Kachi drilling to support production increase

Brisbane, May 19, 2021 AEST (ABN Newswire) - Clean lithium developer Lake Resources NL ( ASX:LKE) (

ASX:LKE) ( LK1:FRA) (

LK1:FRA) ( LLKKF:OTCMKTS) is expanding drilling and testing beyond that required for the Definitive Feasibility Study (DFS) at the Company's flagship Kachi Lithium Brine Project, Argentina amid strong demand for its high purity, sustainably produced product.

LLKKF:OTCMKTS) is expanding drilling and testing beyond that required for the Definitive Feasibility Study (DFS) at the Company's flagship Kachi Lithium Brine Project, Argentina amid strong demand for its high purity, sustainably produced product.

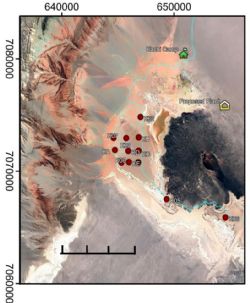

The aim is to accelerate the conversion of Inferred Resources to Measured and Indicated (M&I) Resources, to allow for an expansion beyond the 25,500 tonnes per annum (tpa) lithium carbonate planned in the DFS. The current drilling seeks to convert resources to reserves as part of the DFS work.

Initially a diamond drill program of four wells from four platforms for 1,600m will be conducted, together with brine and sediment sampling and pump testing to refine the resource estimations for a conversion to reserves, with economic assumptions. Drilling will commence within approximately two weeks, following COVID-19 controls and procedures.

The Kachi Project covers 74,000 ha of leases over a salt-lake south of Livent's lithium operation in Argentina, with a large indicated and inferred resource of 4.4 Mt LCE (Indicated 1.0Mt, Inferred 3.4Mt) (refer ASX announcement 27 November 2018). Less than 20% of the current total resource is utilised for the planned 25,500 tpa lithium carbonate production over 25 years (refer ASX announcements 23 March 2021; 30 April 2020).

Infill drilling should assist the conversion of resources to a higher category with increased data. Subsequently, a program involving the drilling of four additional production wells is also planned to support increased production.

The Company is well financed for the DFS with A$24 million available at end March, which will fund Kachi through to the construction phase in 2022 (refer ASX announcements 25 January 2021 and 30 April 2021).

Lake recently upgraded Kachi's estimated NPV to US$1.6 billion based on the production of 25,500 tpa and on projected higher lithium prices in the PFS (refer ASX announcement 23 March 2021 and 30 April 2020). The assumptions used in the PFS to underpin the production targets and the forecast financial information have not changed materially. The Company is seeking to further boost its reserve base across its portfolio of projects in the 'Lithium Triangle,' responding to projections of a growing supply deficit from 2024.

Testing by Novonix has demonstrated that Lake's 99.97% purity lithium carbonate performs better than commercially available battery-grade lithium carbonate in NMC622 lithium-ion battery test cells (refer ASX announcement 2 March 2021).

Lake aims to sustainably produce the cleanest quality lithium carbonate at scale, with demand rapidly increasing for battery materials for use in the fast-growing battery market as the adoption of electric vehicles accelerates globally. This is evidenced by recent moves by major automakers such as Volkswagen, BMW, General Motors and others, which are investing billions of dollars in EV production and batteries. Argentina also is attracting increased investor and industry focus as a centre for low-cost lithium production, with Ganfeng Lithium planning a battery factory in Jujuy Province, BMW signing a supply deal with Livent and other M&A moves such as the merger between Orocobre and Galaxy Resources. These moves demonstrate the South American nation will remain a centre for lithium production for decades to come.

Lake's Managing Director, Steve Promnitz commented: "Backing from global investors has enabled us to ramp up our activity at Kachi. This drill program will not only support current production, but also allow for further expansion of Kachi's resource to potentially double production, making Kachi a globally significant project in terms of high purity lithium carbonate production.

"We are witnessing considerable interest from potential off-takers for a high purity, sustainable product like we have at Kachi. Volkswagen alone has flagged moves to consume two-thirds of current lithium production by 2030 with its new battery gigafactories, adding to the investments by other major EV and battery makers. There is no question that the billions of dollars being invested in the world's clean energy drive require an increased supply of the necessary battery materials, sustainably sourced. That is exactly what Lake intends to deliver and importantly our projects are highly scalable."

To view tables and figures, please visit:

https://abnnewswire.net/lnk/I0IA09XM

About Lake Resources NL

Lake Resources NL (ASX:LKE) (OTCMKTS:LLKKF) is a clean lithium developer utilising state-of-the-art ion exchange extraction technology for production of sustainable, high purity lithium from its flagship Kachi Project in Catamarca Province within the Lithium Triangle in Argentina among three other projects covering 220,000 ha.

Lake Resources NL (ASX:LKE) (OTCMKTS:LLKKF) is a clean lithium developer utilising state-of-the-art ion exchange extraction technology for production of sustainable, high purity lithium from its flagship Kachi Project in Catamarca Province within the Lithium Triangle in Argentina among three other projects covering 220,000 ha.

This ion exchange extraction technology delivers a solution for two rising demands - high purity battery materials to avoid performance issues, and more sustainable, responsibly sourced materials with low carbon footprint and significant ESG benefits.

| ||

|