2018 - 2019 drilling campaign to target improved Mineral Resource classification and growth

Bankable Feasibility Study Drilling Campaign and Project Optimisation Studies

Bankable Feasibility Study Drilling Campaign and Project Optimisation Studies

Sydney, Sep 13, 2018 AEST (ABN Newswire) - Cobalt Blue Holdings Limited ( ASX:COB) (

ASX:COB) ( CBBHF:OTCMKTS) announces Bankable Feasibility Study commences with drilling campaign and project optimisation studies.

CBBHF:OTCMKTS) announces Bankable Feasibility Study commences with drilling campaign and project optimisation studies.

KEY POINTS:

- Following completion of a Pre-Feasibility Study (PFS), the Thackaringa Cobalt Project has entered the Bankable Feasibility Study (BFS) phase. We are pleased to update the market on progress.

- Cobalt Blue Holdings Limited ( ASX:COB) is commencing the largest single drilling campaign at Thackaringa - in excess of 15,000 metres will be drilled over the coming six months. Previously, between 2H 2016 and 1H 2018, COB has drilled a total of 20,445 metres (38 diamond drill holes, 93 RC drill holes, and 3 RC drill holes with diamond tails) over three campaigns.

ASX:COB) is commencing the largest single drilling campaign at Thackaringa - in excess of 15,000 metres will be drilled over the coming six months. Previously, between 2H 2016 and 1H 2018, COB has drilled a total of 20,445 metres (38 diamond drill holes, 93 RC drill holes, and 3 RC drill holes with diamond tails) over three campaigns.

- Updated Resource Model due end Q2 2019.

2018-2019 Drilling Program Aims:

The drilling campaign has five broad aims:

- Improved Mineral Resource classification - defining Measured Resources.

- Growth of Mineral Resources - exploration along margins of existing mineralised bodies.

- Confirmation of the location of infrastructure and site layout - geotechnical and hydrogeological drilling for project infrastructure and process plant civil works.

- Overburden definition - identification of oxide and/or transition layer(s).

- Blue-sky exploration - follow up previously identified geophysical anomalies.

Improved Resource Classification

Based on the results of the PFS, COB is aiming to define a component of Measured Mineral Resources. This will require in-fill drilling at approximately 40 metre spacing to improve geological confidence and data density. During the BFS Mining Study, Measured Mineral Resources will be evaluated for conversion to Proven Ore Reserves. Typically, the target quantity for Proven Ore Reserves would be sufficient to fulfil the initial 3 to 5 year period of the proposed project production, as defined in the BFS.

Additional in-fill drilling will target improved classification of Inferred to Indicated Mineral Resources. Indicated Mineral Resources will be evaluated for conversion into Probable Ore Reserves during the BFS Mining Study.

Mineral Resource Growth

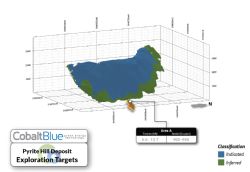

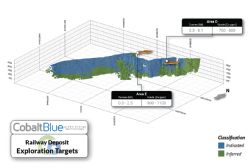

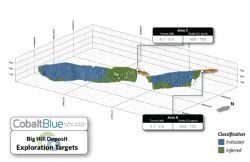

In the upcoming campaign, COB is aiming to increase the Inferred Mineral Resources by targeting down-dip extensions at the Pyrite Hill deposit and shallow strike extensions at the Big Hill and Railway deposits. As part of the BFS, COB is targeting a 20+ year mine life with growth of the overall Mineral Resource a key component of achieving this target. For clarity, future additional drilling campaigns are expected to be undertaken following completion of the 2H 2018 to 1H 2019 program which is described in this announcement.

Exploration targets identified for current and future phases of exploration drilling are summarised in Table 1(see link below), and the location of these targets with respect to the Mineral Resources are shown in Figures 1, 2 and 3(see link below).

Oxidation Boundary Definition

COB will drill near-surface holes to better define the oxide and/or transition oxide-sulphide layers which represent shallow overburden (10-25 metres) on top of the fresh sulphide ore. To date (in the PFS and Scoping Study), oxidised and partially oxidised material was excluded from the reported Mineral Resources and subsequently proposed mining and processing studies. The drilling campaign will identify if any cobalt is present through the oxidation profile, and if so, related metallurgical studies will then be undertaken.

Infrastructure and Site Layout

In support of continuing technical studies commissioned for the broader BFS, COB will complete additional drilling for the purposes of geotechnical, hydrological and hydrogeological assessment related to infrastructure, mining and process plant planning.

Blue-sky exploration

In September 2017, the entire project area (63km2) was surveyed using a heliborne electromagnetic (EM) survey (VTEM-Max) at a nominal 100 metre line spacing. Several strong EM responses outside of the existing Mineral Resources (Pyrite Hill, Railway Deposit and Big Hill) were recorded and have now been cross-checked with coincident geophysical (Induced Polarisation) and geochemical anomalism (see Figure 4 in link below). In the upcoming drilling campaign, COB will undertake some preliminary drilling at these targets during the proposed program.

We look forward to keeping the market informed as the campaign results become available during Q4 2018 and Q1 2019. An updated Mineral Resource statement is due by the end of Q1 CY2019.

Over the period 2H CY 2016 to 1H CY2018, COB has delivered a 118% increase in total Mineral Resource tonnes and a 124% increase in contained cobalt (inclusive of Indicated and Inferred Mineral Resource classifications). This growth in total Mineral Resources and improvement of classification is shown in Figure 5(see link below).

