Sydney, Jan 19, 2018 AEST (ABN Newswire) - New Century Resources ( ASX:NCZ) has released an initial resource for its South Block deposit, part of the Century Zinc operation in Queensland. Highlights of the announcement include the following.

ASX:NCZ) has released an initial resource for its South Block deposit, part of the Century Zinc operation in Queensland. Highlights of the announcement include the following.

- South Block resource - 6.1 Mt at 6.8% Zn + Pb (5.3% Zn, 1.5% Pb, 43 g/t Ag).

- Total hard-rock resource - 9.3 Mt at 10.8% Zn + Pb (6.1% Zn, 4.7% Pb, 66 g/t Ag).

- Expansion feasibility study to assess potential for in situ resources to enhance Century's mine life and increase zinc and lead production.

Analyst comment: the increase in the hard-rock resource has confirmed our long-held belief that there is significantly more potential at the Century Zinc operation than just the tailings reprocessing opportunity.

We take the view that the existing hard-rock resource alone will underpin a positive expansion feasibility study, which will lead to hard-rock mining recommencing at the Century mine (TSI estimate: 2020), operating in parallel with the tailings reprocessing operation.

Processing tailings and hard-rock assets simultaneously will extend the operations mine life from six to 10 years and allow for greater operational flexibility (ore will be sourced from at least four deposits rather than one). Moreover, both the forecast total and annualised revenues will benefit from an increase in silver as well as lead production (the latter metal, we note, is trading at a six-year high).

Based on the current resource, we predict that hard-rock operations will continue for an initial five-year period (1.6 Mt OP and 0.6 Mt UG). And, given that the significant historical exploration database is still under review, it seems probable that more deposits - those deemed too small by previous operators at Century - will be proven up and brought into the future mine plan.

Prior to production from the tailings reprocessing facility commencing in 3Q 2018 and the release of the expansion feasibility study later this year (4Q 2018), we expect that New Century's debt facility with Sprott will be finalised, as will an announcement regarding zinc offtake over the coming months.

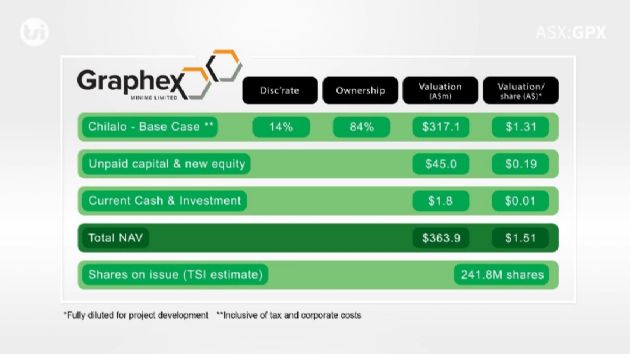

Valuation: having incorporated the hard-rock resources into our projected mine plan, which has increased our valuation to $3.61/share (previously $3.10).

To view the video, please visit:

http://www.abnnewswire.net/press/en/91718/NCZ

About New Century Resources Ltd

New Century Resources Limited (ASX:NCZ) is an Australian base metal producer operating the Century Mine in Queensland with the aim of becoming one of the world's top 10 zinc producers.

New Century Resources Limited (ASX:NCZ) is an Australian base metal producer operating the Century Mine in Queensland with the aim of becoming one of the world's top 10 zinc producers.

New Century acquired the Century Mine when it ceased production in 2016 and has executed an economic rehabilitation plan comprised of upgrading the mine's existing world-class infrastructure. This rehabilitation was completed in August 2018 when the mine successfully entered production.

New Century Resources is initially focusing on the existing ore reserves to produce zinc in the lowest cost quartile globally. Substantial mineral resources exist on the mining leases which will provide a significant opportunity for mine life extension and metal production increases from the mine's operations.

About The Sophisticated Investor

The Sophisticated Investor is a new equity investment tool which seeks to assist investors in becoming more informed in their investment decision making. We show and tell investors about a company in a series of short, informative videos. We possess specialist equity analyst skills and are complemented by video professionals. We conduct site visits and interview management, in a way most investors simply aren’t able to access. We promote long term value creation for investors by employing detailed financial analysis and intrinsic value calculations.

Customer notice

Adam Kiley trading as The Sophisticated Investor ('TSI'), (AR No. 458224), is an authorised representative of Intelligent Financial Markets Pty Ltd (AFSL No. 426359). The information contained in this communication is intended as general advice only. Your personal objectives, financial situation and needs have not been taken into consideration. Accordingly, you should consider how appropriate the advice is (or is not) to your objectives, financial situation and needs before acting on the advice. The information in this communication should not be the only trigger for your investment decision. We strongly recommend you seek professional financial advice whenever making financial investment decisions.

Conflict of interest

TSI does and seeks to do business with companies featured in its articles and videos. As a result, investors should be aware that TSI may have a conflict of interest that could affect the objectivity of some articles or videos. Investors should consider TSI articles and videos as only a single factor in making any investment decision. The publishers also wish to disclose that they may hold stock in some companies featured in their articles and videos, and that any decision you make to purchase the stock of a company TSI profiles should be made only after you have initiated your own enquiries as to the validity of any information contained in those articles and videos.

Publisher's note

TSI will only initiate coverage of a company that passes our internal investment checklist. Once a company has passed this checklist, we will initiate coverage of that company and follow up with ongoing updates and commentary on its activities. Articles and videos produced and published by TSI are NOT Research Reports in terms of ASIC Regulatory Guide 79.

| ||

|