Sydney, June 10, 2016 AEST (ABN Newswire) - Lithium Australia NL ( ASX:LIT) was one of the first groups to identify the growing demand for lithium on the ASX. However, unlike the majority of other lithium focused companies that have ambitions to discover and eventually produce lithium concentrate, Lithium Australia has plan to become a vertically integrated producer of lithium chemicals through the development of their Sileach hydrometallurgical processing technology.

ASX:LIT) was one of the first groups to identify the growing demand for lithium on the ASX. However, unlike the majority of other lithium focused companies that have ambitions to discover and eventually produce lithium concentrate, Lithium Australia has plan to become a vertically integrated producer of lithium chemicals through the development of their Sileach hydrometallurgical processing technology.

Sileach aims to reduce the cost of lithium chemical production from hard rock sources by eliminating roasting, a major cost associated with chemical production, as well as increasing by-product credit revenue.

Analyst Comment & Valuation: If Lithium Australia (LIT) commercialises Sileach, it could revolutionise the lithium industry, as it would reduce the cost to produce lithium chemicals from hard rock sources (potentially in-line with brine operations), whilst also making previously uneconomical lithium projects viable.

However, as work is still required before the technology reaches this stage of development (which we detail in our risk assessment video), we have not valued LIT at this time. Our investment analysis does however highlight the potential annual profit margins that could be achieved if the technology is commercialised.

Takeover?: If Sileach works at the pilot plant stage of development, we believe one of the major lithium chemical producers could launch a takeover offer, as the risk of not controlling a technology that could have such a significant impact on the future supply of lithium would be too great.

Short term: Whilst Sileach remains the driver to LIT's long term valuation potential, with exploration work due to shortly commence on the company's vast portfolio of exploration assets, any significant discovery could see a re-rating in the company's share price in the short-medium term.

As always, we present our analysis differently as it is shown through a series of videos. This allows us to explain:

- Both the investment opportunity and risks associated with LIT;

- How Sileach works and the potential cost benefits;

- The company's portfolio of prospective lithium assets; and

- The supply, demand and pricing fundamentals for lithium

To view the video, please visit:

http://www.abnnewswire.net/press/en/83810/Lithium-Australia

About Lithium Australia

Lithium Australia NL ( ASX:LIT) (LIT) is a dedicated developer of disruptive lithium extraction technologies including the versatile Sileach(TM) process which is capable of recovering lithium from any silicate minerals. LIT has strategic alliances with a number of companies, potentially providing access to a diversified lithium mineral inventory globally.

ASX:LIT) (LIT) is a dedicated developer of disruptive lithium extraction technologies including the versatile Sileach(TM) process which is capable of recovering lithium from any silicate minerals. LIT has strategic alliances with a number of companies, potentially providing access to a diversified lithium mineral inventory globally.

About The Sophisticated Investor

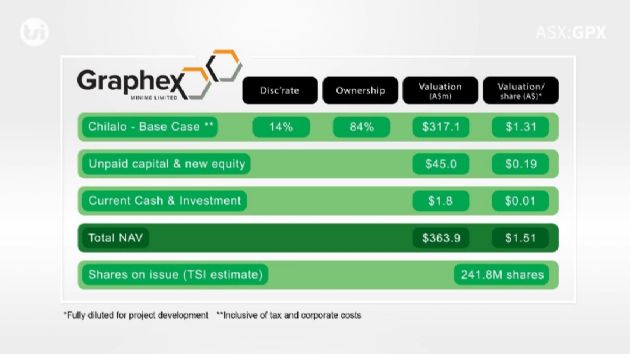

The Sophisticated Investor is a new equity investment tool which seeks to assist investors in becoming more informed in their investment decision making. We show and tell investors about a company in a series of short, informative videos. We possess specialist equity analyst skills and are complemented by video professionals. We conduct site visits and interview management, in a way most investors simply aren’t able to access. We promote long term value creation for investors by employing detailed financial analysis and intrinsic value calculations.

Customer notice

Adam Kiley trading as The Sophisticated Investor ('TSI'), (AR No. 458224), is an authorised representative of Intelligent Financial Markets Pty Ltd (AFSL No. 426359). The information contained in this communication is intended as general advice only. Your personal objectives, financial situation and needs have not been taken into consideration. Accordingly, you should consider how appropriate the advice is (or is not) to your objectives, financial situation and needs before acting on the advice. The information in this communication should not be the only trigger for your investment decision. We strongly recommend you seek professional financial advice whenever making financial investment decisions.

Conflict of interest

TSI does and seeks to do business with companies featured in its articles and videos. As a result, investors should be aware that TSI may have a conflict of interest that could affect the objectivity of some articles or videos. Investors should consider TSI articles and videos as only a single factor in making any investment decision. The publishers also wish to disclose that they may hold stock in some companies featured in their articles and videos, and that any decision you make to purchase the stock of a company TSI profiles should be made only after you have initiated your own enquiries as to the validity of any information contained in those articles and videos.

Publisher's note

TSI will only initiate coverage of a company that passes our internal investment checklist. Once a company has passed this checklist, we will initiate coverage of that company and follow up with ongoing updates and commentary on its activities. Articles and videos produced and published by TSI are NOT Research Reports in terms of ASIC Regulatory Guide 79.

| ||

|