Strong PFS highlights long term potential at Matilda Gold Project

Perth, Sep 1, 2017 AEST (ABN Newswire) - Blackham Resources ( ASX:BLK) (

ASX:BLK) ( BKHRF:OTCMKTS) has announced a positive Pre-Feasibility Study for their Matilda/Wiluna Gold Project in Western Australia.

BKHRF:OTCMKTS) has announced a positive Pre-Feasibility Study for their Matilda/Wiluna Gold Project in Western Australia.

Highlights of the study include:

- Forecasted gold production - 207koz per annum (first 6 yrs);

- LOM AISC - A$1,058/oz;

- 9 Yr mine life (initial) - 19.2Mt at 2.7g/t for 1.7Moz Au; and

- Initial Capital Costs - $114m.

Analyst Comment: Overall this was a positive result for Blackham as the Pre-Feasibility Study highlighted the potential for the Matilda/Wiluna Project to become a +200koz Au per annum operation by 2019.

One of the key difference's between this and previous studies was a significant increase in the open pit inventory (1.1Moz at 2.3g/t Au). The major driver for this was the Wiluna open pits, which until recently was only a small part of the company's long term plan. However since drilling intensified late last year, the company has delineated an ore reserve of 669koz at 2.7g/t Au, which is an impressive achievement in such a short space of time.

Capital costs were largely in line with previous guidance (ES $104m vs. PFS $114m). We did note the inclusion of a Filter Press (Capex $75m) as an alternative option to refurbishing the BIOX Facility ($114m).

This would see the company produce a concentrate rather than dore', which would be discounted to the prevailing gold price (TSI estimate - 10% to 15%). However, given the significant capital cost saving ($39m) and the likelihood that operating costs fall further due to limited back end processing, we believe this option should investigated further, as it would significantly improve the company's ability to raise funds for capital development.

Before the expansion achieving production guidance for the remainder of 2017 is critical, as this will help rebuild confidence in the market regarding the company's ability to meet their targets.

The information in this email should not be the only trigger for your investment decision. We strongly recommend you seek professional financial advice whenever making financial investment decisions.

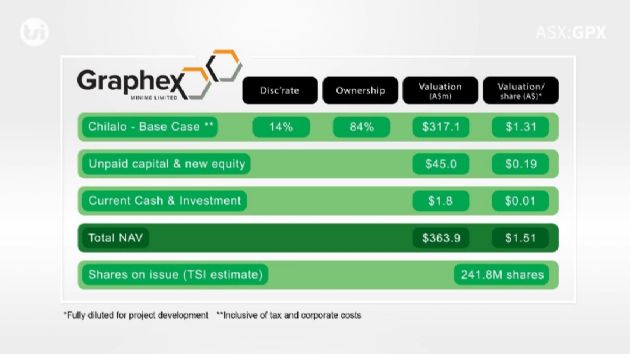

Valuation: We have increased our valuation to $0.97 / share (share price $0.28) .

To view the video, please visit:

http://www.abnnewswire.net/press/en/89842/blk

About The Sophisticated Investor

The Sophisticated Investor is a new equity investment tool which seeks to assist investors in becoming more informed in their investment decision making. We show and tell investors about a company in a series of short, informative videos. We possess specialist equity analyst skills and are complemented by video professionals. We conduct site visits and interview management, in a way most investors simply aren’t able to access. We promote long term value creation for investors by employing detailed financial analysis and intrinsic value calculations.

Customer notice

Adam Kiley trading as The Sophisticated Investor ('TSI'), (AR No. 458224), is an authorised representative of Intelligent Financial Markets Pty Ltd (AFSL No. 426359). The information contained in this communication is intended as general advice only. Your personal objectives, financial situation and needs have not been taken into consideration. Accordingly, you should consider how appropriate the advice is (or is not) to your objectives, financial situation and needs before acting on the advice. The information in this communication should not be the only trigger for your investment decision. We strongly recommend you seek professional financial advice whenever making financial investment decisions.

Conflict of interest

TSI does and seeks to do business with companies featured in its articles and videos. As a result, investors should be aware that TSI may have a conflict of interest that could affect the objectivity of some articles or videos. Investors should consider TSI articles and videos as only a single factor in making any investment decision. The publishers also wish to disclose that they may hold stock in some companies featured in their articles and videos, and that any decision you make to purchase the stock of a company TSI profiles should be made only after you have initiated your own enquiries as to the validity of any information contained in those articles and videos.

Publisher's note

TSI will only initiate coverage of a company that passes our internal investment checklist. Once a company has passed this checklist, we will initiate coverage of that company and follow up with ongoing updates and commentary on its activities. Articles and videos produced and published by TSI are NOT Research Reports in terms of ASIC Regulatory Guide 79.

About Wiluna Mining Corporation Ltd

Wiluna Mining Corporation (ASX:WMC) (OTCMKTS:WMXCF) is a Perth based, ASX listed gold mining company that controls over 1,600 square kilometres of the Yilgarn Craton in the Northern Goldfields of WA. The Yilgarn Craton has a historic and current gold endowment of over 380 million ounces, making it one of most prolific gold regions in the world. The Company owns 100% of the Wiluna Gold Operation which has a defined resource of 8.04M oz at 1.67 g/t au. In May 2019, a new highly skilled management team took control of the Company with a clear plan to leverage the Wiluna Gold Operation's multi-million-ounce potential.

Wiluna Mining Corporation (ASX:WMC) (OTCMKTS:WMXCF) is a Perth based, ASX listed gold mining company that controls over 1,600 square kilometres of the Yilgarn Craton in the Northern Goldfields of WA. The Yilgarn Craton has a historic and current gold endowment of over 380 million ounces, making it one of most prolific gold regions in the world. The Company owns 100% of the Wiluna Gold Operation which has a defined resource of 8.04M oz at 1.67 g/t au. In May 2019, a new highly skilled management team took control of the Company with a clear plan to leverage the Wiluna Gold Operation's multi-million-ounce potential.

| ||

|