Perth, Aug 4, 2017 AEST (ABN Newswire) - Carbine Resources ( ASX:CRB) has announced the signing of a binding offtake agreement for its pyrite production with Chinese Trading company IKing International Limited (IKing) at the company's Mount Morgan gold copper tailings re-treatment project in Queensland.

ASX:CRB) has announced the signing of a binding offtake agreement for its pyrite production with Chinese Trading company IKing International Limited (IKing) at the company's Mount Morgan gold copper tailings re-treatment project in Queensland.

The agreement contains a guaranteed floor price for all the pyrite concentrate delivered with a profit sharing mechanism for prices achieved greater than the floor price. The floor price will be negotiated on an annual basis and the agreement is for a minimum of 85% of the concentrate produced for the first three years.

Analyst Comment: The magnitude of this announcement cannot be under estimated. In our opinion, given the markets limited knowledge of pyrite, and the importance of pyrite to the projects overall revenue generation (TSI estimate - 24% LOM), obtaining offtake was in our opinion the greatest risk associated with the projects development.

With binding terms now agreed, which also importantly defined production levels (a minimum of 85% of the concentrate produced) as well as guaranteeing a floor price, we are hopeful finance negotiations will intensify in the coming months.

Catalyst: The two major items that need to be resolved prior to project financing is the third of the government approvals (Environmental Authority (EA) amendment), remembering that an EA was previously approved for the project in 2010 and complete the Front End Engineering and Design (FEED). Both of these are likely to be completed in September. Albeit that the approval process for this project seems to be a drawn out process particularly given this project has so many environmental benefits for the Queensland government.

In addition, the company submitted an application for financial support from the Queensland government $130m Jobs and Regional Growth Fund. Given the projects large environmental legacy as well as the high unemployment in the region, whilst not factored into our current valuation, this could reduce the equity component for project financing significantly. Again it would seem logical that this project would be a prime candidate to receive assistance from this fund.

The information in this email should not be the only trigger for your investment decision. We strongly recommend you seek professional financial advice whenever making financial investment decisions.

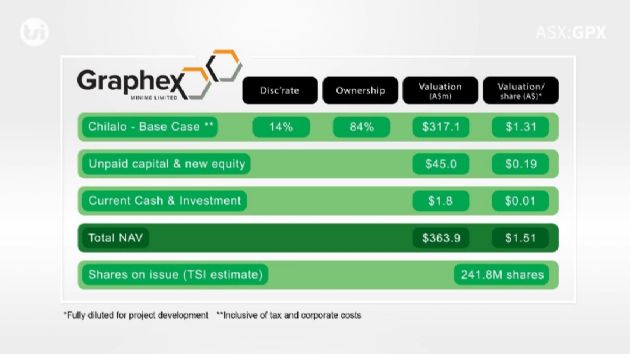

Valuation: We maintained our valuation for Carbine at $0.44 / share (SP $0.08 / share), as we were already conservative with our commodity price assumptions (Gold; US$1,250, Copper Sulphate US$6,450/t; Pyrite -$US$60/t). With the inclusion of the by-production credits this LOM AISC of A$660/oz. This will maintain Mount Morgan as one of the lowest gold producers in Australia.

This information is general information only. Any advice is general advice only. Neither your personal objectives, financial situation or needs have not been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice. Adam Kiley (AR No. 458224) is an authorised representative of Intelligent Financial Markets Pty Ltd (AFSL No. 426359).

TSI Capital Pty Ltd (TSI Capital) will only initiate coverage of a company that passes our internal investment checklist. Once a company has passed this checklist will we initiation coverage of the company as well as follow up with ongoing updates and commentary on that company's activities.

TSI Capital does and seeks to do business with companies featured in videos on this website. As a result, investors should be aware that TSI Capital may have a conflict of interest that could affect the objectivity of our analysis. Investors should consider the information and commentary within this website as only a single factor in making any investment decision. The publishers of this video also wish to disclose that they may hold this stock in their portfolios and that any decision to purchase this stock should be done so after the purchaser has made their own inquires as to the validity of any information in this video.

To view the video, please visit:

http://www.abnnewswire.net/press/en/89450/crb

About Carbine Resources Limited

Carbine Resources (ASX:CRB) is an Australian public company based in Perth, Western Australia. The strategic objective of the Company is the advancement of shareholder's interests through exploration and evaluation of its current projects and acquisition of additional projects on favourable terms.

Carbine Resources (ASX:CRB) is an Australian public company based in Perth, Western Australia. The strategic objective of the Company is the advancement of shareholder's interests through exploration and evaluation of its current projects and acquisition of additional projects on favourable terms.

About The Sophisticated Investor

The Sophisticated Investor is a new equity investment tool which seeks to assist investors in becoming more informed in their investment decision making. We show and tell investors about a company in a series of short, informative videos. We possess specialist equity analyst skills and are complemented by video professionals. We conduct site visits and interview management, in a way most investors simply aren’t able to access. We promote long term value creation for investors by employing detailed financial analysis and intrinsic value calculations.

Customer notice

Adam Kiley trading as The Sophisticated Investor ('TSI'), (AR No. 458224), is an authorised representative of Intelligent Financial Markets Pty Ltd (AFSL No. 426359). The information contained in this communication is intended as general advice only. Your personal objectives, financial situation and needs have not been taken into consideration. Accordingly, you should consider how appropriate the advice is (or is not) to your objectives, financial situation and needs before acting on the advice. The information in this communication should not be the only trigger for your investment decision. We strongly recommend you seek professional financial advice whenever making financial investment decisions.

Conflict of interest

TSI does and seeks to do business with companies featured in its articles and videos. As a result, investors should be aware that TSI may have a conflict of interest that could affect the objectivity of some articles or videos. Investors should consider TSI articles and videos as only a single factor in making any investment decision. The publishers also wish to disclose that they may hold stock in some companies featured in their articles and videos, and that any decision you make to purchase the stock of a company TSI profiles should be made only after you have initiated your own enquiries as to the validity of any information contained in those articles and videos.

Publisher's note

TSI will only initiate coverage of a company that passes our internal investment checklist. Once a company has passed this checklist, we will initiate coverage of that company and follow up with ongoing updates and commentary on its activities. Articles and videos produced and published by TSI are NOT Research Reports in terms of ASIC Regulatory Guide 79.

| ||

|