Sales Revenue Growth +3% at Constant FX Rates; FY25 Guidance Reconfirmed

Sales Revenue Growth +3% at Constant FX Rates; FY25 Guidance Reconfirmed

Sydney, Oct 25, 2024 AEST (ABN Newswire) - Brambles Limited ( ASX:BXB) (

ASX:BXB) ( BXBLY:OTCMKTS) reported sales revenue from continuing operations of US$1,679.9 million at actual FX rates for the first three months of the financial year ending 30 June 2025 (FY25). This represents an increase of 3% at both actual and constant FX rates on the prior corresponding period.

BXBLY:OTCMKTS) reported sales revenue from continuing operations of US$1,679.9 million at actual FX rates for the first three months of the financial year ending 30 June 2025 (FY25). This represents an increase of 3% at both actual and constant FX rates on the prior corresponding period.

Sales revenue growth was driven by price realisation of 3%, with rollover benefits from pricing actions taken in FY24 and, to a lesser extent, contributions from current-year pricing recovering increases in the cost-to-serve. Group volumes were flat to prior year as net new business growth of 1% offset a (1)% decline in like-for-like volumes, driven by the timing of US produce harvest and a return to more seasonal customer demand patterns in Australia.

By segment, the sales revenue performance for the first three months of FY25 was as follows:

- CHEP Americas sales revenue increased 5% at constant FX rates and included price growth of 4%, largely driven by rollover contributions from pricing actions taken in FY24. In-year pricing growth was modest as improved asset productivity outcomes and lower rates of input-cost inflation led to a moderation in cost-to-serve increases. Segment volumes increased 1% driven by net new business wins in all markets, while like-for-like volumes were flat as growth in Canada and Latin America was offset by a decline in US pallets. In the US, pallets sales revenue increased 5%, driven by similar pricing dynamics as the segment, with net new business wins of 1% offsetting a (1)% decline in like-for-like volumes. The decline in demand from existing customers reflected an earlier US produce season bringing forward volumes to 4Q24 and broader macroeconomic conditions resulting in lower manufacturer and retailer inventory levels.

- CHEP EMEA sales revenue increased 1% at constant FX rates reflecting price growth in the Automotive and IMETA businesses. Like-for-like and net new business volumes for the segment were both flat as improved organic volumes in Europe pallets were offset by lower demand in the Automotive and IMETA businesses. In Europe, pallets sales revenue increased 1% driven by like-for-like volume growth of 1%, as the benefit from cycling retailer and manufacturer inventory optimisation in 1Q24 was partially offset by weak consumer demand. Net new business volumes in the Europe pallets business were flat as net contract wins in the current period were offset by the rollover impact of contract losses in the prior year. Net new business growth is expected for the full year, with new business wins to be weighted to the second half. Price growth in the Europe pallets business was flat and aligned with the cost-to-serve, as moderate price increases, primarily to recover labour inflation, were offset by lower contributions from pricing mechanisms linked to asset efficiency given ongoing improvements in loss rates and cycle times during the quarter.

- CHEP Asia-Pacific sales revenue was in line with the prior corresponding period at constant FX rates as price growth of 4%, largely from rollover contributions relating to pricing actions from FY24 to recover cost-to-serve increases, was offset by a decline in volumes. Like-for-like volume declines of (5)% reflects a normalisation of the average pallets-on-hire balance driven by a number of factors including a return to more seasonal customer demand patterns following pallet availability challenges in the prior year comparative. Net new business wins of 1% was driven by both new wins in 1Q25 and rollover contributions from contracts won in the prior year.

Commenting on the first-quarter performance, Brambles' CEO, Graham Chipchase, said: "Our overall financial performance was broadly in line with expectations. Price growth across the Group continues to be aligned to the cost-to-serve, as price realisation to recover modest input-cost inflation was partially offset by the revenue impact of improved asset efficiency in the first quarter. These improvements in asset efficiency continue to improve Brambles' financial performance by lowering the cost-to-serve, delivering profit and cash flow benefits.

"Volumes were flat due to lower than expected like-for-like volumes. This was largely driven by macroeconomic conditions, lower US produce volumes, and a return to seasonal patterns as well as a normalisation of pallets on hire in Australia. It was, however, pleasing to see positive contributions from net new business volumes, particularly in North America, which reflect targeted efforts by our teams to actively re-engage the new business pipeline.

"Although the pace of new business wins varies between regions, conditions for customer conversions in our markets have started to improve, with moderate increases in whitewood prices noted in the period. Industry feedback also suggests some decline in the availability of quality whitewood pallets, which should encourage manufacturers to consider switching to pooling from the single-use alternative.

"The market dynamics in the first quarter, including the continued moderation in dual sourcing activity, supports our expectation of net new business growth accelerating in the second half of the year. The benefits of pooling are clear, and we continue to highlight our customer value proposition. This includes leveraging the unmatched scale of our network to provide our customers with high-quality pallets, when and where they need them, while supporting their sustainability commitments.

"Finally, we have today reconfirmed our FY25 outlook for sales revenue growth, Underlying Profit leverage and Free Cash Flow generation. While our sales revenue performance in the first quarter was slightly below the full-year guidance range, we expect ongoing price realisation and improved volume growth through the balance of the year.

"We expect that ongoing asset productivity and other efficiency improvements will continue to drive Underlying Profit leverage, with price growth expected to be in line with moderating cost-to-serve increases. Our Free Cash Flow generation remains strong, and we expect performance to be weighted to the second half, broadly in line with prior year phasing."

