Sydney, April 28, 2017 AEST (ABN Newswire) - Primary Gold ( ASX:PGO) has released a positive Scoping Study for their Mt Bundy gold project in the Northern Territory. The study assumes ore would be mined from three existing deposits; the low strip ratio Rustlers Roost deposit (795koz at 1.1g/t Au), the high grade Tom's Gully U/G mine (315koz at 8.9g/t Au) and the Quest 29 deposit (148koz at 1.4g/t Au).

ASX:PGO) has released a positive Scoping Study for their Mt Bundy gold project in the Northern Territory. The study assumes ore would be mined from three existing deposits; the low strip ratio Rustlers Roost deposit (795koz at 1.1g/t Au), the high grade Tom's Gully U/G mine (315koz at 8.9g/t Au) and the Quest 29 deposit (148koz at 1.4g/t Au).

Highlights of the study include:

- All-In Sustaining Costs (AISC) - LOM A$1050;

- AISC - first three yrs of production - A$900/oz;

- Total initial capex - A$155M;

- 3.0Mtpa processing facility;

- Low strip ratio (LOM) - 1.8:1; and

- Mine life - 9 years.

Analyst Comment: The Scoping Study has provided a strong platform for the future development of the Mt Bundy project, with the highlights including low AISC of $1,050 (LOM) as well as the relatively low initial capex of $155m for a project of this size (3Mtpa processing facility).

We however believe there are a number of areas that could potentially improve when the PFS is released later this year. This includes increasing the processing facility's throughput, operating and capital costs reductions, as well as increased gold recoveries (different processing technologies eg: resins).

The success of the upcoming drill program at the Rustlers Roost and Quest 29 deposits, which is the first drill program at these deposits for more than 20 years, will be central to these potential improvements. We look forward to this program commencing during May 2017.

The information in this video should not be the only trigger for your investment decision. We strongly recommend you seek professional financial advice whenever making financial investment decisions.

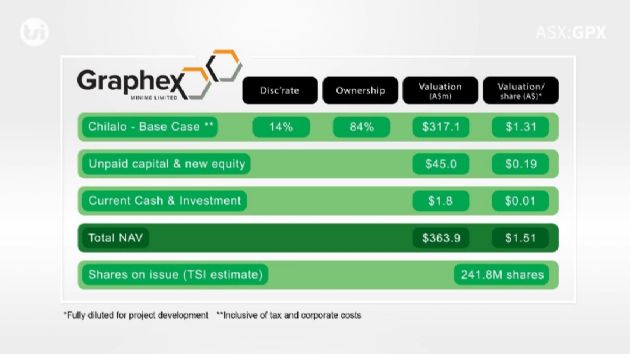

Valuation: We have updated our valuation for Primary to $0.35 / share (price - $0.07/share).

To view the video, please visit:

http://www.abnnewswire.net/press/en/88023/PGO

About The Sophisticated Investor

The Sophisticated Investor is a new equity investment tool which seeks to assist investors in becoming more informed in their investment decision making. We show and tell investors about a company in a series of short, informative videos. We possess specialist equity analyst skills and are complemented by video professionals. We conduct site visits and interview management, in a way most investors simply aren’t able to access. We promote long term value creation for investors by employing detailed financial analysis and intrinsic value calculations.

Customer notice

Adam Kiley trading as The Sophisticated Investor ('TSI'), (AR No. 458224), is an authorised representative of Intelligent Financial Markets Pty Ltd (AFSL No. 426359). The information contained in this communication is intended as general advice only. Your personal objectives, financial situation and needs have not been taken into consideration. Accordingly, you should consider how appropriate the advice is (or is not) to your objectives, financial situation and needs before acting on the advice. The information in this communication should not be the only trigger for your investment decision. We strongly recommend you seek professional financial advice whenever making financial investment decisions.

Conflict of interest

TSI does and seeks to do business with companies featured in its articles and videos. As a result, investors should be aware that TSI may have a conflict of interest that could affect the objectivity of some articles or videos. Investors should consider TSI articles and videos as only a single factor in making any investment decision. The publishers also wish to disclose that they may hold stock in some companies featured in their articles and videos, and that any decision you make to purchase the stock of a company TSI profiles should be made only after you have initiated your own enquiries as to the validity of any information contained in those articles and videos.

Publisher's note

TSI will only initiate coverage of a company that passes our internal investment checklist. Once a company has passed this checklist, we will initiate coverage of that company and follow up with ongoing updates and commentary on its activities. Articles and videos produced and published by TSI are NOT Research Reports in terms of ASIC Regulatory Guide 79.

| ||

|