Scotia Tenements Purchased From Breakaway

Adelaide, July 29, 2013 AEST (ABN Newswire) - Minotaur Exploration Ltd ( ASX:MEP) advises its 50% owned subsidiary(note 1) Minotaur Gold Solutions Ltd ('MinAuSol') has completed its acquisition(note 2) from Breakaway Resources Ltd ('Breakaway') (

ASX:MEP) advises its 50% owned subsidiary(note 1) Minotaur Gold Solutions Ltd ('MinAuSol') has completed its acquisition(note 2) from Breakaway Resources Ltd ('Breakaway') ( ASX:BRW) and its wholly owned subsidiary Scotia Nickel Pty Ltd of the Scotia tenements in Western Australia.

ASX:BRW) and its wholly owned subsidiary Scotia Nickel Pty Ltd of the Scotia tenements in Western Australia.

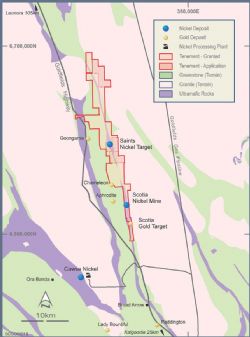

The Scotia tenements (see link for Figure 1), covering approximately 160km2, are located about 65km north of Kalgoorlie. Aphrodite Gold Limited ('Aphrodite') ( ASX:AQQ) may earn a joint venture beneficial interest of up to 80% in the gold rights and is obliged to keep all tenement expenditure requirements up to date.

ASX:AQQ) may earn a joint venture beneficial interest of up to 80% in the gold rights and is obliged to keep all tenement expenditure requirements up to date.

Minotaur considers the Scotia tenements to be highly prospective for gold and nickel mineralisation. Gold occurrences have been proven by AQQ's recent joint venture exploration (see end note). Past nickel exploration by Breakaway and others established the presence of new targets around the historic Scotia Nickel mine(note 3) and, 15km to the north at the Saints Nickel Target (Figure 1), the undeveloped St Patricks nickel deposit(note 4).

MinAuSol retains, subject to overriding obligations noted below:

- 100% of the rights to all minerals other than gold, and

- the right to no less than 20% of gold deposits which will be free-carried unless and until a decision to mine any gold deposit is made. If a decision to mine is made, MinAuSol may elect to forego its interest in the gold mining area for a royalty of 1.5% of the gold net smelter return.

MinAuSol's acquisition of the Scotia tenements completes the foundation step in its assembly of mineral prospective ground in WA. MinAuSol is specifically attracted by the gold potential at Chameleon and elsewhere on the Scotia tenements and its location proximal to AQQ's Aphrodite Gold Project.

Two of the tenements are the subject of an overriding obligation to pay to St Ives Gold Mining Company Pty Ltd and Agnew Gold Mining Company Pty Ltd a royalty of $1.20 per dry tonne of ore milled from any gold mining operation.

Six of the tenements are the subject of an overriding obligation to pay to Norilsk Nickel Australia Pty Ltd or Norilsk Avalon Pty Ltd a 2.5% net smelter return for nickel, copper and platinum group elements recovered.

End Note:

Gold intercepts reported by AQQ(note 5) from drilling at the Chameleon prospect included 12m @ 10.99g/t (66-78m, Hole CHR0001), 6m @ 4.48g/t (92-98m, Hole CHR0016) and 11m @ 2.05g/t Au (129-140m, Hole 0002). Excellent historic gold intercepts at Chameleon reported earlier by Breakaway, are presented on the Breakaway web page(note 6).

1 Minotaur's exploration Alliance investor recently acquired a 50% interest in MinAuSol for $300,000. Refer to Minotaur's release to ASX dated 14 June 2013, Cornerstone Placement and Copper-Gold Funding Alliance.

2 For details of the sale and purchase agreement refer to Minotaur's release to ASX dated 20 May 2013, Minotaur acquires Scotia tenements from Breakaway.

3 Up to mine closure in 1977, Scotia Nickel mine had produced 1.4Mt ore at average grade of 2.2% Ni to 360m depth. Source:

http://www.breakawayresources.com.au/projects/scotia_project.phtml

4 Source:

http://www.breakawayresources.com.au/projects/scotia_project.phtml

5 Refer to Aphrodite Gold releases to ASX dated 2 August 2011, 30 August 2011 and 15 December 2011 for details and Competent Person's statements.

6 Source:

http://www.breakawayresources.com.au/projects/scotia_project.phtml

To view diagrams, please visit:

http://media.abnnewswire.net/media/en/docs/ASX-MEP-746779.pdf

About Minotaur Exploration Ltd

Minotaur Exploration Ltd (ASX:MEP) is a public company listed on the Australian Securities Exchange (ASX) under the market code MEP. MEP commenced trading on ASX on 25 February 2005. Minotaur has extensive minerals exploration tenements in South Australia, New South Wales, Victoria, Queensland and Western Australia.

Minotaur Exploration Ltd (ASX:MEP) is a public company listed on the Australian Securities Exchange (ASX) under the market code MEP. MEP commenced trading on ASX on 25 February 2005. Minotaur has extensive minerals exploration tenements in South Australia, New South Wales, Victoria, Queensland and Western Australia.

The Company is governed by a Board of Directors according to Australian Corporate law and the Listing Rules of the ASX. Minotaur specialises in application of innovative geophysical techniques to locate virgin mineralisation deep below the surface. Often, economic mineral deposits are contained within basement rocks, buried below several hundred metres of transported cover (overburden) and cannot be located through conventional surface exploration methods such as soil sampling, geochemical assays and drilling. Minotaur's remote sensing and interpretative approach has proven very successful, time and time again.

The directors and management of Minotaur each have over 30 years of exploration, mining and mineral resource experience and are eminently qualified in their respective fields of expertise. Under their direction, Minotaur has earned a strong reputation for technical excellence and a high profile within the Australian resources sector. Minotaur's share register comprises 3500 shareholders.

Minotaur is actively exploring IOCG style targets in Australia, where geophysics have identified numerous sub-surface anomalies prospective for copper-gold mineralisation and other targets prospective for base metals such as zinc, lead, copper.

| ||

|