Sydney, Aug 9, 2016 AEST (ABN Newswire) - Boss Resources Ltd ( ASX:BOE) has announced preliminary results from an Option Study that is assessing the most appropriate technology to both optimise and reduce the costs for the planned expansion at their Honeymoon uranium project in South Australia. Boss also recently announced that the resource had increased to 57.8Mlbs (654 ppm U3O8). Boss has more than tripled the resource since they acquired the project late last year.

ASX:BOE) has announced preliminary results from an Option Study that is assessing the most appropriate technology to both optimise and reduce the costs for the planned expansion at their Honeymoon uranium project in South Australia. Boss also recently announced that the resource had increased to 57.8Mlbs (654 ppm U3O8). Boss has more than tripled the resource since they acquired the project late last year.

The Honeymoon project is located in South Australia and is one of only 4 uranium projects in Australia that is fully permitted for uranium mining. $170m has already been spent on infrastructure at the project, which includes a 0.88lb pa solvent extraction processing facility, 75km powerline to the power mains, camp and administration office, vehicles, spares and other significant infrastructure.

The information provided here should not be the only trigger for your investment decision. We strongly recommend you seek professional financial advice whenever making financial investment decisions.

Analyst Comment: Boss has continued to move forward with the development of their Honeymoon project as they announced positive preliminary results from their Option Study as well grown the resource to 57.8Mlbs (654 ppm U3O8). Both announcements confirm our belief that when production recommences, it will be at a significantly higher rate than the current plants 0.88Mlbs pa capacity.

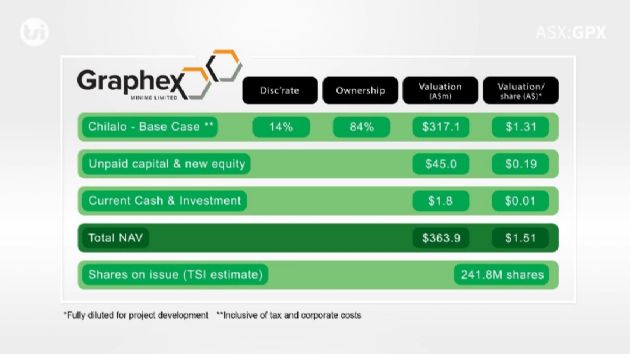

Based on the current resource as well as the exploration potential (100Mlbs exploration target), we have estimated that production will be ramped up to 4Mlbs pa over the five years of production. A staged ramp up allows for cash flow generated from the project to pay for the capital expansion when mining commences at Goulds Dam as well as increase the plants throughput from 2Mlbs pa to 4Mlbs pa.

We also estimated that when production reaches the 4Mlb pa mark, C1 operating costs will fall to around US$15 / lb (TSI estimate), which would put the Honeymoon project in the lowest cost quartile for uranium operations globally.

Valuation: We have increased our valuation for Boss to $0.27 / share (share price $0.06 / share).The key driver for the change to our valuation was increasing our production rate to 4Mlbs pa (previous 2Mlbs pa). Further information regarding the key assumptions and our scenario analysis can be found in our valuation analysis video.

To view the video, please visit:

http://www.abnnewswire.net/press/en/84414/BOE

This information is general information only. Any advice is general advice only. Neither your personal objectives, financial situation or needs have not been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice. Adam Kiley (AR No. 458224) is an authorised representative of Intelligent Financial Markets Pty Ltd (AFSL No. 426359).

About The Sophisticated Investor

The Sophisticated Investor is a new equity investment tool which seeks to assist investors in becoming more informed in their investment decision making. We show and tell investors about a company in a series of short, informative videos. We possess specialist equity analyst skills and are complemented by video professionals. We conduct site visits and interview management, in a way most investors simply aren’t able to access. We promote long term value creation for investors by employing detailed financial analysis and intrinsic value calculations.

Customer notice

Adam Kiley trading as The Sophisticated Investor ('TSI'), (AR No. 458224), is an authorised representative of Intelligent Financial Markets Pty Ltd (AFSL No. 426359). The information contained in this communication is intended as general advice only. Your personal objectives, financial situation and needs have not been taken into consideration. Accordingly, you should consider how appropriate the advice is (or is not) to your objectives, financial situation and needs before acting on the advice. The information in this communication should not be the only trigger for your investment decision. We strongly recommend you seek professional financial advice whenever making financial investment decisions.

Conflict of interest

TSI does and seeks to do business with companies featured in its articles and videos. As a result, investors should be aware that TSI may have a conflict of interest that could affect the objectivity of some articles or videos. Investors should consider TSI articles and videos as only a single factor in making any investment decision. The publishers also wish to disclose that they may hold stock in some companies featured in their articles and videos, and that any decision you make to purchase the stock of a company TSI profiles should be made only after you have initiated your own enquiries as to the validity of any information contained in those articles and videos.

Publisher's note

TSI will only initiate coverage of a company that passes our internal investment checklist. Once a company has passed this checklist, we will initiate coverage of that company and follow up with ongoing updates and commentary on its activities. Articles and videos produced and published by TSI are NOT Research Reports in terms of ASIC Regulatory Guide 79.

| ||

|