Perth, Oct 12, 2018 AEST (ABN Newswire) - Superior Lake Resources ( ASX:SUP) has released details of a restart study for its Superior Lake zinc project ('the Project') in Canada. Highlights of the announcement include the following.

ASX:SUP) has released details of a restart study for its Superior Lake zinc project ('the Project') in Canada. Highlights of the announcement include the following.

- Restart study confirms robust economics forecast:

o post-tax net present value 10% - US$158 million;

o low all in sustaining operating costs ('AISC') - US$0.51/lb (lowest global cost quartile);

o low initial capital costs - US$75 million.

- Initial mine life 6.5 years, with excellent potential to increase - exploration target 2.1 to 5.2 Mt grading between 13.3% and 15.4% Zn.

- Annual average concentrate production of 88,000 tpa Zn and 6,700 tpa Cu.

- Fully funded definitive feasibility study commenced - due for completion mid-2019.

Analyst comment: this is a strong result for SUP, given that it took control of the Project less than 12 months ago. The standout feature of the study was the low AISC of US$0.51/lb (C1 cost US$0.39/lb), which ranks the Project in the lowest cost quartile of zinc producers globally. It ensures that the Project will remain profitable in the future, even if the zinc price deteriorates (current spot - US$1.21/lb), which appears unlikely in the near term in that zinc stockpiles remain at near record lows, with limited new supply forecast to enter the market.

Virtual site trip: we recently visited the Project in Canada and were impressed. As expected, the surrounding infrastructure is world-class. Moreover, existing development at the site, which will be utilised in the future, has keep capital costs relatively low for a project of this type. We encourage investors to view our virtual site trip by visiting http://thesophisticatedinvestor.com.au

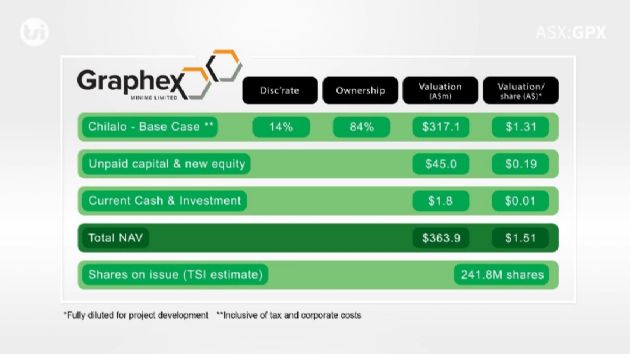

Valuation: in light of the restart study, we have provided an initial valuation target for SUP of $0.12 / share (share price $0.045 / share). We determined this valuation by via a DCF valuation on the Superior Lake project at a discount rate of 10%. For more details of the key assumptions underlying our valuation, watch the attached video.

To view the video, please visit:

http://www.abnnewswire.net/press/en/94990/SUP

About Superior Lake Resources Ltd

Superior Lake Resources Ltd (ASX:SUP) engages in the exploration and development of mineral prospects in Australia and Canada. It primarily explores copper, zinc, gold, and other base metals. The company holds interests in the Pick Lake Zinc project covering 47.5 square kilometers of area located in northwest Ontario; and the Winston Lake Project covering 4.5 square kilometers of area located in northwest Ontario. It also holds interests in the Leonora Project located in the Eastern Goldfields Province of the Archaean-aged Yilgarn Craton of Western Australia; and the Mt Morley Project covering 50 square kilometers of area located in Western Australia. The company was founded in 2009 and is based in Perth, Australia. Superior Lake Resources Limited is a subsidiary of Add New Energy Investment Holdings Group Limited.

Superior Lake Resources Ltd (ASX:SUP) engages in the exploration and development of mineral prospects in Australia and Canada. It primarily explores copper, zinc, gold, and other base metals. The company holds interests in the Pick Lake Zinc project covering 47.5 square kilometers of area located in northwest Ontario; and the Winston Lake Project covering 4.5 square kilometers of area located in northwest Ontario. It also holds interests in the Leonora Project located in the Eastern Goldfields Province of the Archaean-aged Yilgarn Craton of Western Australia; and the Mt Morley Project covering 50 square kilometers of area located in Western Australia. The company was founded in 2009 and is based in Perth, Australia. Superior Lake Resources Limited is a subsidiary of Add New Energy Investment Holdings Group Limited.

About The Sophisticated Investor

The Sophisticated Investor is a new equity investment tool which seeks to assist investors in becoming more informed in their investment decision making. We show and tell investors about a company in a series of short, informative videos. We possess specialist equity analyst skills and are complemented by video professionals. We conduct site visits and interview management, in a way most investors simply aren’t able to access. We promote long term value creation for investors by employing detailed financial analysis and intrinsic value calculations.

Customer notice

Adam Kiley trading as The Sophisticated Investor ('TSI'), (AR No. 458224), is an authorised representative of Intelligent Financial Markets Pty Ltd (AFSL No. 426359). The information contained in this communication is intended as general advice only. Your personal objectives, financial situation and needs have not been taken into consideration. Accordingly, you should consider how appropriate the advice is (or is not) to your objectives, financial situation and needs before acting on the advice. The information in this communication should not be the only trigger for your investment decision. We strongly recommend you seek professional financial advice whenever making financial investment decisions.

Conflict of interest

TSI does and seeks to do business with companies featured in its articles and videos. As a result, investors should be aware that TSI may have a conflict of interest that could affect the objectivity of some articles or videos. Investors should consider TSI articles and videos as only a single factor in making any investment decision. The publishers also wish to disclose that they may hold stock in some companies featured in their articles and videos, and that any decision you make to purchase the stock of a company TSI profiles should be made only after you have initiated your own enquiries as to the validity of any information contained in those articles and videos.

Publisher's note

TSI will only initiate coverage of a company that passes our internal investment checklist. Once a company has passed this checklist, we will initiate coverage of that company and follow up with ongoing updates and commentary on its activities. Articles and videos produced and published by TSI are NOT Research Reports in terms of ASIC Regulatory Guide 79.

| ||

|