Soil Sampling Programme Completed at Maggie Hays

Perth, July 6, 2021 AEST (ABN Newswire) - Okapi Resources Limited ( ASX:OKR) (

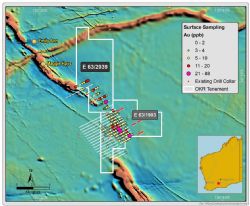

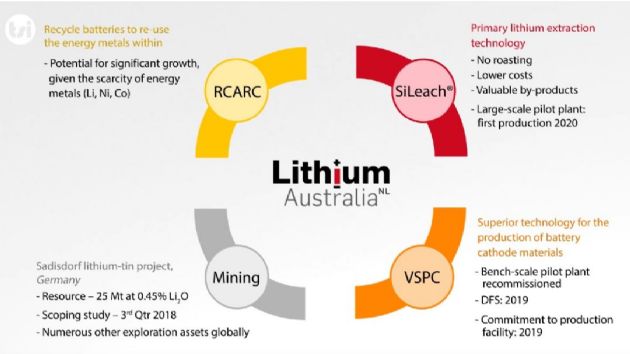

ASX:OKR) ( 26O:FRA) is pleased to advise that a soil sampling programme has been conducted on the newly granted tenement E63/2039. Tenement E63/2039 is located approximately 450 km east of Perth, Western Australia and lies adjacent to Okapi's Mount Day Project joint venture (Farm-in to earn 75%) with Lithium Australia NL (

26O:FRA) is pleased to advise that a soil sampling programme has been conducted on the newly granted tenement E63/2039. Tenement E63/2039 is located approximately 450 km east of Perth, Western Australia and lies adjacent to Okapi's Mount Day Project joint venture (Farm-in to earn 75%) with Lithium Australia NL ( ASX:LIT) in the Lake Johnston Greenstone Belt.

ASX:LIT) in the Lake Johnston Greenstone Belt.

Okapi applied for tenement E63/2039 to cover an interpreted structural target area with a coincident gold-in-soil anomaly, realised from review of historic exploration in the area. The tenement also contains the historical Maggie Hays Hill gold workings. These workings comprise two lines of SE-trending historical gold pits and shafts, hosted in sheared amphibolites and minor felsic units. They are among the few historical gold workings in the belt and have therefore been a focus for the limited previous gold exploration programmes. Okapi's priority target zone sits adjacent to the historical workings but has not yet been drill tested.

Review of historical exploration in the area revealed a 10 km long zone of anomalous gold-in-soil results with a peak value of 88 ppb Au. Nearby drilling intercepted a gold-bearing structure that returned gold values in several holes up to 2m @ 11.04 g/t Au (LJPC004, 26-28m)*. The tenor of gold mineralisation returned from the small historical programme is highly encouraging for Okapi's main structural target.

The previously announced soil programme at E63/2039 has been completed and samples submitted for assay in Perth. This soil programme is an effective extension of sampling conducted over tenement E63/1903 in Mount Day Project joint venture with Lithium Australia NL ( ASX:LIT) (see announcement 25th May 2021).

ASX:LIT) (see announcement 25th May 2021).

Results from the current programme will enable greater perspective on the broader mineralisation evident on the tenements. Assay results are expected within weeks and will enable Okapi to confirm historic results and better define drilling targets. Okapi expects to progress to other exploration activities including drilling as soon as the required clearances are obtained.

*To view tables and figures, please visit:

https://abnnewswire.net/lnk/8U7O32FV

About Okapi Resources Limited

Okapi Resources Limited (ASX:OKR) recently acquired a portfolio of advanced, high grade uranium assets located in the United States of America and in the Athabasca Basin, Canada.

Okapi Resources Limited (ASX:OKR) recently acquired a portfolio of advanced, high grade uranium assets located in the United States of America and in the Athabasca Basin, Canada.

Assets include a strategic position in one of the most prolific uranium districts in the USA - the Tallahassee Creek Uranium District in Colorado. The Tallahassee Uranium Project contains a JORC 2012 Mineral Resource estimate of 27.6 million pounds of U3O8 at a grade of 490ppm U3O8 with significant exploration upside. The greater Tallahassee Creek Uranium District hosts more than 100 million pounds of U3O8 with considerable opportunity to expand the existing resource base by acquiring additional complementary assets in the district.

The portfolio of assets also includes an option to acquire 100% of the high-grade Rattler Uranium Project in Utah, which includes the historical Rattlesnake open pit mine. The Rattler Uranium Project is located 85km from the White Mesa Uranium Mill, the only operating conventional uranium mill in the USA hence provides a near term, low-capital development opportunity.

In January 2022, Okapi acquired a portfolio of high-grade exploration assets in the world's premier uranium district, the Athabasca Basin. The Athabasca Basin is home to the world's largest and highest-grade uranium mines.

Okapi's clear strategy is to become a new leader in North American carbon-free nuclear energy by assembling a portfolio of high-quality uranium assets through accretive acquisitions and exploration.

| ||

|