Sydney, July 21, 2016 AEST (ABN Newswire) - Primary Gold ( ASX:PGO) is developing the Mt Bundy Gold Project in the Northern Territory which has an existing resource of more than 1.2Moz of gold spread across three deposits. These include the shallow, low strip ratio Rustlers Roost deposit (795koz at 1.1g/t), the high grade historical Tom's Gully U/G mine (315koz at 8.9g/t) and Quest 29 deposit (148koz at 1.4g/t). All resources are located within 10km of each other, providing the opportunity for a large scale bulk operation targeting >150,000oz per annum production over a minimum 6 year mine life.

ASX:PGO) is developing the Mt Bundy Gold Project in the Northern Territory which has an existing resource of more than 1.2Moz of gold spread across three deposits. These include the shallow, low strip ratio Rustlers Roost deposit (795koz at 1.1g/t), the high grade historical Tom's Gully U/G mine (315koz at 8.9g/t) and Quest 29 deposit (148koz at 1.4g/t). All resources are located within 10km of each other, providing the opportunity for a large scale bulk operation targeting >150,000oz per annum production over a minimum 6 year mine life.

Significant opportunity also exists for the Company to grow the existing resource base as the Mt Bundy project also has a substantial exploration package (1,500km2 of tenements). These tenements have had very little exploration in the past 20 years, despite more than 60 gold occurrences being identified to date, which include a number of gold outcroppings at surface.

Analyst Comment:

Primary has until recently flown under the radar of investors and is currently trading at a substantial discount to other Australian gold developers. Recent changes to the Board structure and Company strategy have however started to bring in strong investor attention. In comparison to their peers group (EV / resource oz - Av. $115/oz vs. PGO $34/oz) Primary is still at a significant discount, despite what we see as having a quality portfolio of assets, which forms the platform for their future production target (+150koz pa).

We see increased upcoming exploration activities as the long term drivers for Primary's share price. Exploration success is particularly relevant given numerous historical drill results have encountered gold mineralisation, however they are outside of the current resource base, which could result in a resource upgrade in the near term with some infill drill. Whilst more exciting is the significant number of Greenfield targets (60 gold occurrences) that have never been drill tested, despite this including a number of gold outcropping from surface.

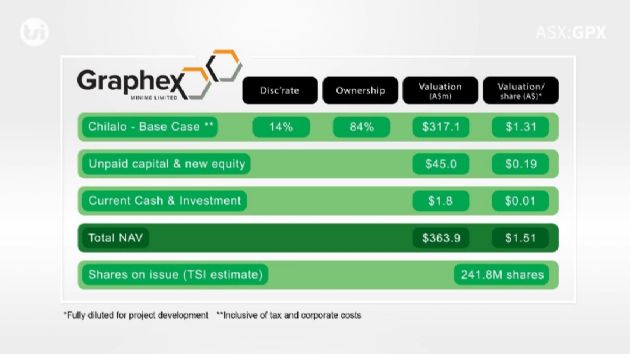

Valuation:

We see significant upside in the current share price ($0.10 / share) as we value Primary at $0.30 / share. This valuation could increase further through exploration success, as our expanded mine life scenario has a valuation of 0.47 / share.

The information in this email should not be the only trigger for your investment decision. We strongly recommend you seek professional financial advice whenever making financial investment decisions.

To view the video, please visit:

http://www.abnnewswire.net/press/en/84240/PGO

This information is general information only. Any advice is general advice only. Neither your personal objectives, financial situation or needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice. Adam Kiley (AR No. 458224) is an authorised representative of Intelligent Financial Markets Pty Ltd (AFSL No. 426359).

About The Sophisticated Investor

The Sophisticated Investor is a new equity investment tool which seeks to assist investors in becoming more informed in their investment decision making. We show and tell investors about a company in a series of short, informative videos. We possess specialist equity analyst skills and are complemented by video professionals. We conduct site visits and interview management, in a way most investors simply aren’t able to access. We promote long term value creation for investors by employing detailed financial analysis and intrinsic value calculations.

Customer notice

Adam Kiley trading as The Sophisticated Investor ('TSI'), (AR No. 458224), is an authorised representative of Intelligent Financial Markets Pty Ltd (AFSL No. 426359). The information contained in this communication is intended as general advice only. Your personal objectives, financial situation and needs have not been taken into consideration. Accordingly, you should consider how appropriate the advice is (or is not) to your objectives, financial situation and needs before acting on the advice. The information in this communication should not be the only trigger for your investment decision. We strongly recommend you seek professional financial advice whenever making financial investment decisions.

Conflict of interest

TSI does and seeks to do business with companies featured in its articles and videos. As a result, investors should be aware that TSI may have a conflict of interest that could affect the objectivity of some articles or videos. Investors should consider TSI articles and videos as only a single factor in making any investment decision. The publishers also wish to disclose that they may hold stock in some companies featured in their articles and videos, and that any decision you make to purchase the stock of a company TSI profiles should be made only after you have initiated your own enquiries as to the validity of any information contained in those articles and videos.

Publisher's note

TSI will only initiate coverage of a company that passes our internal investment checklist. Once a company has passed this checklist, we will initiate coverage of that company and follow up with ongoing updates and commentary on its activities. Articles and videos produced and published by TSI are NOT Research Reports in terms of ASIC Regulatory Guide 79.

| ||

|