Maiden 205 Million Tonne Iron Ore Reserve at Agbaja

Perth, Mar 4, 2014 AEST (ABN Newswire) - Australian based iron ore development company, Kogi Iron Limited ( ASX:KFE) ("Kogi", "Kogi Iron" or the "Company") and its 100% owned Nigerian operating company, KCM Mining Limited ("KCM") are pleased to detail a maiden Ore Reserve estimate for the 100% owned Agbaja Iron Ore Project located in Kogi State, Republic of Nigeria, West Africa ("Agbaja" or "Agbaja Project").

ASX:KFE) ("Kogi", "Kogi Iron" or the "Company") and its 100% owned Nigerian operating company, KCM Mining Limited ("KCM") are pleased to detail a maiden Ore Reserve estimate for the 100% owned Agbaja Iron Ore Project located in Kogi State, Republic of Nigeria, West Africa ("Agbaja" or "Agbaja Project").

Ore Reserve Estimate

The maiden Ore Reserve estimate for the Agbaja Project ("Maiden Ore Reserve") totals 205 million tonnes at 45.7% Fe and is classified as Probable Ore Reserve (refer Table 1 below).

Table 1 - Agbaja Project Ore Reserve Summary

---------------------------------------------------Classification Ore Fe SiO2 Al203 P Mn LOI (Mt) (%) (%) (%) (%) (%) (%) ---------------------------------------------------- Probable 205 45.7 9.93 10.56 0.93 0.08 10.51----------------------------------------------------Note 1. Tonnes are expressed in dry metric tonnes

The Maiden Ore Reserve was determined in accordance with the JORC Code (2012) by Mr Harry Warries of independent, international mining consultancy, Coffey Mining Pty Ltd ("Coffey") and closely follows the 29 January 2014 announcement by the Company of a positive Preliminary Feasibility Study ("PFS") into the development of the Agbaja Project.

A detailed summary of the supporting project assumptions and data (Table 1 as per JORC (2012) guidelines) is provided in Appendix A in link below.

Commenting on the Maiden Ore Reserve, Kogi's Managing Director Mr Iggy Tan, said: "This Ore Reserve is another important milestone in Kogi's vision to be an African iron ore producer and comes only a matter of weeks after the Company announced the very positive results from its PFS, giving us further confidence in the Agbaja Project."

"The 205 million tonne Maiden Ore Reserve re-affirms the PFS findings that there is sufficient mineable ore of requisite grade within the Stage 1 and Stage 2 mining areas at Agbaja to support economic mining and processing operations at an annual rate of 5.0 million tonnes of iron ore concentrate, for 21 years. The Maiden Ore Reserve will be the basis for a Definitive Feasibility Study ("DFS") at Agbaja, which the Company expects to complete by the end of 2014."

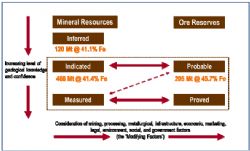

Summary of Kogi's Mineral Resource and Ore Reserves Estimates

Over the last two years the Company has been pleased to announce progressive increases in the size and geological confidence of the Agbaja Project Mineral Resource/Ore Reserve estimates, as the level of knowledge and geological understanding of the Project has grown. These announcements are summarised below:

Date of ASX Resource/Reserve Tonnes &Announcement Estimation Grade28 Sep 2012 Maiden Resource (Inferred) 488 Mt @ 42.7% Fe10 Dec 2013 Updated Mineral Resource (20% increase) 586 Mt @ 41.3% Fe10 Dec 2013 Maiden Indicated Mineral Resource 466 Mt @ 41.4% Fe27 Feb 2014 Maiden Ore Reserve 205 Mt @ 45.7% Fe

The general relationship between the exploration phase of the Project (Mineral Resources) and the development phase (Ore Reserves) is best illustrated by Figure 1 in link below, which is taken from the JORC Code (2012) and is populated with the Company's Updated Mineral Resource and Ore Reserve numbers.

Cut-off grade

As the processing method selected by the Company for the Agbaja Project incorporates magnetic separation, the cut-off for ore determination was not based on Fe, rather, it was based on the magnetic susceptibility of the mineralised material.

The magnetic susceptibility measurements identified that the boundary between magnetic and non-magnetic material is very sharp, i.e. the material is either magnetic or not. The lateritic (Zone A) horizon is non-magnetic.

A cut-off of 20 x 10 -3 SI within the Zone B (Oolite) resource was used for ore determination. It is noted that the Oolite zone was based on a nominal 30% Fe lower cut-off.

The deposit exhibits a relatively consistent ore profile that comprises a layer of lateritic material (non-magnetic and not treated at this stage of the Project) followed by a layer of oolitic material (magnetic). In addition, the deposit is relatively contiguous and readily discernible. As such, no pit optimisation was undertaken. The pit design was based on the Stage 1 and Stage 2 mining areas that exhibited the lowest waste to ore strip ratio and was sufficiently large to sustain a 21 year mine life (refer figure 2 in link below).

