Quarterly Activities and Cash Flow Report

Quarterly Activities and Cash Flow Report

Perth, April 30, 2014 AEST (ABN Newswire) - Australian based iron ore development company, Kogi Iron Limited ( ASX:KFE) ("Kogi Iron", or the "Company") and its 100% owned Nigerian operating company, KCM Mining Limited ("KCM") presents the quarterly activity report for the three months ended 31 March 2014.

ASX:KFE) ("Kogi Iron", or the "Company") and its 100% owned Nigerian operating company, KCM Mining Limited ("KCM") presents the quarterly activity report for the three months ended 31 March 2014.

Kogi Iron is focused on becoming an African iron ore producer through the development of its 100% owned Agbaja iron ore project located in Kogi State, Republic of Nigeria ("Agbaja" or "Agbaja Project").

During the quarter, the Company announced the completion of 3 key milestones:

1. The positive and robust Preliminary Feasibility Study into the development of an iron ore mining and processing operation at Agbaja;

2. Submission of the Environmental Impact Assessment for the Agbaja Project to the Nigerian Federal Ministry of Environment; and

3. A maiden Ore Reserve of 205 million tonnes at 45.7%Fe within the Stage 1 and Stage 2 Mining Areas of the Agbaja Project.

The focus for the Company during the latter part of the quarter was the presentation of PFS results to a variety of potential investors and parties interested in the next stage of Agbaja's development, and the progress of various activities important to the proposed development.

Preliminary Feasibility Study

The Company's Preliminary Feasibility Study ("PFS") into the development of iron ore mining and processing operations at the Agbaja Project to produce 5Mtpa of iron ore concentrate was completed in January 2014 and the results of the study were announced to the ASX on 29 January 2014.

The key findings of the PFS are:

- Robust economic and technical viability of a 5 Mtpa iron ore project at Agbaja;

- A highly attractive project with an IRR of 23.7% and estimated pre-tax NPV of US$420 million (12% discount rate);

- Capex estimated at $497 million and capital intensity of US$99.4/tonne;

- Average estimated operating costs of US$42.98/tonne of concentrate (FOB);

- Four year capital payback;

- The project ranks in the bottom quartile for capital intensity and the bottom half of operating cost curves for magnetite iron ore projects;

- A net margin of US$30/tonne using a long term forecast FOB iron ore price of US$73/tonne; and

- EBITDA of US$136 million per annum.

The executive summary from the PFS report is set out in the Company's 29 January 2014 ASX announcement. At the time of the PFS announcement Kogi Iron said: "the PFS has been completed two months ahead of schedule which is testament to the hard work put in by the high quality team involved. The highly positive results of the study determined that the development and operation of a mine and processing plant at Agbaja to produce 5Mtpa of iron ore concentrate is technically feasible, economically viable and socially and environmentally acceptable".

Environmental Impact Assessment Study

The Company submitted its Environmental Impact Assessment ("EIA") for the Agbaja Project to the Nigerian Federal Ministry of Environment during the quarter. The mandatory 21 working day EIA public exposure period commenced on 24 March 2014 and ran until 23 April 2014. The public exposure period is followed by a panel review and in due course the Company will be advised of the review outcome, most likely in the early part of the September quarter 2014.

An EIA is a mandatory requirement under the Nigerian Minerals and Mining Act 2007 for completion prior to the commencement of mining operations and/or application for the conversion of a Mineral title (e.g. from exploration licence to mining lease).

Maiden Ore Reserve for Stage 1 and Stage 2 Mining Areas

A Probable Ore Reserve estimate of 205 million tonnes at 45.7% Fe ("Maiden Ore Reserve"), was announced to the ASX on 4 March 2014 (refer Table 1 below).

The Maiden Ore Reserve was determined for the Stage 1 and Stage 2 Mining Areas only (refer Figure 1 below). These two areas contain approximately 224 million tonnes of Mineral Resources of the total Mineral Resources of 586.3 million tonnes for the entire Agbaja Project (refer ASX announcement dated 10 December 2013 for details).

The conversion rate of Indicated Mineral Resources to Probable Ore Reserves for the two Mining Areas is approximately 92 percent, reflecting the homogenous nature of the Agbaja iron ore deposit.

