Galaxy Resources Ltd. (ASX:GXY) will move quickly to develop its proposed A$55 million factory in Jiangsu Province China to process lithium carbonate for use in batteries and electronic devices, the company said. Galaxy plans to start site preparation in December and start construction in April, with first production scheduled in the 2010 fourth quarter.

Sydney, Oct 22, 2009 AEST (ABN Newswire) - US shares fell overnight led by Wells Fargo. A late sell-off in financial stocks was triggered after an analyst cut his investment rating on the company, saying the quality of its earnings was pretty poor. The Federal Reserve's latest beige book, showing weak consumer spending during late summer, also weighed down the market.

The Australian share market declined at the opening this morning, following the poor lead from Wall Street. The Australian shares closed slightly lower yesterday on the downbeat US corporate earnings. The benchmark S&P/ASX200 index lost 7.6 points, or 0.16 per cent, to 4838.6 points, while the broader All Ordinaries index fell 6.6 points, or 0.14 per cent, to 4846.2 points.

Key Economic Facts and Figures

Australian Bureau of Statistics (ABS) figures showed that new motor vehicle sales increased by 2.9 per cent, seasonally adjusted, in September. The number rose for the second straight month in September as more consumers committed to major purchases amid signs of an improving economy, an economist says. The data is reflecting the improvement in consumer and business confidence, as shown by recent private sector surveys.

Today in economic news, the Housing Industry Association publishes its affordability report for the September quarter.

M&A News

Brookfield Multiplex has made an undertaking to the Takeovers Panel to hold fire on a A$50million entitlement issue for its Multiplex Prime Property Fund (ASX:MAFCA). The fund manager said that, pending resolution of an application from Nicholas Bolton's company Australian Style Investments, it would not issue units or process the application in the cash-out facility offer. The Takeovers Panel said it had accepted the undertaking from Brookfield Multiplex.

Important Corporate News

Transport and logistics firm Asciano Group (ASX:AIO) says the strong trading conditions seen in the second half of 2008-09 have continued into the new financial year. There has been some encouraging signs within a number of Asciano's businesses, with volumes showing signs of stability or improvement over the quarter. The company said it is clearly experiencing some limited benefits from the rebuilding of inventories following the significant de-stocking process last year.

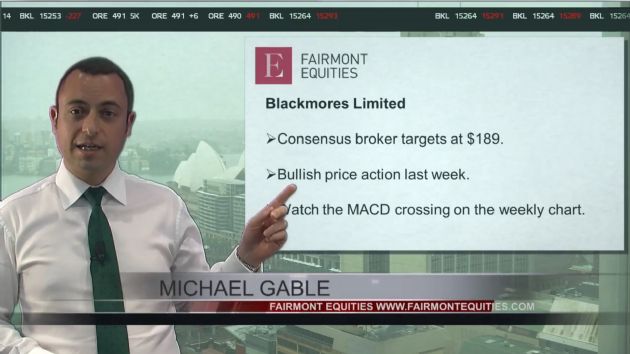

Blackmores Limited (ASX:BKL) posted a 17 per cent increase in first quarter revenue to A$54.7 million, compared to previous correspoinding period. The group delivered a A$6.9 million net profit after tax, down slightly compared to the same quarter last year reflecting the impact of increased interest and depreciation costs associated with the investment in the new Blackmores Campaus at Warriewood.

Carsales.com (ASX:CRZ), an online car selling company, has reiterated its earnings guidance for 2009/10 financial year. The company said that revenue for 2009-10 was expected to be 20 percent up on 2008-09. Carsales said it wanted to improve its online sales capability to take advantage of the improvement in the market

Galaxy Resources Ltd. (ASX:GXY) will move quickly to develop its proposed A$55 million factory in Jiangsu Province China to process lithium carbonate for use in batteries and electronic devices, the company said. Galaxy plans to start site preparation in December and start construction in April, with first production scheduled in the 2010 fourth quarter.

Nomad Building Solutions (ASX:NOD) shares fell 10 per cent yesterday. The company forecasts a profitable full-year result, although its forecast of between A$10 million to A$12 million was down from the A$13.3 million it made in 2008-09 - again down 45 per cent on a year earlier. The weaker-than-expected forecasts were attributed largely to contract delays. Nomad chief financial officer Paul Depiazzi said the sector outlook was strong. The weaker-than-expected forecasts were attributed largely to contract delays.

Oil and gas producer Santos Ltd (ASX:STO) says it's on track to meet its production guidance for calendar 2009, after reporting a five per cent lift in third quarter output. Production rose to 13.9 million barrels of oil equivalent (mmboe) in the three months ended September 30, from 13.2 mmboe the same quarter in 2008.

Funds manager Perpetual (ASX:PPT) forecasts its net profit for the six months to December 31 between A$40 million and A$50 million, Sydney-based Perpetual said in a statement today. That would compare to the $14.19 million net profit reported in the prior corresponding period.

Contact

Michelle Liang

Asia Business News Asia Bureau

Tel: +61-2-9247-4344

Email: michelle.liang@abnnewswire.net

| ||

|