Perth, Oct 10, 2018 AEST (ABN Newswire) - Marquee Resources ( ASX:MQR) is exploring its Werner Lake cobalt-sulphide project in the province of Ontario, Canada. Discovered during the 1920s, the project became a small but high-grade mining operation in the 1940s. Since then, however (with the exception of a period during the 1990s in which a development study commenced but was not completed due to funding issues for the then owner), only limited work has been completed.

ASX:MQR) is exploring its Werner Lake cobalt-sulphide project in the province of Ontario, Canada. Discovered during the 1920s, the project became a small but high-grade mining operation in the 1940s. Since then, however (with the exception of a period during the 1990s in which a development study commenced but was not completed due to funding issues for the then owner), only limited work has been completed.

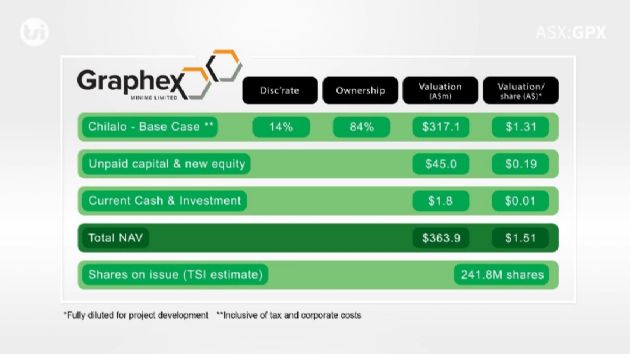

In early 2018, Marquee took control of the project and has since commenced a 6,000-metre diamond-drilling programme, the first in more than 15 years. Encouragingly, results to date confirm mineralisation that starts from surface, continues at depth to at least 220 metres (vertical) and remains open. Assuming continued success with the current drill programme, an initial JORC resource (TSI estimate - 4Q18) is likely to follow, with a development study likely to quickly follow (scoping or pre-feasibility).

Why cobalt?: Cobalt has been the standout commodity in the past year, its price more than doubling during that time - largely in response to increased demand for lithium-ion batteries, a major consumer of cobalt. Typically, when demand for a commodity increases, as is the case with other electric-vehicle related metals, supply also increases to meet it. This typically leads to the price stabilsing or, in some cases, falling due to over-supply. In the case of cobalt, however, a unique set of circumstances (among them political risk and the fact that, typically, cobalt is a by-product metal), we believe supply is unlikely to match the increase in demand without fundamental changes within the sector ... meaning higher prices are probably here to stay.

Sulphide or laterite: Cobalt is found in either sulphide or laterite mineralisation, the latter being the most of the ASX-listed cobalt developers. Compared to cobalt sulphide projects, cobalt laterite projects generally have a larger resource however at a lower grade. Combined with more challenging metallurgy, operating and capital costs are usually significantly higher for laterite project.

On saying this, with the exception of projects in the Democratic Republic of Congo, where ethically unsound mining practices and political unrest are cause for concern - very few primary cobalt sulphide deposits with the potential to commence production have been discovered to date.

Werner Lake - results to date: as noted, early results from the ongoing diamond-drilling programme at Werner Lake have been encouraging, with most intercepts at a grade similar to or higher than the NI 43-101 mineral resource (0.43% cobalt). Importantly, drilling has confirmed that the mineralisation is continuous from surface to a depth of at least 220 vertical meters and remains open.

Development potential: while more drilling is obviously required, we believe the company is on track to deliver a maiden JORC resource before the end of the year. Subsequently, a development study that takes into account historical work at the project (including the development study begun but not completed during the 1990s) is likely to commence thereafter, with completion potentially as early as the first half of 2019.

We do not anticipate an initial resource in the 'millions of tonnes'. However, given the grade of the 43-101 resource, promising drilling results to date, as well as the strength of the cobalt price, we believe even a modestly-sized operation (with low initial capital costs) has the potential to deliver significant operating margins that could be used to further explore the vast, yet largely under explored, total project package.

To view the video, please visit:

http://www.abnnewswire.net/press/en/94955/Marquee

About Marquee Resources Ltd

Marquee Resources Ltd (ASX:MQR) is a Lithium focused exploration Company who has recently acquired 2 new projects - The Centenario Project in Argentina and the 100% owned Redlings REE Project in Western Australia.

Marquee Resources Ltd (ASX:MQR) is a Lithium focused exploration Company who has recently acquired 2 new projects - The Centenario Project in Argentina and the 100% owned Redlings REE Project in Western Australia.

The Centenario Project leases are in a prime location within "The Lithium Triangle" in the mining friendly Salta province. The Leases cover an area of 68km2 in the Centenario Lithium Brine Salar over seven adjoining leases. It is located approximately 165km west of the City of Salta which has an international airport, hotels and other facilities.

The Redlings REE Project (E37/1311) has a total area of 39.06km2 (13 blocks). Detailed magnetic and geochemical surveys have revealed 14 significant REE targets.

The Company will also continue to add value to its existing assets which include the Werner Lake Cobalt Project and the Clayton Valley Lithium Project.

About The First Mover

The First Mover identifies and explains early stage ASX investment opportunities that we believe have a significant long term upside for investors.

The First Mover identifies and explains early stage ASX investment opportunities that we believe have a significant long term upside for investors.

About The Sophisticated Investor

The Sophisticated Investor is a new equity investment tool which seeks to assist investors in becoming more informed in their investment decision making. We show and tell investors about a company in a series of short, informative videos. We possess specialist equity analyst skills and are complemented by video professionals. We conduct site visits and interview management, in a way most investors simply aren’t able to access. We promote long term value creation for investors by employing detailed financial analysis and intrinsic value calculations.

Customer notice

Adam Kiley trading as The Sophisticated Investor ('TSI'), (AR No. 458224), is an authorised representative of Intelligent Financial Markets Pty Ltd (AFSL No. 426359). The information contained in this communication is intended as general advice only. Your personal objectives, financial situation and needs have not been taken into consideration. Accordingly, you should consider how appropriate the advice is (or is not) to your objectives, financial situation and needs before acting on the advice. The information in this communication should not be the only trigger for your investment decision. We strongly recommend you seek professional financial advice whenever making financial investment decisions.

Conflict of interest

TSI does and seeks to do business with companies featured in its articles and videos. As a result, investors should be aware that TSI may have a conflict of interest that could affect the objectivity of some articles or videos. Investors should consider TSI articles and videos as only a single factor in making any investment decision. The publishers also wish to disclose that they may hold stock in some companies featured in their articles and videos, and that any decision you make to purchase the stock of a company TSI profiles should be made only after you have initiated your own enquiries as to the validity of any information contained in those articles and videos.

Publisher's note

TSI will only initiate coverage of a company that passes our internal investment checklist. Once a company has passed this checklist, we will initiate coverage of that company and follow up with ongoing updates and commentary on its activities. Articles and videos produced and published by TSI are NOT Research Reports in terms of ASIC Regulatory Guide 79.

| ||

|