Perth, June 5, 2018 AEST (ABN Newswire) - Superior Lake Resources ( ASX:SUP) recently acquired the Superior Lake zinc project in Canada. It was the country's highest-grade zinc operation (3.5 Mt at 14% Zn, 1% Cu) for a decade before closing in 1998 as a result of ongoing low zinc prices. Any exploration work since has been limited, due to the continued low zinc price and the project's fragmented ownership.

ASX:SUP) recently acquired the Superior Lake zinc project in Canada. It was the country's highest-grade zinc operation (3.5 Mt at 14% Zn, 1% Cu) for a decade before closing in 1998 as a result of ongoing low zinc prices. Any exploration work since has been limited, due to the continued low zinc price and the project's fragmented ownership.

Why is this asset now viable? The zinc price, now at near-record highs, is expected to remain that way for some time. With no exploration at the project in 20 years, its potential seems excellent. Additionally, existing infrastructure (mine development, roads, power, water and workforce) at the mine should reduce future development capital costs.

What work has been completed recently? SUP acquired the project in early 2018 and has since been reviewing and verifying historic data. That has seen the release of exceptionally high-grade results within the unmined region of the deposit, including the following.

- UP-147: 33.2 m @ 18.77% Zn, 2.26% Cu

- UP-149: 10.5 m @ 24.8% Zn, 1.33% Cu

- UP-148: 15.8 m @ 30.05% Zn, 1.91% Cu

Valuation catalysts: the company will release a number of key announcements in coming months that should shape the future of the project. They include the following.

- Initial JORC Resource - 2Q18

- Identification of priority drill targets/3D geological model - 3Q18

- Commencement of an exploration drill program (first for 20 years) - 3Q18

- Initial capital estimates - 2H18

- Development study - 1H19

- Construction decision - 2H19

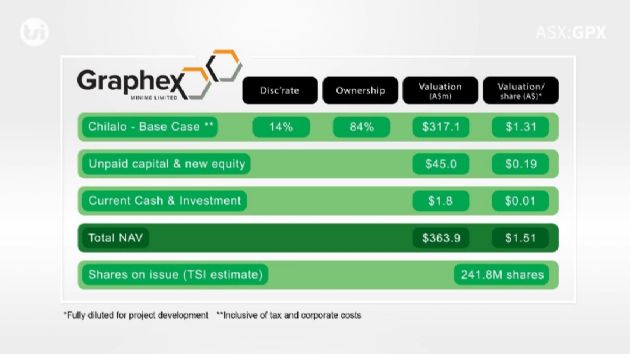

Analyst comments: the upcoming JORC resource is likely to confirm the Superior Lake zinc project as the highest-grade zinc asset on the ASX. Based on the historic resource and drill results, we expect the resource grade to be around 14% Zn and 18% Zn Eq, once by-products are accounted for. To put this grade into perspective, it equates to a gold grade of around 13 g/t Au (FM estimate - gold price US$1,300).

Post the release of the JORC resource (which is imminent) the first significant exploration program in more than 20 years will commence, including the first drill program. Initially, we anticipate that targets will focus around potential extensions to the resource areas, given these will be the easiest to convert to additional resources and hence extend the project's mine life.

In addition to drilling, SUP plans to use downhole electromagnetics (EM) for, we understand, the first time at the project. EM has been used with great success at volcanic massive sulphide (VMS) ore deposits (such as those at Superior Lake) to identify additional mineralized zones or lenses. SUP non-executive director Peter Williams has vast experience in this area, having been heavily involved in the development and success of Independence Group and, more specifically, the discovery of the McLeay nickel sulphide deposit (Long nickel mine) at Kambalda, in which downhole EM played a major role. We believe the discovery of additional lenses at Superior Lake is likely to result in a significant share price re-rating.

Coinciding with the exploration program, SUP plans to release initial capital costs for project development. We see this as a critical step in the long-term development of the Superior Lake project, as it will give an indication of the future production profile.

To view the video, please visit:

http://www.abnnewswire.net/press/en/93405/SUP

About Superior Lake Resources Ltd

Superior Lake Resources Ltd (ASX:SUP) engages in the exploration and development of mineral prospects in Australia and Canada. It primarily explores copper, zinc, gold, and other base metals. The company holds interests in the Pick Lake Zinc project covering 47.5 square kilometers of area located in northwest Ontario; and the Winston Lake Project covering 4.5 square kilometers of area located in northwest Ontario. It also holds interests in the Leonora Project located in the Eastern Goldfields Province of the Archaean-aged Yilgarn Craton of Western Australia; and the Mt Morley Project covering 50 square kilometers of area located in Western Australia. The company was founded in 2009 and is based in Perth, Australia. Superior Lake Resources Limited is a subsidiary of Add New Energy Investment Holdings Group Limited.

Superior Lake Resources Ltd (ASX:SUP) engages in the exploration and development of mineral prospects in Australia and Canada. It primarily explores copper, zinc, gold, and other base metals. The company holds interests in the Pick Lake Zinc project covering 47.5 square kilometers of area located in northwest Ontario; and the Winston Lake Project covering 4.5 square kilometers of area located in northwest Ontario. It also holds interests in the Leonora Project located in the Eastern Goldfields Province of the Archaean-aged Yilgarn Craton of Western Australia; and the Mt Morley Project covering 50 square kilometers of area located in Western Australia. The company was founded in 2009 and is based in Perth, Australia. Superior Lake Resources Limited is a subsidiary of Add New Energy Investment Holdings Group Limited.

About The First Mover

The First Mover identifies and explains early stage ASX investment opportunities that we believe have a significant long term upside for investors.

The First Mover identifies and explains early stage ASX investment opportunities that we believe have a significant long term upside for investors.

About The Sophisticated Investor

The Sophisticated Investor is a new equity investment tool which seeks to assist investors in becoming more informed in their investment decision making. We show and tell investors about a company in a series of short, informative videos. We possess specialist equity analyst skills and are complemented by video professionals. We conduct site visits and interview management, in a way most investors simply aren’t able to access. We promote long term value creation for investors by employing detailed financial analysis and intrinsic value calculations.

Customer notice

Adam Kiley trading as The Sophisticated Investor ('TSI'), (AR No. 458224), is an authorised representative of Intelligent Financial Markets Pty Ltd (AFSL No. 426359). The information contained in this communication is intended as general advice only. Your personal objectives, financial situation and needs have not been taken into consideration. Accordingly, you should consider how appropriate the advice is (or is not) to your objectives, financial situation and needs before acting on the advice. The information in this communication should not be the only trigger for your investment decision. We strongly recommend you seek professional financial advice whenever making financial investment decisions.

Conflict of interest

TSI does and seeks to do business with companies featured in its articles and videos. As a result, investors should be aware that TSI may have a conflict of interest that could affect the objectivity of some articles or videos. Investors should consider TSI articles and videos as only a single factor in making any investment decision. The publishers also wish to disclose that they may hold stock in some companies featured in their articles and videos, and that any decision you make to purchase the stock of a company TSI profiles should be made only after you have initiated your own enquiries as to the validity of any information contained in those articles and videos.

Publisher's note

TSI will only initiate coverage of a company that passes our internal investment checklist. Once a company has passed this checklist, we will initiate coverage of that company and follow up with ongoing updates and commentary on its activities. Articles and videos produced and published by TSI are NOT Research Reports in terms of ASIC Regulatory Guide 79.

| ||

|