Perth, Nov 23, 2016 AEST (ABN Newswire) - Graphex Mining Ltd ( ASX:GPX) is developing the Chilalo graphite project in Tanzania. Unlike the majority of other graphite developers that have targeted the spherical graphite sector, Graphex plans to sell concentrate from Chilalo into the expandable graphite market.

ASX:GPX) is developing the Chilalo graphite project in Tanzania. Unlike the majority of other graphite developers that have targeted the spherical graphite sector, Graphex plans to sell concentrate from Chilalo into the expandable graphite market.

Expandable graphite is used predominately in flame retardant building materials. Recent changes in Chinese building regulations have mandated the use of flame retardant building materials in all future constructions, meaning the demand for expandable graphite looks set for significant growth.

The Chilalo project is one of the world's premier expandable graphite projects, with an expansion ratio six times the rate of Chinese projects and around three times the rate of other African development projects.

Analyst Comment: Offtake in our opinion is the most critical aspect prior to the development of any commodity that is not traded on a designated metal exchange (such as graphite). Without offtake there is no guarantee of a buyer for the product, which in turn makes project financing difficult.

Graphex is on the verge of securing offtake with two highly reputable Chinese State owned enterprises (CNBM & China Gold) which would eliminates this risk. Attracting partners of this size and calibre also highlights the quality and significance's of the Chilalo Project.

With the offtake partner also likely to become a Joint Venture partner in the project (anticipated 50% acquisition at the project level), Graphex will essentially be fully funded once offtake is finalised. Given this we expect a significant re-rating in Graphex's share price once the binding offtake terms are finalised in early 2017.

The information in this email should not be the only trigger for your investment decision. We strongly recommend you seek professional financial advice whenever making financial investment decisions.

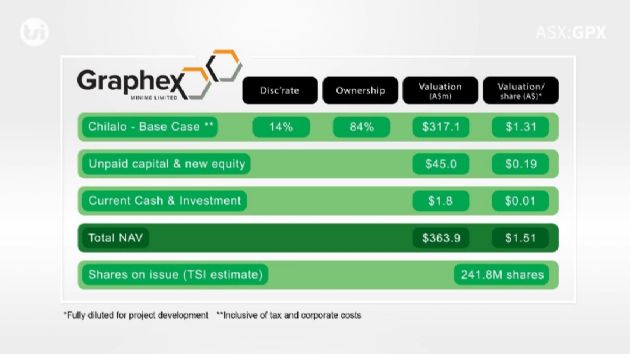

Valuation: We initiated coverage on Graphex with a valuation of $1.16 / share (share price $0.34 / share). This valuation assumes a 50% interest in the project and a 12% discount rate. Full details of our valuation can be accessed by clicking on the link below.

As always, we present our analysis differently as it is shown through a series of videos. This allows us to explain:

- A detailed review of our valuation analysis which highlights our key assumptions and sensitivities;

- Investment and risk analysis, which highlights both upside and downside factors investors should be aware of before making an investment decision;

- Review of the graphite sector, including uses, supply & demand as well as pricing;

- Site trip to the Chilalo project in Tanzania; and

- Interviews with management regarding the exploration strategy and offtake negotiations.

The information is general information only. Any advice is general advice only. Neither your personal objectives, financial situation or needs have not been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice. Adam Kiley (AR No. 458224) is an authorised representative of Intelligent Financial Markets Pty Ltd (AFSL No. 426359).

To view the video, please visit:

http://www.abnnewswire.net/press/en/85707/gpx

About Graphex Mining Ltd

Graphex Mining Limited (ASX:GPX) is an Australian resources company listed on the Australian Securities Exchange under stock code GPX. Graphex owns the world-class, coarse flake Chilalo Graphite Project, located in south-east Tanzania, which is an outstanding development ready opportunity.

Graphex Mining Limited (ASX:GPX) is an Australian resources company listed on the Australian Securities Exchange under stock code GPX. Graphex owns the world-class, coarse flake Chilalo Graphite Project, located in south-east Tanzania, which is an outstanding development ready opportunity.

About The Sophisticated Investor

The Sophisticated Investor is a new equity investment tool which seeks to assist investors in becoming more informed in their investment decision making. We show and tell investors about a company in a series of short, informative videos. We possess specialist equity analyst skills and are complemented by video professionals. We conduct site visits and interview management, in a way most investors simply aren’t able to access. We promote long term value creation for investors by employing detailed financial analysis and intrinsic value calculations.

Customer notice

Adam Kiley trading as The Sophisticated Investor ('TSI'), (AR No. 458224), is an authorised representative of Intelligent Financial Markets Pty Ltd (AFSL No. 426359). The information contained in this communication is intended as general advice only. Your personal objectives, financial situation and needs have not been taken into consideration. Accordingly, you should consider how appropriate the advice is (or is not) to your objectives, financial situation and needs before acting on the advice. The information in this communication should not be the only trigger for your investment decision. We strongly recommend you seek professional financial advice whenever making financial investment decisions.

Conflict of interest

TSI does and seeks to do business with companies featured in its articles and videos. As a result, investors should be aware that TSI may have a conflict of interest that could affect the objectivity of some articles or videos. Investors should consider TSI articles and videos as only a single factor in making any investment decision. The publishers also wish to disclose that they may hold stock in some companies featured in their articles and videos, and that any decision you make to purchase the stock of a company TSI profiles should be made only after you have initiated your own enquiries as to the validity of any information contained in those articles and videos.

Publisher's note

TSI will only initiate coverage of a company that passes our internal investment checklist. Once a company has passed this checklist, we will initiate coverage of that company and follow up with ongoing updates and commentary on its activities. Articles and videos produced and published by TSI are NOT Research Reports in terms of ASIC Regulatory Guide 79.

| ||

|