. We possess specialist equity analyst skills and are complemented by video professionals. We conduct site visits and interview management, in a way most investors simply aren’t able to access. We promote long term value creation for investors by employing detailed financial analysis and intrinsic value calculations.

Customer notice

Adam Kiley trading as The Sophisticated Investor ('TSI'), (AR No. 458224), is an authorised representative of Intelligent Financial Markets Pty Ltd (AFSL No. 426359). The information contained in this communication is intended as general advice only. Your personal objectives, financial situation and needs have not been taken into consideration. Accordingly, you should consider how appropriate the advice is (or is not) to your objectives, financial situation and needs before acting on the advice. The information in this communication should not be the only trigger for your investment decision. We strongly recommend you seek professional financial advice whenever making financial investment decisions.

Conflict of interest

TSI does and seeks to do business with companies featured in its articles and videos. As a result, investors should be aware that TSI may have a conflict of interest that could affect the objectivity of some articles or videos. Investors should consider TSI articles and videos as only a single factor in making any investment decision. The publishers also wish to disclose that they may hold stock in some companies featured in their articles and videos, and that any decision you make to purchase the stock of a company TSI profiles should be made only after you have initiated your own enquiries as to the validity of any information contained in those articles and videos.

Publisher's note

TSI will only initiate coverage of a company that passes our internal investment checklist. Once a company has passed this checklist, we will initiate coverage of that company and follow up with ongoing updates and commentary on its activities. Articles and videos produced and published by TSI are NOT Research Reports in terms of ASIC Regulatory Guide 79.

| ||

|