Perth, Jan 16, 2018 AEST (ABN Newswire) - Boss Resources Ltd ( ASX:BOE) recently entered into a binding but conditional agreement to acquire the 0utstanding 20% interest in the Honeymoon uranium project for 300 million Boss shares. If completed, this will increase Boss' ownership of the project from 80% to 100%.

ASX:BOE) recently entered into a binding but conditional agreement to acquire the 0utstanding 20% interest in the Honeymoon uranium project for 300 million Boss shares. If completed, this will increase Boss' ownership of the project from 80% to 100%.

Boss anticipates replacing solvent extraction with ion exchange at the project's processing facility (ion exchange is based on the same principles as solvent extraction but uses small resin beads rather than organic solvent to load the uranium). In support of this, Boss announced that the results of field leach trials at Honeymoon have exceeded expectations - a grade of 80 mg/l U3O8 (triuranium oxide) was achieved compared to the preliminary feasibility study (PFS) assumption of 48 mg/l U3O8.

Historically, more than $170 million has been invested in infrastructure at Honeymoon, one of only four uranium projects in Australia to be fully permitted for uranium mining. This reduces the capital cost (Stage 1 - US$10 million) and shortens the time frame for production to recommence in the future.

Analyst comment: Boss, which made a number of key announcements late in 2017, aims to hasten a potential restart of the Honeymoon uranium project.

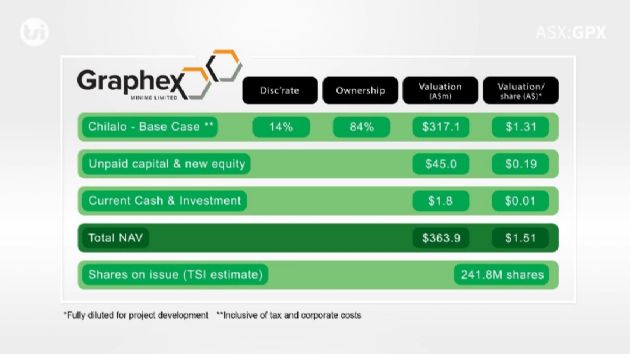

Project ownership: Boss' agreement to increase its ownership in Honeymoon (provisional on shareholder approval) has had limited effect on our current valuation, an increase in project ownership being offset by increased dilution. That said, the numerous quantitative benefits of the acquisition include better use of management time and simpler negotiations with potential partners (project financier, offtake, government, etc.).

Field leach trials: as noted above, results exceeded expectations and in so doing supported Boss' aim of converting the current solvent extraction facility to one using ion exchange in its proposed Stage 2 and Stage 3 expansions. Given the significant increase in grade revealed by the trials, it is probable that operating costs - already low at US$23/lb - will be further reduced when results of the DFS are released later this year.

Uranium price: last year was one of the toughest in recent memory for the uranium price. However, the situation may finally be easing, since that price lifted from decade-long lows at the end of 2017, largely in response to two of the world's major uranium producers announcing cuts in production.

While the uranium price still has some way to go before Boss and other developers would consider commencing production, we believe everything points to further price appreciation through 2018.

Valuation: we maintain our valuation for Boss at $0.23/share.

To view the video, please visit:

http://www.abnnewswire.net/press/en/91673/boss

About Boss Resources Ltd

Boss Resources Limited (ASX:BOE) has one of a few uranium projects ready to participate in the early stages of a new bull market; it truly is a product for this time. Against a backdrop of strengthening uranium prices, the Company has been proactively identifying, addressing, and positioning the Honeymoon Project to be Australia’s next producer of up to 3.2M lbs per annum.

About The Sophisticated Investor

The Sophisticated Investor is a new equity investment tool which seeks to assist investors in becoming more informed in their investment decision making. We show and tell investors about a company in a series of short, informative videos. We possess specialist equity analyst skills and are complemented by video professionals. We conduct site visits and interview management, in a way most investors simply aren’t able to access. We promote long term value creation for investors by employing detailed financial analysis and intrinsic value calculations.

Customer notice

Adam Kiley trading as The Sophisticated Investor ('TSI'), (AR No. 458224), is an authorised representative of Intelligent Financial Markets Pty Ltd (AFSL No. 426359). The information contained in this communication is intended as general advice only. Your personal objectives, financial situation and needs have not been taken into consideration. Accordingly, you should consider how appropriate the advice is (or is not) to your objectives, financial situation and needs before acting on the advice. The information in this communication should not be the only trigger for your investment decision. We strongly recommend you seek professional financial advice whenever making financial investment decisions.

Conflict of interest

TSI does and seeks to do business with companies featured in its articles and videos. As a result, investors should be aware that TSI may have a conflict of interest that could affect the objectivity of some articles or videos. Investors should consider TSI articles and videos as only a single factor in making any investment decision. The publishers also wish to disclose that they may hold stock in some companies featured in their articles and videos, and that any decision you make to purchase the stock of a company TSI profiles should be made only after you have initiated your own enquiries as to the validity of any information contained in those articles and videos.

Publisher's note

TSI will only initiate coverage of a company that passes our internal investment checklist. Once a company has passed this checklist, we will initiate coverage of that company and follow up with ongoing updates and commentary on its activities. Articles and videos produced and published by TSI are NOT Research Reports in terms of ASIC Regulatory Guide 79.

| ||

|