Significant Value Upgrade Following Updated PFS - Arcadia

Significant Value Upgrade Following Updated PFS - Arcadia

Perth, Mar 19, 2018 AEST (ABN Newswire) - Prospect Resources Ltd ( ASX:PSC) (the "Company") is pleased to announce that it has revised its Pre-Feasibility Study ("PFS") over the Arcadia Lithium Project in Zimbabwe.

ASX:PSC) (the "Company") is pleased to announce that it has revised its Pre-Feasibility Study ("PFS") over the Arcadia Lithium Project in Zimbabwe.

- Positive improvements in key project parameters further enhances the economics of the project confirming arcadia as a significant future supplier of lithium to the global market.

UPDATED PFS HIGHLIGHTS:

- Increased Ore Reserve of 26.9Mt @ 1.31% Li2O and 128 ppm Ta2O5 Maiden (previously 15.8 Mt @ 1.34% Li2O and 127 ppm Ta2O5). The Ore Reserves support a +20 year mine life.

- Improved ratio of higher value Spodumene to Petalite minerals following delivery of X-ray Diffraction (XRD) sampling programme results.

- Product pricing improvements based on pricing formulae reflecting the long-term Offtake Agreement with Sinomine.

FINANCIAL HIGHLIGHTS OF UPDATED PFS MINE PLAN:

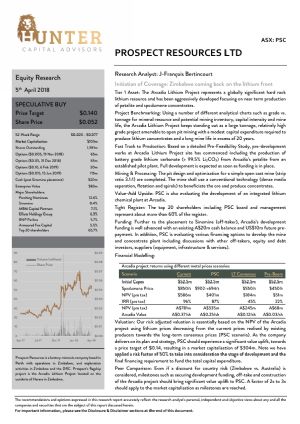

- NPV (see Note 1 below) (10% Discount Rate, pre Tax) of USD340 Million, IRR (see Note 1 below) of 77% and payback of 2 years

- LoM Revenue USD2.6 Billion at a Cash Operating Cost (see Note 2 below) of USD287 per tonne concentrate

- Capital Expenditure remains at USD52.5 Million

ARCADIA UPDATED LITHIUM PFS STUDY

Since the PFS was announced in July 2017, the Company has:

- Increased the Mineral Resource to 43.2 Mt @ 1.41% Li2O and 119 ppm Ta2O5 (1% Li2O cut-off), (34.9 Mt @ 1.42% Li2O and 125 ppm Ta2O5 (1% Li2O cut-off) in the PFS)

- Completed an XRD program on 3,162 lithium ore samples to gain a greater understanding of the lithium mineralogy resulting in an increased in the ratio of higher value Spodumene to Petalite minerals within the orebody

- Increased the Ore Reserve to 26.9 Mt @ 1.31% Li2O and 128 ppm Ta2O5, (15.8 Mt @ 1.34% Li2O and 125 ppm Ta2O5 in the PFS).

- Entered into a conditional, long-term (7 year) Offtake Agreement with Sinomine with a Spodumene and Petalite concentrate formulae based on the price of lithium carbonate imported into China and concentrate prices sold on an FOB Port of Beira basis.

- Increased our understanding of the recently defined Basal and Lower Pegmatites in the southwest of the planned pit area.

This updated data has been incorporated into the project's financial model resulting in a pretax NPV10 of USD 340 Million and an IRR of 77%. The PFS financial model estimates a net revenue of USD 2.6 Billion over a 22-year mine life. Pricing has been increased compared to the PFS reflecting the pricing formulae in the Offtake Agreement, which, consistent with other industry contracts is linked to the lithium carbonate price. The revenue was further improved due to the higher ratio of Spodumene to Petalite mineralisation identified by the XRD work on the orebody resulting in more lithium reporting to the higher value Spodumene concentrate.

Unit operating costs net of tantalum credits average USD 287/t of lithium concentrate. The reduced unit cost compared to the PFS mainly reflects reduced transport costs with the concentrates being sold on a FOB Port of Beira rather than a CFR China port basis.