FY25 outlook

Brambles has reconfirmed its FY25 guidance, for the year ended 30 June 2025:

- Sales revenue growth of between 4-6% at constant currency;

- Underlying Profit growth of between 8-11% at constant currency;

- Positive Free Cash Flow before dividends of between US$750-850 million; and

- Dividend payout ratio to be consistent with the dividend payout policy of 50-70% of Underlying Profit after finance costs and tax in US dollar terms and fully funded through Free Cash Flow.

These financial outcomes are dependent on a number of factors. These factors include, prevailing macroeconomic conditions, customer demand, the price of lumber and other key inputs, the efficiency of global supply chains, including the extent of inventory optimisation, and movements in FX rates.

*To view tables and figures, please visit:

https://abnnewswire.net/lnk/0WUH8O00

About Brambles Limited

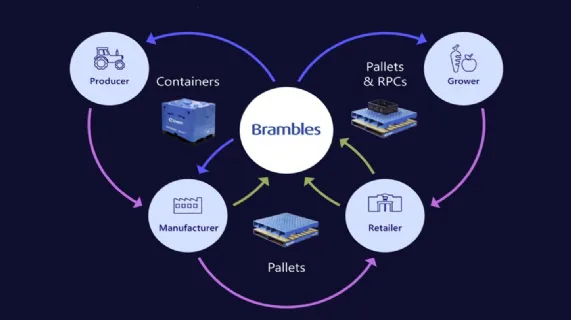

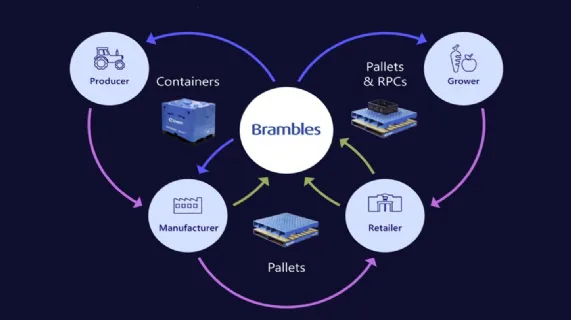

Brambles Limited (ASX:BXB) (OTCMKTS:BXBLY) under the CHEP brand, helps move more goods to more people, in more places than any other organisation on earth. Its pallets, crates and containers form the invisible backbone of the global supply chain and the world's biggest brands trust Brambles to help them transport their goods more efficiently, sustainably and safely. As pioneers of the sharing economy, Brambles created one of the world's most sustainable logistics businesses through the share and reuse of its platforms under a model known as 'pooling'. Brambles primarily serves the fast-moving consumer goods (e.g. dry food, grocery, and health and personal care), fresh produce, beverage, retail and general manufacturing industries. The Group employs approximately 13,000 people and owns approximately 347 million pallets, crates and containers through a network of more than 750 service centres. Brambles operates in approximately 60 countries with its largest operations in North America and Western Europe.

Brambles Limited (ASX:BXB) (OTCMKTS:BXBLY) under the CHEP brand, helps move more goods to more people, in more places than any other organisation on earth. Its pallets, crates and containers form the invisible backbone of the global supply chain and the world's biggest brands trust Brambles to help them transport their goods more efficiently, sustainably and safely. As pioneers of the sharing economy, Brambles created one of the world's most sustainable logistics businesses through the share and reuse of its platforms under a model known as 'pooling'. Brambles primarily serves the fast-moving consumer goods (e.g. dry food, grocery, and health and personal care), fresh produce, beverage, retail and general manufacturing industries. The Group employs approximately 13,000 people and owns approximately 347 million pallets, crates and containers through a network of more than 750 service centres. Brambles operates in approximately 60 countries with its largest operations in North America and Western Europe.

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

ASX:BXB) (

ASX:BXB) ( BXBLY:OTCMKTS) reported sales revenue from continuing operations of US$1,679.9 million at actual FX rates for the first three months of the financial year ending 30 June 2025 (FY25). This represents an increase of 3% at both actual and constant FX rates on the prior corresponding period.

BXBLY:OTCMKTS) reported sales revenue from continuing operations of US$1,679.9 million at actual FX rates for the first three months of the financial year ending 30 June 2025 (FY25). This represents an increase of 3% at both actual and constant FX rates on the prior corresponding period.  Brambles Limited (ASX:BXB) (OTCMKTS:BXBLY) under the CHEP brand, helps move more goods to more people, in more places than any other organisation on earth. Its pallets, crates and containers form the invisible backbone of the global supply chain and the world's biggest brands trust Brambles to help them transport their goods more efficiently, sustainably and safely. As pioneers of the sharing economy, Brambles created one of the world's most sustainable logistics businesses through the share and reuse of its platforms under a model known as 'pooling'. Brambles primarily serves the fast-moving consumer goods (e.g. dry food, grocery, and health and personal care), fresh produce, beverage, retail and general manufacturing industries. The Group employs approximately 13,000 people and owns approximately 347 million pallets, crates and containers through a network of more than 750 service centres. Brambles operates in approximately 60 countries with its largest operations in North America and Western Europe.

Brambles Limited (ASX:BXB) (OTCMKTS:BXBLY) under the CHEP brand, helps move more goods to more people, in more places than any other organisation on earth. Its pallets, crates and containers form the invisible backbone of the global supply chain and the world's biggest brands trust Brambles to help them transport their goods more efficiently, sustainably and safely. As pioneers of the sharing economy, Brambles created one of the world's most sustainable logistics businesses through the share and reuse of its platforms under a model known as 'pooling'. Brambles primarily serves the fast-moving consumer goods (e.g. dry food, grocery, and health and personal care), fresh produce, beverage, retail and general manufacturing industries. The Group employs approximately 13,000 people and owns approximately 347 million pallets, crates and containers through a network of more than 750 service centres. Brambles operates in approximately 60 countries with its largest operations in North America and Western Europe.