Preliminary Feasibility Study (Material Assumptions and Outcomes)

In determining the Maiden Ore Reserve, Coffey undertook detailed mine planning work based on the Company's 466 million tonne Indicated Mineral Resource (refer ASX Announcement 10 December 2013) and considered various material assumptions and Modifying Factors from the PFS which are summarised in Table 2 below and discussed in more detail on pages 18 to 23 of this announcement (Appendix A - JORC Code (2012) Table 1).

Table 2 - Summary of the Material Modifying Factors applied in Ore Reserve Determination

---------------------------------------------------------Item Unit Value---------------------------------------------------------Crusher feed Mtpa 11.1Crusher feed yield % 45Product rate Mtpa 5Product price US$/dmt 73Royalty (of net revenue) % 4Initial capital expenditure US$M 497Sustaining capital US$M 144Processing cost US$/dmt product 13.96Barging and transhipping US $/dmt product 18.77Average mining costs (Contract mining) US $/dmt product 8.12General and administration cost US $/dmt product 2.13Mining dilution % 1Mining recovery % 94Overall pit wall slope angle (inclusive of a ramp system) degrees 40---------------------------------------------------------

The PFS determined that the Agbaja Project is a robust and attractive project. The payback of the Project is excellent at four years with a net present value of US$420 million (@ 12% discount) and Internal Rate of Return of 23.7%. The Project ranks in the bottom quartile for capital intensity and bottom half of operating cost curve of magnetite projects around the world. Agbaja is positioned in the most attractive cost profile and lowest capital intensity matrix quadrant (bottom left quadrant), which reflects in the overall potential and robustness of the Project.

Mining Method, Recovery, Dilution and Infrastructure

The Agbaja iron ore deposit comprises an extensive shallow (on average less than 30m) flat-lying channel iron deposit of material that is relatively soft and friable. It is proposed the deposit be mined using traditional truck/excavator open pit development which will result in a low strip ratio of 0.55 to 1 over the 21 year mine plan. The low stripping ratio is a distinct advantage for the Project and is expected to deliver relatively low mining costs, estimated in the PFS at US$3.69/t of ore feed to the processing plant, which equates to US$8.12/t of iron ore concentrate produced.

The mine plan is primarily based on Indicated Resources with 8% of the mill feed being classified as Inferred Resources. The Maiden Ore Reserve is located within the two initial mining areas (Stage 1 and Stage 2) identified during the PFS, as illustrated in Figure 2. The mine plan incorporates a two year mining ramp-up, with steady state production of 5 Mtpa of product (or 11.1 Mtpa of crusher feed based on a yield of 45%) reached in Year 3. The average total material movement (ore and waste) after Year 3 ranges from 18 Mtpa to 21 Mtpa.

In the absence of geotechnical parameters, the pit design was based on a terrace style pit wall configuration, adopting 75 degree batter angles, in conjunction with 2m high benches and 2m wide berms. Mining dilution and mining recovery was modelled by regularising the sub-blocked resource model using a selective mining unit (SMU) of 20mE x 20mN x 2mRL.

The SMU resulted in a 6% ore loss and a 1% dilution in Fe grade.

As the Agbaja deposit exhibits a relatively consistent ore profile that comprises a layer of lateritic material (non-magnetic and not treated at this stage of the Project) followed by a layer of oolitic material (magnetic) and the deposit is relatively contiguous and readily discernible, no pit optimisation was undertaken and the pit design was based on an area that exhibited the lowest waste to ore strip ratio.

The primary infrastructure required for the development of the Project are: general administration and services infrastructure, general mining facilities, natural gas fired power station at site, process plant, a 22 km slurry pipeline pumping concentrate from the process plant to the river barging facility, a river barging facility which will be powered by dedicated diesel generators, a barge transfer station located some 600 km from the river barging facility where the iron ore product is transferred onto ocean going barges, and a floating transhipment storage facility where the product will be loaded onto Panamax or Cape size ships.

Mineral Resource Estimation Methodology

The Zone B (Oolite) component of the 466 million tonne Indicated Mineral Resource (which was the major portion of the Updated Mineral Resource announced by the Company on 10 December 2013) was estimated by Coffey and forms the basis for the Maiden Ore Reserve estimate (refer Table 3 in link below).

To view the full release including figures and tables, please visit:

http://media.abnnewswire.net/media/en/docs/76712-ASX-KFE-669568.pdf

About Macro Metals Limited

Macro Metals Limited is an ASX-listed company (ASX:M4M) with the intent to build a cast steel plant on the Agbaja Plateau in Kogi State, Nigeria. The project will utilise company leased iron ore deposits and will supply a cast steel feedstock to steel manufacturing and product fabricators in Nigeria and overseas.

| ||

|