Infill Soils at Mount Day Project

Perth, May 25, 2021 AEST (ABN Newswire) - Okapi Resources Limited ( ASX:OKR) is pleased to advise that results from a soil sampling survey conducted over the Mount Day Project in Western Australia has confirmed earlier data with gold-in-soil anomaly extending over approximately 1.5km strike.

ASX:OKR) is pleased to advise that results from a soil sampling survey conducted over the Mount Day Project in Western Australia has confirmed earlier data with gold-in-soil anomaly extending over approximately 1.5km strike.

Approximately 410 samples were collected on a 100m x 25m grid to infill the 400m x 50m grid. Samples were assayed for gold and multi-element pathfinder metals.

Combined with earlier data, the new soil results confirm the presence of gold-in-soil anomaly while pathfinder elements including silver, copper, molybdenum and bismuth, also support the gold trend. Planning has commenced to undertake detailed ground magnetics over the anomalous trend to define structures and possible drill targets.

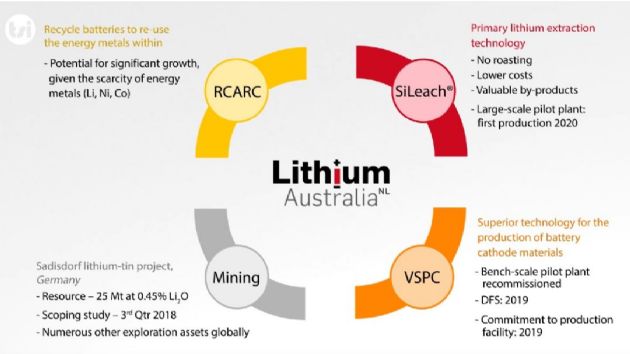

Okapi earns 75% interest in non-lithium minerals from Lithium Australia NL ( ASX:LIT) from the Mount Day Project.

ASX:LIT) from the Mount Day Project.

Okapi's Executive Director, Mr David Nour commented: "We are pleased with the results from this exploration work, confirming the gold-in-soil anomaly extending over 1.5km strike. Further exploration work at the tenement is currently being planned to define structures and possible drill targets."

"Meanwhile, we are nearing completion of our application process for the adjacent tenement and drilling at the Enmore Gold Project expected to begin in June. Our gold exploration complements our recent acquisition of multiple large scale kaolin halloysite and mineral sands projects."

Mount Day Project (Western Australia) (Farm-In to earn 75%)

Tenement E63/1903 is located at the southern end of the Lake Johnston Greenstone Belt in central Western Australia. The belt hosts the Lake Johnston nickel mines (Poseidon Nickel) ( ASX:POS). The Project is located ~10km from the Maggie Hays and Emily Ann underground nickel mines as well as the Windy Hill accommodation village owned by Poseidon Nickel (Figure 1*).

ASX:POS). The Project is located ~10km from the Maggie Hays and Emily Ann underground nickel mines as well as the Windy Hill accommodation village owned by Poseidon Nickel (Figure 1*).

In addition, Okapi has applied for an adjacent tenement (E63/2039), to cover a target defined by coincident structural and geochemical criteria. The area has been the focus of nickel and lithium exploration with limited follow up on the gold potential. The tenement application process is nearing completion and is expected to be granted next month.

At the Mount Day Project, Okapi has identified a high priority structural target from the magnetics, that is coincident with an anomalous gold in a soil anomaly over a 10km strike length (Figure 2*). Limited historical drilling near the main target area reported gold mineralisation, including LJPC004 (RC): 26-28m 2m @ 11.04 g/t gold and LJPC0058 (RC): 71-74m, 3m @ 1.74 g/t. The current soil survey was conducted over the southern portion of the historically defined anomaly.

The recent soil survey was designed to infill both the 400m spaced survey lines on E63/1903 to better define drilling targets. The survey was conducted on 100m spaced lines with along line spacing of 25m, for 409 samples collected. The infill survey was conducted over a 2km long anomalous zone defined from the October 2020 survey undertaken by Okapi. The infill survey has increased definition of the anomalous trend over a 1,500m length (Figure 3*).

The pathfinder data shows a consistent north - south fabric suggesting some underlying structural control could be present. Okapi plans to undertake a detailed ground magnetics survey in the current quarter to better define the underlying structure.

*To view tables and figures, please visit:

https://abnnewswire.net/lnk/9GAV3A9T

About Okapi Resources Limited

Okapi Resources Limited (ASX:OKR) recently acquired a portfolio of advanced, high grade uranium assets located in the United States of America and in the Athabasca Basin, Canada.

Okapi Resources Limited (ASX:OKR) recently acquired a portfolio of advanced, high grade uranium assets located in the United States of America and in the Athabasca Basin, Canada.

Assets include a strategic position in one of the most prolific uranium districts in the USA - the Tallahassee Creek Uranium District in Colorado. The Tallahassee Uranium Project contains a JORC 2012 Mineral Resource estimate of 27.6 million pounds of U3O8 at a grade of 490ppm U3O8 with significant exploration upside. The greater Tallahassee Creek Uranium District hosts more than 100 million pounds of U3O8 with considerable opportunity to expand the existing resource base by acquiring additional complementary assets in the district.

The portfolio of assets also includes an option to acquire 100% of the high-grade Rattler Uranium Project in Utah, which includes the historical Rattlesnake open pit mine. The Rattler Uranium Project is located 85km from the White Mesa Uranium Mill, the only operating conventional uranium mill in the USA hence provides a near term, low-capital development opportunity.

In January 2022, Okapi acquired a portfolio of high-grade exploration assets in the world's premier uranium district, the Athabasca Basin. The Athabasca Basin is home to the world's largest and highest-grade uranium mines.

Okapi's clear strategy is to become a new leader in North American carbon-free nuclear energy by assembling a portfolio of high-quality uranium assets through accretive acquisitions and exploration.

| ||

|