Announces Positive and Robust PFS for Agbaja

Announces Positive and Robust PFS for Agbaja

Perth, Jan 29, 2014 AEST (ABN Newswire) - Australian based iron ore development company, Kogi Iron Limited ( ASX:KFE) ("Kogi", "Kogi Iron", or the "Company") and it's 100% owned Nigerian operating company, KCM Mining Limited ("KCM") are pleased to advise a positive and robust outcome for the Preliminary Feasibility Study ("PFS") on its 100% owned Agbaja Iron Ore Project, in Kogi State, Federal Republic of Nigera ("Agbaja Project", "Agbaja" or the "Project").

ASX:KFE) ("Kogi", "Kogi Iron", or the "Company") and it's 100% owned Nigerian operating company, KCM Mining Limited ("KCM") are pleased to advise a positive and robust outcome for the Preliminary Feasibility Study ("PFS") on its 100% owned Agbaja Iron Ore Project, in Kogi State, Federal Republic of Nigera ("Agbaja Project", "Agbaja" or the "Project").

Highlights

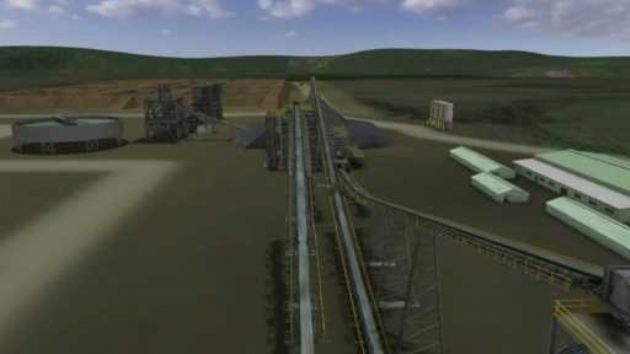

- PFS establishes robust economic and technical viability of a 5 Mtpa iron ore project at Agbaja

- Project is highly attractive with IRR of 23.7% and estimated pre-tax NPV of US$420 million (@ 12% discount)

- CAPEX estimate US$497 million and capital intensity of US$99.4/t

- Average operating costs US$42.98/t concentrate FOB

- Four year capital payback

- Project ranks in the bottom quartile for capital intensity and the bottom half of operating cost curve of magnetite projects

- Long term forecast FOB price of US$73.00/t iron ore concentrate

- Net margin US$ 30/t and average EBITDA of US$136M p.a.

- Commencement of a Definitive Feasibility Study (DFS) approved

Kogi's Managing Director Iggy Tan said: that "the PFS has been completed two months ahead of schedule which is testament to the hard work put in by the high quality team involved. The highly positive results of the study determined that the development and operation of a mine and processing plant at Agbaja to produce 5 Mtpa of iron ore concentrate is technically feasible, economically viable and socially and environmentally acceptable".

"Operating costs are estimated at ~$43/dmt FOB and capital intensity at ~$99/dmt, this places both the projected operating costs and the projected capital costs for Agbaja in the bottom half and bottom quartile respectively for global magnetite projects and comparable to some DSO hematite iron ore projects. This is due to the softness of the Agbaja material and the resultant moderate grinding intensity and simple processing plant design, the low strip ratio (0.55:1), gas fired power and river barging for concentrate transport".

"These strong results have led to approval from the Board of Kogi Iron to proceed to a Definitive Feasibility Study ("DFS") as a precursor to a decision to mine at Agbaja. The DFS is expected to be completed by end of Q4 2014".

To view the Executive Summary and diagrams, please visit:

http://media.abnnewswire.net/media/en/docs/ASX-KFE-665267.pdf

About Macro Metals Limited

Macro Metals Limited is an ASX-listed company (ASX:M4M) with the intent to build a cast steel plant on the Agbaja Plateau in Kogi State, Nigeria. The project will utilise company leased iron ore deposits and will supply a cast steel feedstock to steel manufacturing and product fabricators in Nigeria and overseas.

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

ASX:KFE) ("Kogi", "Kogi Iron", or the "Company") and it's 100% owned Nigerian operating company, KCM Mining Limited ("KCM") are pleased to advise a positive and robust outcome for the Preliminary Feasibility Study ("PFS") on its 100% owned Agbaja Iron Ore Project, in Kogi State, Federal Republic of Nigera ("Agbaja Project", "Agbaja" or the "Project").

ASX:KFE) ("Kogi", "Kogi Iron", or the "Company") and it's 100% owned Nigerian operating company, KCM Mining Limited ("KCM") are pleased to advise a positive and robust outcome for the Preliminary Feasibility Study ("PFS") on its 100% owned Agbaja Iron Ore Project, in Kogi State, Federal Republic of Nigera ("Agbaja Project", "Agbaja" or the "Project").