Sydney, July 18, 2016 AEST (ABN Newswire) - Geopacific Resources ( ASX:GPR) is a gold/copper development company with a portfolio of assets in the Asia-Pacific region (PNG, Cambodia & Fiji).

ASX:GPR) is a gold/copper development company with a portfolio of assets in the Asia-Pacific region (PNG, Cambodia & Fiji).

Woodlark Island Gold Project

GPR recently announced they had entered into a project-level, earn-in agreement to acquire up to a 75% interest in the Woodlark Island Gold Project (Woodlark) in Papua New Guinea. Woodlark has a reserve and resource of 776koz and 2.1Moz of gold respectively, and a DFS completed in 2012 highlighted the potential for a 1.8Mtpa facility to produce more than 100koz gold over an initial 9 year mine life.

Kou Sa Cu-Au Project

The Kou Sa project is an advanced exploration asset in Cambodia. Drilling at the project has encountered a number of high grade copper/gold intercepts (inc. 17m @ 12.38% Cu eq. from 19m; 41m at 1.69% Cu eq from 55m). The company recently announced a maiden resource at Kou Sa of 51,000t Cu eq, with an additional resource upgrade expected in the future.

Fiji portfolio

GPR has one of the largest portfolios of gold/copper exploration assets in Fiji. Drilling is due to commence on the Faddy's Prospect during 2016. GPR has identified a potential opportunity for a toll milling agreement at the Faddy's Prospect in the future.

Analyst Comment:

The Woodlark Island Gold Project appears to be an excellent opportunity for GPR, as it is one of the few open pittable, multi-million ounce gold deposits in the Asia/Pacific region that has not been developed.

We see exploration upside to grow both the reserve and resource further, more importantly we believe a reduction in the initial capital cost estimate (US$160m) is likely, given the original estimate was at the peak of the resources boom (2012). Investors however should be aware there is a risk that the transaction may not proceed as GPR is still in a due diligence period.

We believe there remains good exploration potential at the Kou Sa copper/gold project, although the maiden resource was smaller and at a lower grade than we anticipated. However, with further resource upgrades likely in the near future, Kou Sa could still become Cambodia's first mining operation, however further work and time will be required.

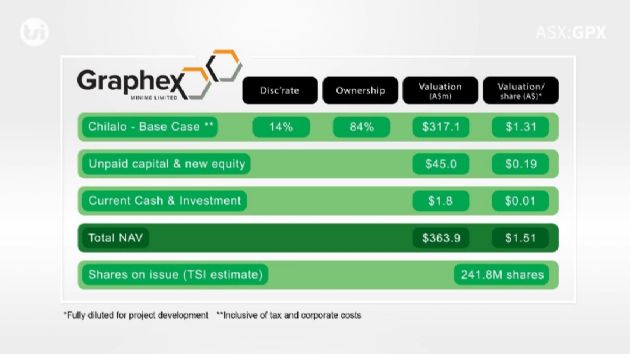

Valuation:

As there is a risk that the Woodlark transaction may not proceed given GPR is still in the due diligence period, we have not valued GPR at this time. We will review this pending the completion of the transaction.

To view the video, please visit:

http://www.abnnewswire.net/press/en/84196/GPR

This information is general information only. Any advice is general advice only. Neither your personal objectives, financial situation or needs have been taken into consideration. Accordingly you should consider how appropriate the advice (if any) is to those objectives, financial situation and needs, before acting on the advice. Adam Kiley (AR No. 458224) is an authorised representative of Intelligent Financial Markets Pty Ltd (AFSL No. 426359).

About Geopacific Resources Ltd

Geopacific Resources Ltd (ASX:GPR) has been listed on the Australian Stock Exchange (ASX) since 2006. The Company's initial activities were on its tenement holdings in Fiji where its exploration activities have identified several highly prospective project areas.

Geopacific Resources Ltd (ASX:GPR) has been listed on the Australian Stock Exchange (ASX) since 2006. The Company's initial activities were on its tenement holdings in Fiji where its exploration activities have identified several highly prospective project areas.

When Geopacific merged with World Wide Mining in 2013 the Company became a regional explorer with an Asia-Pacific-focus – adding the Kou Sa Project in Cambodia to its existing Fijian Projects. Economic conditions then led the Company to adopt a single-project strategy, focussed on Kou Sa. The experience of Geopacific's Board and Senior Management Team equips the Company with the capability and capacity to run projects concurrently – exploration at the Fijian Projects will therefore recommence while work at Kou Sa continues.

About The Sophisticated Investor

The Sophisticated Investor is a new equity investment tool which seeks to assist investors in becoming more informed in their investment decision making. We show and tell investors about a company in a series of short, informative videos. We possess specialist equity analyst skills and are complemented by video professionals. We conduct site visits and interview management, in a way most investors simply aren’t able to access. We promote long term value creation for investors by employing detailed financial analysis and intrinsic value calculations.

Customer notice

Adam Kiley trading as The Sophisticated Investor ('TSI'), (AR No. 458224), is an authorised representative of Intelligent Financial Markets Pty Ltd (AFSL No. 426359). The information contained in this communication is intended as general advice only. Your personal objectives, financial situation and needs have not been taken into consideration. Accordingly, you should consider how appropriate the advice is (or is not) to your objectives, financial situation and needs before acting on the advice. The information in this communication should not be the only trigger for your investment decision. We strongly recommend you seek professional financial advice whenever making financial investment decisions.

Conflict of interest

TSI does and seeks to do business with companies featured in its articles and videos. As a result, investors should be aware that TSI may have a conflict of interest that could affect the objectivity of some articles or videos. Investors should consider TSI articles and videos as only a single factor in making any investment decision. The publishers also wish to disclose that they may hold stock in some companies featured in their articles and videos, and that any decision you make to purchase the stock of a company TSI profiles should be made only after you have initiated your own enquiries as to the validity of any information contained in those articles and videos.

Publisher's note

TSI will only initiate coverage of a company that passes our internal investment checklist. Once a company has passed this checklist, we will initiate coverage of that company and follow up with ongoing updates and commentary on its activities. Articles and videos produced and published by TSI are NOT Research Reports in terms of ASIC Regulatory Guide 79.

| ||

|