The estimation of ore reserves beyond the Stage 1 and Stage 2 Mining Areas is yet to be performed as sufficient ore is expected be available from these two Mining Areas to support a mine life of in excess of 20 years, at the annual iron ore concentrate production rate of 5Mtpa assumed in the PFS.

Table 1 - Stage 1 and Stage 2 Mining Areas Ore Reserve Summary

--------------------------------------------------------Classification Ore Tonnes Fe SiO2 Al203 P Mn LOI (Mt) (%) (%) (%) (%) (%) (%)--------------------------------------------------------Probable 205 45.7 9.93 10.56 0.93 0.08 10.51Note 1. Tonnes are expressed in dry metric tonnes--------------------------------------------------------

The Maiden Ore Reserve was determined in accordance with the JORC Code (2012) by Mr Harry Warries of independent, international mining consultancy, Coffey Mining Pty Ltd ("Coffey") and closely followed the 29 January 2014 ASX announcement by the Company of a positive Preliminary Feasibility Study ("PFS") into the development of the Agbaja Project.

A detailed summary of the supporting Project assumptions and data (Table 1 as per JORC (2012) guidelines) was provided in the Company's 4 March 2014 ASX Announcement.

Corporate

Kogi Iron's Chairman, Dr Ian Burston, Managing Director, Mr Iggy Tan and Nigerian resident Executive Director, Mr Kevin Joseph all attended Mining Indaba 2014 in Cape Town, South Africa from 3 to 6 February 2014 to meet with a variety of potential investors and other stake-holders.

On 19 March 2014, the Company's Managing Director Mr Iggy Tan presented at the "Stars in 2014 Series" Proactive Investors forum in Sydney.

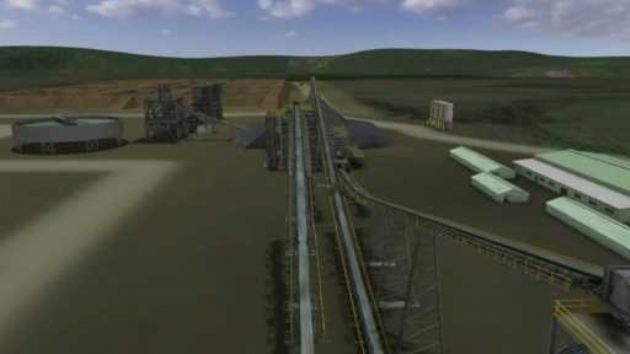

During the quarter, the Company released a Corporate Video, which presents an animation of the proposed mine, processing, bio-leaching, slurry, barging and transhipment facilities associated with the proposed development of the Agbaja Project. The corporate video is available for viewing on the Company's web site: www.kogiiron.com.

On 15 March 2014 the Company released 87,766,667 ordinary fully paid shares from a 24 month ASX imposed escrow period. As at 31 March 2014, the Company had 320,198,563 fully paid ordinary shares on issue and no options on issue (refer the attached Appendix 5B for details).

Funding

On 31 March 2014, the Company had cash at bank of approximately $0.240 million.

The Company continues to engage with potential investors, in respect to the next tranche of funding to enable the implementation of a number of value adding initiatives building on the PFS.

To view the complete quarterly activities report, please visit:

http://media.abnnewswire.net/media/en/docs/ASX-KFE-676303.pdf

About Macro Metals Limited

Macro Metals Limited is an ASX-listed company (ASX:M4M) with the intent to build a cast steel plant on the Agbaja Plateau in Kogi State, Nigeria. The project will utilise company leased iron ore deposits and will supply a cast steel feedstock to steel manufacturing and product fabricators in Nigeria and overseas.

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

ASX:KFE) ("Kogi Iron", or the "Company") and its 100% owned Nigerian operating company, KCM Mining Limited ("KCM") presents the quarterly activity report for the three months ended 31 March 2014.

ASX:KFE) ("Kogi Iron", or the "Company") and its 100% owned Nigerian operating company, KCM Mining Limited ("KCM") presents the quarterly activity report for the three months ended 31 March 2014.