Sydney, Dec 21, 2017 AEST (ABN Newswire) - Lithium Power ( ASX:LPI) (

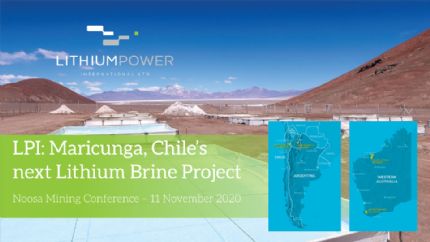

ASX:LPI) ( LTHHF:OTCMKTS) has released a positive preliminary economic assessment (PEA) study for its Maricunga lithium brine project in Chile. Highlights of that study include the following.

LTHHF:OTCMKTS) has released a positive preliminary economic assessment (PEA) study for its Maricunga lithium brine project in Chile. Highlights of that study include the following.

- Production - 20,000 tpa of lithium carbonate (LCE) and 74,000 tpa of potassium chloride (KCl) fertiliser.

- Operating costs - US$2,938/t LCE (US$2,635/t post KCl credit).

- Project NPV - US$731 million after tax at 8% discount rate (US$1.049 billion before tax

- IRR of 23.4% (ungeared).

- Capital costs - US$527 million (US$389 million direct costs, including KCl plant).

- Short payback - 2 years and 11 months (based on 2-year ramp-up period).

- Mine life - 20 years (initial).

Analyst comment: this excellent achievement for Lithium Power positions Maricunga to become the next producing lithium asset in Chile and, in our opinion, the standout lithium brine development project globally, due to its forecast exceptionally low operating costs.

While most of the assumptions were in line with our previous estimates, capital costs are higher. We believe there may be scope to reduce these costs in future studies, given that US$137 million of the total capital outlay was for contingencies and indirect costs.

Also boding well for the development of Maricunga is the election of SebastiƔn PiƱera, a conservative billionaire, as the country's president. PiƱera is reportedly pro-business and foreign investment, and there is a high degree of expectation that the new government will enact numerous policies to encourage and improve the lithium industry in Chile.

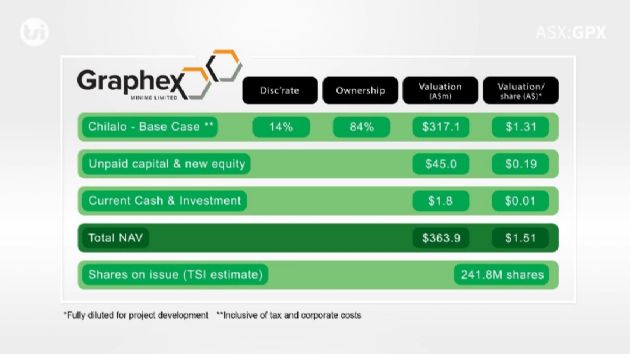

Valuation: we have decreased our valuation of Lithium Power to $1.13/share (previously $1.24). The driver for this reduction was higher capital costs than our previous estimate.

To view the video, please visit:

http://www.abnnewswire.net/press/en/91494/lpi

About Lithium Power International Ltd

Lithium Power International Limited (ASX:LPI) is a pure play lithium company with three distinct project regions to provide diversification. One is located in South America's brine region and three are in Australia's spodumene hard rock areas of Western Australia.

Lithium Power International Limited (ASX:LPI) is a pure play lithium company with three distinct project regions to provide diversification. One is located in South America's brine region and three are in Australia's spodumene hard rock areas of Western Australia.

The primary focus is to develop of Chile's next high-grade lithium mine on the Maricunga Salar in an area known as the Lithium Triangle. The Company has also expanded its tenement holdings of lithium exploration prospects in Western Australia.

About The Sophisticated Investor

The Sophisticated Investor is a new equity investment tool which seeks to assist investors in becoming more informed in their investment decision making. We show and tell investors about a company in a series of short, informative videos. We possess specialist equity analyst skills and are complemented by video professionals. We conduct site visits and interview management, in a way most investors simply aren’t able to access. We promote long term value creation for investors by employing detailed financial analysis and intrinsic value calculations.

Customer notice

Adam Kiley trading as The Sophisticated Investor ('TSI'), (AR No. 458224), is an authorised representative of Intelligent Financial Markets Pty Ltd (AFSL No. 426359). The information contained in this communication is intended as general advice only. Your personal objectives, financial situation and needs have not been taken into consideration. Accordingly, you should consider how appropriate the advice is (or is not) to your objectives, financial situation and needs before acting on the advice. The information in this communication should not be the only trigger for your investment decision. We strongly recommend you seek professional financial advice whenever making financial investment decisions.

Conflict of interest

TSI does and seeks to do business with companies featured in its articles and videos. As a result, investors should be aware that TSI may have a conflict of interest that could affect the objectivity of some articles or videos. Investors should consider TSI articles and videos as only a single factor in making any investment decision. The publishers also wish to disclose that they may hold stock in some companies featured in their articles and videos, and that any decision you make to purchase the stock of a company TSI profiles should be made only after you have initiated your own enquiries as to the validity of any information contained in those articles and videos.

Publisher's note

TSI will only initiate coverage of a company that passes our internal investment checklist. Once a company has passed this checklist, we will initiate coverage of that company and follow up with ongoing updates and commentary on its activities. Articles and videos produced and published by TSI are NOT Research Reports in terms of ASIC Regulatory Guide 79.

| ||

|