Strategic Position in the Greenbushes Lithium District

Perth, Feb 9, 2016 AEST (ABN Newswire) - The Directors of Venus Metals Corporation Limited ( ASX:VMC) are pleased to announce that the Company has applied for two strategic tenements in the world-class Greenbushes lithium province. The Greenbushes mine, in the Southwest Mineral Province of Western Australia, is one of the world's largest producers of 'hard-rock' lithium and tantalum; Venus Metals tenements lie to the east of the mine and abut Talison's mining leases (Figures 1 & 2 in link below).

ASX:VMC) are pleased to announce that the Company has applied for two strategic tenements in the world-class Greenbushes lithium province. The Greenbushes mine, in the Southwest Mineral Province of Western Australia, is one of the world's largest producers of 'hard-rock' lithium and tantalum; Venus Metals tenements lie to the east of the mine and abut Talison's mining leases (Figures 1 & 2 in link below).

1.0 Introduction

Venus Metals Corporation Limited ('Venus Metals') has made applications for two strategic exploration licences in the Greenbushes region of Western Australia. These new applications cover an area of adjacent to, and east of, the world-class Greenbushes Lithium-Tantalum mine. The tenement areas contain outcropping pegmatitic stratigraphy, the host rock for lithium-tantalum mineralisation in the region.

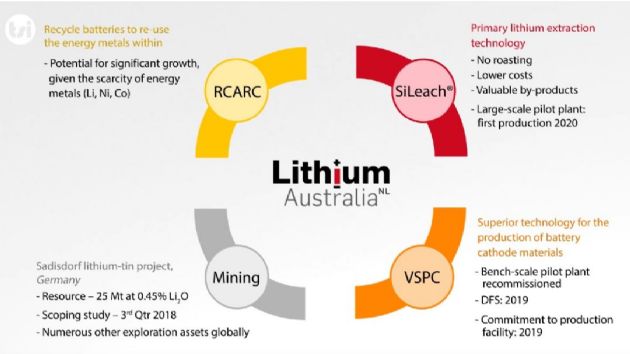

The region hosts Talison Lithium's world-class Greenbushes Lithium-Tantalum mine, with other tenement holders in region including Lithium Australia NL ( ASX:LIT) and Metalicity (

ASX:LIT) and Metalicity ( ASX:MCT) - Figure 2 in link below.

ASX:MCT) - Figure 2 in link below.

2.0 Greenbushes East Lithium-Tantalum Project, Southwest Mineral Field, WA.

The Greenbushes East Project (ELA 70/4810 & 4814) covers over 550 km2 and is located 220 km to the south-southeast of Perth in the Southwest Mineral Field of Western Australia. The project is accessed via the South West Highway then east along local formed roads and station tracks. The Greenbushes East Project abuts the Talison's mining leases at Greenbushes with the area covered by the tenement applications show similarities structure and geology setting to those of the mine area.

Talison Lithium's Greenbushes mine is the largest hard rock lithium (spodumene) deposit in the world.

3.0 The Lithium Market

The global lithium market is growing at a rapidly due to developments in the technology and energy sectors, especially in the use of lithium based batteries for automotive and domestic applications.

Presently the global lithium market consumes around 200,000 tonnes of lithium carbonate (or lithium carbonate equivalent, 'VCE') per annum. Two thirds of global consumption is utilised in ceramics, glass, polymers and alloys, however growth in the technology (smart phones and computers) and energy sectors (lithium batteries for automotive and home usage) may see consumption double to over 400,000 tonnes of LCE by 2025.

The short to medium term growth in the lithium market will be limited by supply constraints, with few new operations being commissioned and four producers controlling much of the market. In the last year alone the price of LCE has risen more than 20%, from less than US$4,900/tonne in September 2014, to over US$6,100/tonne today. Current price predictions indicate that LCE may rise to over US$7,000 in 2016.

It is clear that new sources of lithium carbonate are required to meet growing demand.

4.0 Conclusion

The recent applications at Greenbushes continue to build the Company's portfolio of lithium projects and further complements the four lithium-tantalum project areas applied for by Venus Metals in 2015. These project areas all cover, or are adjacent to, recognised lithiumtantalum mineralisation.

Venus Metals looks forward to updating shareholders as its applications over the Greenbushes East, Pilgangoora NE , Stannum, Nardoo and Poona Lithium-Tantalum projects proceed to grant.

To view figures, please visit:

http://media.abnnewswire.net/media/en/docs/ASX-VMC-752223.pdf

About Venus Metals Corporation Limited

Venus Metals Corporation Limited (ASX:VMC) is a West Australian based Company with a focus on gold, base metals, vanadium and lithium exploration projects. The Company aims to increase shareholder value through targeted exploration success on its projects.

The Company's major gold project is the Youanmi Gold Mine, located 500km north-east of Perth. The Youanmi Gold Mine is now jointly owned by Venus Metals (30%) and Rox Resources Limited (70%); Indicated and Inferred Resource of the mine is in excess of 3 million ounces of gold.

| ||

|