The estimated Capital Expenditure (including initial working capital) remains the same as the PFS at USD52.5 Million following ongoing discussions with equipment and infrastructure suppliers.

A summary of the key inputs and results are highlighted in the table (see link below).

Below are details of the key variances between PFS and the Updated PFS Study.

MINERAL RESOURCES

The Mineral Resource estimate that formed the basis to the PFS was announced on 14 March 2017. Further drilling after the PFS increased the Mineral Resource estimate (at a 1% Li2O cut-off) to 43.2 Mt or a 24% increase in the resource. The two Mineral Resource estimates are tabled below (see link below) for comparison.

As part of the Mineral Resource estimate programme, 3 162 samples were taken and subject to XRD analysis to determine the lithium mineralogy of the orebodies. At the time of the PFS, limited results were available from assay program. Based on this limited wide spread data, the weighted average ratio of Spodumene to Petalite within the confines of the open pit was estimated to be about 40:60.

With all the XRD data loaded into the geological block model in the 25 October 2017 Mineral Resource estimate, the weighted average ratio of Spodumene to Petalite within the confines of the new open pit was estimated to be 47:53.

This materially impacts the ratio between of lithium concentrate products produced, with more of the higher value Spodumene concentrate being produced.

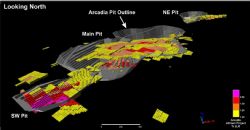

ORE RESERVES

The increase in the Mineral Resource estimate was a key factor in the increase in the Ore Reserves announced on 6 December 2017 and formed the basis of the Updated PFS. Other positive factors which impacted pit optimisation and design were:

- Reduced transport cost with products sold on an FOB basis

- Increase in the Spodumene concentrate price based on the formula within the seven-year Offtake agreement

All other inputs used in the PFS for the optimisation process remained the same. The optimisation and subsequent pit design increase the Ore Reserve from 15.8 Mt to 26.9 Mt.

METALLURGICAL TEST WORK

Metallurgical test work is ongoing and is not expected to cease even after commissioning. Spirals test work is ongoing and optical sorting is also being considered to further improve on the overall lithia recovery.

CAPITAL COST ESTIMATES

Capital expenditure (CAPEX) estimates have not materially changed since the PFS. The costs have been estimated using firm prices, budget prices, list prices and current industry costs. Ongoing discussions continue with suppliers on pricing to confirm no material change. The capital estimate remains at an accuracy of +/- 25 %.

OPERATING COST ESTIMATES

Operating costs (OPEX) for each of the activities within the project have not substantially varied on a unit basis between the PFS and Updated PFS. The two areas that have changed are:

- Mining as a result of the slight increase in the stripping ratio

- Transport with the lithium concentrates in the Updated PFS being sold on a FOB African port rather than CFR China basis

The latter has a material impact on the overall unit cost of concentrate.

Below is a table (see link below) detailing the difference in unit OPEX between the two studies.

Sales and Pricing

Sales of lithium minerals from the project in the Updated PFS is forecast to average 27 000 tpa LCE in lithium mineral concentrates and approximately 98 000 lb. pa Ta2O5 in tantalite concentrates over the LoM.

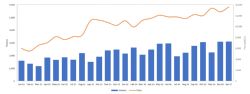

The Spodumene and Petalite concentrate prices as with other lithium concentrate contracts have been derived using formulae linked to the lithium carbonate price delivered into China. This is the structure of the seven-year Offtake Agreement between Prospect and Sinomine with lithium concentrate prices based on a FOB Port of Beira Incoterms(R)2010. While current lithium carbonate prices delivered into China are over USD13,500/t reflecting the existing supply/demand dynamics, the Company has taken a conservative view as to long term price for lithium carbonate as additional supply enters the market over the coming years. The long-term lithium carbonate price forecast of USD10,000 equates to price of USD675/t for 6.0% Li2O spodumene concentrate and USD413/t for 4.1% Li2O Petalite concentrate. This compares to current announced pricing of around USD900/t for 6% Li2O spodumene concentrate

While the price of tantalite (Ta2O5) has remained flat at around USD60/lb over a number of years, prices have recently increased with sales up to USD90/lb. The Company has taken a conservative view of pricing and has retained a long-term price of USD60/lb. There is significant value add to the project if prices continue to rise given the low incremental cost of producing tantalum as a by-product of lithium processing.

