Perth, Oct 25, 2017 AEST (ABN Newswire) - Family Zone Cyber Safety ('Family Zone') ( ASX:FZO) has signed a share sale agreement to acquire 100% of Linewize Services Limited and Linewize Limited ('Linewize'), which together comprise a leading New Zealand-based provider of cyber security and safety services. Highlights of the transaction include the following.

ASX:FZO) has signed a share sale agreement to acquire 100% of Linewize Services Limited and Linewize Limited ('Linewize'), which together comprise a leading New Zealand-based provider of cyber security and safety services. Highlights of the transaction include the following.

Linewize has a current network of 260 schools (130,000 students) across New Zealand.

Linewize has created an innovative and world-class cloud technology that will achieve an order of magnitude reduction in service costs for Family Zone.

Consideration consists of a deposit of NZ$200,000 in cash, the issue of 9.5 million ordinary shares in Family Zone and 9.5 million performance shares.

Analyst comment: the short-term benefits of the transaction are obvious, given that Family Zone will have immediate access to 260 schools and 130,000 students throughout New Zealand, which we believe will increase revenue for the current year (TSI estimate - total FZO revenue $7 million 2018 FY). That said, the longer-term benefit of implementing Linewize's state-of-the-art platform into Family Zone is expected to result in significant ongoing cost savings, whilst the platform will also likely simplify the company's continued expansion into the US market.

Further, Family Zone continues to progress its telecommunication strategy, as Telkomsel - one of the world's largest mobile carriers, with 178 million users in Indonesia - recently launched its white-label service 'Family Protect'. Given Telkomsel's client base, this has the potential, even with a small uptake, to significantly and positively impact Family Zone's bottom line. We anticipate additional carrier agreements and further commercialisation launches during 2018.

The information in this email should not be the only trigger for your investment decision. We strongly recommend you seek professional financial advice whenever making financial investment decisions.

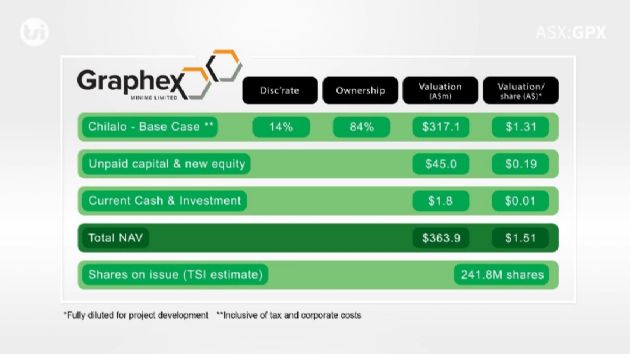

Valuation: we have increased our valuation for Family Zone to $1.33 /share (previously $0.84/share). The major drivers for this were reducing our discount rate to 13.3% (previously 18.5%) and increasing our revenue assumption (1% LT uptake - 2022) for the Asian telecommunication carriers only (the previous assumption being nil revenue for telecommunication carriers). We will reassess this again as the Telkomsel partnership matures.

To view the video presentation, please visit:

http://www.abnnewswire.net/press/en/90523/fzo

About The Sophisticated Investor

The Sophisticated Investor is a new equity investment tool which seeks to assist investors in becoming more informed in their investment decision making. We show and tell investors about a company in a series of short, informative videos. We possess specialist equity analyst skills and are complemented by video professionals. We conduct site visits and interview management, in a way most investors simply aren’t able to access. We promote long term value creation for investors by employing detailed financial analysis and intrinsic value calculations.

Customer notice

Adam Kiley trading as The Sophisticated Investor ('TSI'), (AR No. 458224), is an authorised representative of Intelligent Financial Markets Pty Ltd (AFSL No. 426359). The information contained in this communication is intended as general advice only. Your personal objectives, financial situation and needs have not been taken into consideration. Accordingly, you should consider how appropriate the advice is (or is not) to your objectives, financial situation and needs before acting on the advice. The information in this communication should not be the only trigger for your investment decision. We strongly recommend you seek professional financial advice whenever making financial investment decisions.

Conflict of interest

TSI does and seeks to do business with companies featured in its articles and videos. As a result, investors should be aware that TSI may have a conflict of interest that could affect the objectivity of some articles or videos. Investors should consider TSI articles and videos as only a single factor in making any investment decision. The publishers also wish to disclose that they may hold stock in some companies featured in their articles and videos, and that any decision you make to purchase the stock of a company TSI profiles should be made only after you have initiated your own enquiries as to the validity of any information contained in those articles and videos.

Publisher's note

TSI will only initiate coverage of a company that passes our internal investment checklist. Once a company has passed this checklist, we will initiate coverage of that company and follow up with ongoing updates and commentary on its activities. Articles and videos produced and published by TSI are NOT Research Reports in terms of ASIC Regulatory Guide 79.

| ||

|