UPDATED OUTLOOK FOR 2017

Sydney, Feb 2, 2017 AEST (ABN Newswire) - Brand Protection and Customer Engagement solutions company YPB Group Ltd ( ASX:YPB) is pleased to provide an updated outlook for 2017.

ASX:YPB) is pleased to provide an updated outlook for 2017.

- 2017 profit outlook confirmed at $5m pre-tax

- Annualised operating cost base reduction of 40% by mid-2017 following strategy refinements

- Possible non-recurring restructuring charge in the range $0.50m - 0.75m

- Breakeven expectation delayed three months due to contract closure slippages - now expected end June 2017

YPB has concluded its Annual Operating Plan (AOP) process, reconfirming the expectation of a $5m pretax profit for the year to December 2017. This figure is, however, prior to a potential once-off restructuring charge (discussed in more detail below).

The profit expectation is maintained despite a three month delay in the expected timing of breakeven from the end of March 2017 to the end of June 2017. This slippage is due to contract closures taking longer than expected and therefore first revenues from these deals flowing later than expected.

The key outcome of the AOP was a refinement of strategy that will see a narrower focus of management effort, allowing a reduction in annual operating costs from $11.1m to $6.5m per annum.

Approximately 95% of the planned savings in monthly spend will be delivered by May 2017 with full benefits achieved by August 2017. The changes are unlikely to diminish YPB's revenue potential, with the most likely reconfiguration expected to substantially enhance revenues.

The obvious financial benefit from the refined strategy is securing a breakeven position at a lower revenue base and with less risk, while magnifying profit leverage to revenue growth.

The AOP was due to conclude in December but was delayed due to strategic opportunities in key territories arising in late November. These opportunities will improve market access, lower costs and enhance profit potential.

The most important opportunity is the change from a direct sales force to a partnership model in key territories where YPB's costs have been traditionally high. This prospect arose in late November and has progressed well in the New Year, with targeted partners believing their home markets are ripe for YPB product.

The trade-off for YPB in partnering is lower percentage margin but this penalty is irrelevant in light of the benefits of high quality partners. In one key territory under negotiation, any margin foregone is dwarfed by the potential revenue and profit uplift from vastly superior client access, market reach, organisational credibility and speed to market. This partner is a household name in its home market with a decades-old country-wide distribution network. Higher revenues with minimal costs and capital requirements is a compelling outcome of partnering.

Please note that it is possible that the most valuable partnership currently in train may not be concluded. Nevertheless, the process is well advanced and contractual closure is presently expected to be concluded in Q1 2017. Upon closure, more detail will be provided to the market regarding this new partnership.

The $4.5m per annum in annualised overhead savings noted above is not dependent on the conclusion of any partnerships and will be implemented regardless. The incidence of restructuring charge is, however, possibly dependent on conclusion of the key partnership referred to above and the model adopted. One possible scenario would see YPB incur minimal restructuring costs. In the event of YPB bearing all costs, a once-off charge of $0.50m - $0.75m is likely in H1 2017.

The primary variable in achieving the stated 2017 profit expectation is conversion of opportunity into revenue. If revenues are not achieved as expected, profit will not be achieved as expected. There are, however, solid reasons to anticipate strong and sufficient revenue growth despite some unexpected delays in 2016. YPB is undoubtedly in a much stronger and more prospective position than it was in 2016 given:

- The assembly of the full, new executive team was only completed in Q3 2016. This year management will hit the ground running with greater experience and skill in dealing with client opportunities and barriers to contract closure.

- The opportunity pipeline filled rapidly over 2016, particularly in H2. Starting 2017, new business momentum is strong and leagues ahead of that as at the start of 2016. Not only has the magnitude of the pipeline grown over the past year but the passage of time means the number of mature projects closer to conclusion is also greater than in 2016.

- Key Multiplier Partnerships established in late 2016 with leading packaging companies such as Orora Ltd ( ASX:ORA) (

ASX:ORA) ( ORRAF:OTCMKTS), Impact International and L&E are expected to yield new revenue across multiple clients.

ORRAF:OTCMKTS), Impact International and L&E are expected to yield new revenue across multiple clients.

- Ease of conversion to increase following the signing of household name banner clients. Prominent reference clients reduce career risk for client personnel championing YPB's novel technologies.

- Upgraded versions of the key software platforms SECURETRACK and CONNECT being available expected to accelerate the pace of adoption.

- The incidence of competitive solutions being offered to clients presently engaged with YPB remains close to zero.

Finally, in considering whether the revenues necessary for profitability can be achieved, it is pertinent that the size of the opportunity pipeline and potential revenues currently in development are well ahead of the revenues necessary to achieve the company's profit expectations. In other words, only relatively modest pipeline conversion rates are necessary to achieve revenue and profit targets.

Since last updating the market in September 2016, the total pipeline value has fallen from $128m to $112m for three reasons:

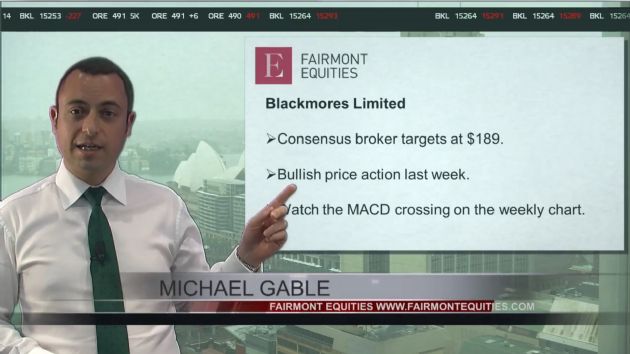

- Conversion from pipeline into realised sales and hence removal from the pipeline. This includes client wins such as Blackmores ( ASX:BKL), Impact International, L&E, Dan Murphy's, BWS, Lorna Jane and Mama Care;

ASX:BKL), Impact International, L&E, Dan Murphy's, BWS, Lorna Jane and Mama Care;

- Reduction in expected value of certain contracts following refinement of scope as projects have advanced with clients; and

- Seeking to further improve reward for sales efforts, resulting in a range of small value projects being removed from the pipeline for the time being.

Advanced projects value has fallen from $65m to $37m for the three reasons just noted. Intermediate projects has increased from $64m to $75m, partly due to the change in classification from Advanced projects resulting from slippage of clients' timetables. The total number of projects increased from 96 to 98. The number of advanced projects has fallen from 55 to 18 with 26 of the deletions being small projects. The number of Intermediate projects has risen from 41 to 80.

YPB Executive Chairman John Houston said: "After a detailed and exhaustive process we are pleased to be able to reconfirm our profit expectations for 2017, despite slippage in the anticipated timing of breakeven. The refinements to strategy developed in the AOP enhance the prospect of successful execution and the major cost-out decisions increase potential profitability and potential profit leverage without sacrificing opportunity. These changes reflect our determination to secure YPB's future as a highly profitable, self-sustaining and strongly growing business."

About YPB Group Ltd

DEACTIVATED

| ||

|