Environment and Government Approvals

Following completion, submission and review of the Environment Impact Assessment completed by Independent Consultants over Arcadia, the Zimbabwe Environmental Management Agency (EMA) issued EIA Certificate number 8000018391 to the Company. This grants the Company permission to operate in accordance with Part XI of the Environmental Management Act (Chapter 20:27) subject to certain specified terms and conditions that are normal for such an authority.

All local stake holders have been consulted and have agreed to the proposed mine plan and development. In addition, the Zimbabwe Investment Authority (ZIA) issued Investment License Number 003496 to the Company which now provides the Company with access to several fiscal and investment benefits and incentives. It was deemed prudent to separate the Company's gold assets from lithium assets into two separate subsidiary structures, each with their own ZIA license. The Board believes that this structure will offer greater flexibility as to how the Arcadia Lithium Project can be financed and also how the Company finances its gold assets.

The Arcadia project now has all approvals in place, as well as a publicised full support of the Zimbabwe Government, to start mining and construction on site. A ground breaking ceremony involving the President of Zimbabwe is planned for in April 2018.

Previously Reported Information

This report includes information and references that relates to Mineral Resources, Ore Reserves and Pre-feasibility Study which were prepared and first disclosed under the JORC Code (2012). The information is sourced from the following ASX announcements:

- 14 March 2017 Significant Mineral Resource Upgrades - Arcadia Lithium

- 16 March 2017 Replacement Announcement - 14 March 2017

- 03 July 2017 Pre-feasibility Study - Arcadia Lithium Project

- 25 October 2017 Significant Increase in Mineral Resource Estimate - Arcadia

- 27 October 2017 Information to comply with Listing Rule 5.8.1

- 10 November 2017 Offtake and Placement and Framework Agreement with Sinomine

Notes:

1 NPV10 and IRR Calculated after State Royalty (2%), a State lithium minerals tax (5%) and Minerals Marketing Corporation Zimbabwe commission (0.875 %) on gross production, pre tax

2 Cash Operating Costs include all costs associated with producing and shipping Li2O concentrates sold on a FOB Port of Beira Incoterms(R) 2010 basis and are net of byproduct credits from Ta2O5 sales

To view tables and figures, please visit:

http://abnnewswire.net/lnk/4Z30CV51

About Prospect Resources Ltd

Prospect Resources Limited (ASX:PSC) is based in Australasia with operations in Zimbabwe and is a publicly listed company. We are committed to creating value for Prospect's shareholders and the communities in which our company operates. Our vision is to build a Southern African based mining company of international scale.

Prospect Resources Limited (ASX:PSC) is based in Australasia with operations in Zimbabwe and is a publicly listed company. We are committed to creating value for Prospect's shareholders and the communities in which our company operates. Our vision is to build a Southern African based mining company of international scale.

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

ASX:PSC) (the "Company") is pleased to announce that it has revised its Pre-Feasibility Study ("PFS") over the Arcadia Lithium Project in Zimbabwe.

ASX:PSC) (the "Company") is pleased to announce that it has revised its Pre-Feasibility Study ("PFS") over the Arcadia Lithium Project in Zimbabwe.  Prospect Resources Limited (ASX:PSC) is based in Australasia with operations in Zimbabwe and is a publicly listed company. We are committed to creating value for Prospect's shareholders and the communities in which our company operates. Our vision is to build a Southern African based mining company of international scale.

Prospect Resources Limited (ASX:PSC) is based in Australasia with operations in Zimbabwe and is a publicly listed company. We are committed to creating value for Prospect's shareholders and the communities in which our company operates. Our vision is to build a Southern African based mining company of international scale.