The Thackaringa Cobalt Project

The Thackaringa Cobalt Project (the Project) is located approximately 23 km west-southwest of Broken Hill and comprises four tenements for a total area of 63 km2. The project is subject to a farm-in agreement between COB and Broken Hill Prospecting Limited ( ASX:BPL) (

ASX:BPL) ( BPLNF:OTCMKTS).

BPLNF:OTCMKTS).

The tenements host three large tonnage cobalt-bearing pyrite deposits with a reported Mineral Resource of 72 million tonnes at 852ppm cobalt (Co), 9.3% sulphur (S) & 10% iron (Fe) for 61Kt contained cobalt (at a 500ppm cobalt cut-off).

The Mineral Resource estimate at Thackaringa is apportioned to the three main deposits as detailed in Table 2(see link below).

Thackaringa Project Optimisation Studies

COB is progressing several option studies identified in the PFS. These opportunities are explained below:

Target Revenue Increases:

- Life of Mine: The production target identified in the PFS provided an initial mine life of 12.8 years at a steady-state throughput of 5.25 million tonnes per annum ore. This mine life is limited largely by current available geological information, rather than economic factors. In other words, the mineral resource of 72 million tonnes limited the production target and remains the most significant upside factor in our focus. Given that the development capital is largely expended in the early years of the project, increasing mine life will drive significant free cash flow generation for the project. Our aspirational target is a 20+ year project and for shareholders this is a substantially different investment. The market can expect a mineral resource update by the end of Q1 2019.

- Cobalt and Sulphur Recoveries: The PFS assumed a conservative 85.5% cobalt recovery (in ground to payable metal), including (negative) allowances for scale-up from the existing laboratory testwork results of 88.5% metal recovery. Our long-term target is to achieve a 90% cobalt recovery. A bulk test work program is being commissioned that will enable COB to undertake more detailed marketing studies and build confidence with potential commercial partners. The market can expect an update on recoveries by the end of Q2 2019.

Target Cost Reductions:

- Power: The PFS identified that approximately 22% of operational cash costs were related to grid power consumption.

COB will perform the following power related studies - to be completed by end of Q2 2019:

o Optimising waste heat capture and re-use - how much energy can be recycled?

o Optimising the daily load profile - how much peak energy can be avoided?

o Distributed energy generation and storage - how much energy can be generated on-site? Can energy storage (e.g.: Li-ion batteries) be used effectively to shift demand away from peak time-of-day prices?

- Process Plant Tailings: Tailings and associated handling represented approximately 10% of operational cash costs in the PFS. COB is undertaking optimisation studies which are expected to be completed by early Q4 2018.

Independent Review - Wood PLC

In parallel with the above studies, Wood PLC (formerly AMEC Foster Wheeler), a leading global engineering firm, has been engaged to provide a gap analysis review of the PFS. This review, expected to be finalised shortly, will help shape the BFS scope and ensure that critical study areas are being addressed with appropriate resources.

To view tables and figures, please visit:

http://abnnewswire.net/lnk/97KU559W

About Cobalt Blue Holdings Limited

Cobalt Blue Holdings Ltd (ASX:COB) (FRA:COH) (OTCMKTS:CBBHF) has a strategic approach that positions us to be among the first wave of new entrants into the allied battery materials supply chain. We are committed to playing a leading role in securing a stable and sustainable future for critical minerals.

Cobalt Blue Holdings Ltd (ASX:COB) (FRA:COH) (OTCMKTS:CBBHF) has a strategic approach that positions us to be among the first wave of new entrants into the allied battery materials supply chain. We are committed to playing a leading role in securing a stable and sustainable future for critical minerals.

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

ASX:COB) (

ASX:COB) ( CBBHF:OTCMKTS) announces Bankable Feasibility Study commences with drilling campaign and project optimisation studies.

CBBHF:OTCMKTS) announces Bankable Feasibility Study commences with drilling campaign and project optimisation studies.  ASX:COB) is commencing the largest single drilling campaign at Thackaringa - in excess of 15,000 metres will be drilled over the coming six months. Previously, between 2H 2016 and 1H 2018, COB has drilled a total of 20,445 metres (38 diamond drill holes, 93 RC drill holes, and 3 RC drill holes with diamond tails) over three campaigns.

ASX:COB) is commencing the largest single drilling campaign at Thackaringa - in excess of 15,000 metres will be drilled over the coming six months. Previously, between 2H 2016 and 1H 2018, COB has drilled a total of 20,445 metres (38 diamond drill holes, 93 RC drill holes, and 3 RC drill holes with diamond tails) over three campaigns.  ASX:BPL) (

ASX:BPL) ( BPLNF:OTCMKTS).

BPLNF:OTCMKTS).  Cobalt Blue Holdings Ltd (ASX:COB) (FRA:COH) (OTCMKTS:CBBHF) has a strategic approach that positions us to be among the first wave of new entrants into the allied battery materials supply chain. We are committed to playing a leading role in securing a stable and sustainable future for critical minerals.

Cobalt Blue Holdings Ltd (ASX:COB) (FRA:COH) (OTCMKTS:CBBHF) has a strategic approach that positions us to be among the first wave of new entrants into the allied battery materials supply chain. We are committed to playing a leading role in securing a stable and sustainable future for critical minerals.