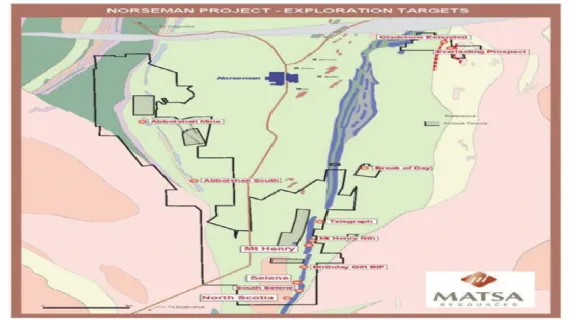

Norseman Project Location and prospects

Perth, Mar 18, 2009 AEST (ABN Newswire) - Matsa Resources Limited (ASX:MAT) is pleased to announce positive results from a Scoping Study into the development potential for the North Scotia deposit at its 100% owned Norseman Gold Project.

Executive Chairman Paul Poli said "We are very impressed with how financially robust the North Scotia deposit is following this Study. What it means is that we can confidently invest our funds towards an early mining commencement date, irrespective of transport distances to regional mills, or fluctuations in the gold price. This has delivered on our earlier statements that we believed the Company had strong potential for early cash-flow opportunities."

Our discussions with various mill owners have been very encouraging and we can now look more closely at the economic viability of several other shallow high-grade resources within the Mt Henry deposit as well. We will be announcing the results of further studies in the very near future" he said

North Scotia Scoping Study

The North Scotia resource was reported to the market on the 19 February 2009. This resource is a typical quartz vein style of gold mineralisation found within the Yilgarn goldfields of Western Australia and the Scoping Study utilised a conventional open cut mining operation. Resources estimated to fall within optimised pits are of the Indicated category. The Company is confident that forecast mining, milling and capital costs are realistic given the type of deposit, location of the project adjacent to the Kalgoorlie-Esperance highway and Norseman town-site, as well as the relatively short time period required for the proposed mining operation.

The key economic factor for this low capital cost mining scenario is the securing of an agreement with an existing mill operator for contract milling which has not yet been completed. The Company has undertaken a thorough review of public information regarding mill facilities between Norseman and Coolgardie and entered into initial discussions with a number of these. The Company believes that treatment opportunities are sufficiently encouraging to justify fast-tracking feasibility studies with a view to early submission of a Notice of Intent to the Department of Mines and Petroleum. A contract for milling is unlikely to be finalised until ore delivery schedules can be defined which is dependent on the date at which mining approval is given.

The Company will immediately commence the following development activities;

- Resource infill and extension drilling. Resources within the optimised pit are Indicated however the margin of high grade zones are defined by 20 metre drill line spacing and require closer definition for mine planning.

- Geotechnical and Metallurgical drilling and sample analysis. Metallurgical recoveries have been assumed based on the strong similarities to other Norseman high-grade quartz vein deposits whereby extensive free gold has been observed and diamond drill samples indicate a spatial association between gold, galena and sphalerite within quartz. Ore comminution data is required to refine future milling costs.

- Hydrological drilling and associated studies.

- Update existing environmental surveys.

- Commence local and state government discussions and approval processes.

The Project is located on a granted Mining Lease and is encompassed by a Native Title Agreement that has agreed mining arrangements. The Company can complete the above activities with existing funds.

The Company is aiming for mining commencement before the end of 2009.

Contact

Paul Poli

Executive Chairman

Or

Andy Viner

Executive Director

Tel: +61-8-9275-4258

Fax: +61-8-9375-1323

Email: reception@matsa.com.au

Web: www.matsa.com.au

| ||

|