Okapi to Acquire Multiple Large Scale Kaolin Halloysite Projects

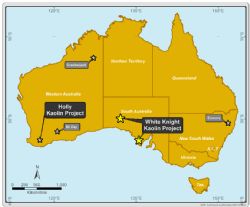

Perth, May 12, 2021 AEST (ABN Newswire) - Okapi Resources Limited ( ASX:OKR) is pleased to advise that the Company has entered into a binding heads of agreement to acquire Bulk Mineral Holdings Pty Ltd ("Bulk Minerals") which holds two (2) granted exploration licenses in Western Australia and four (4) exploration licence applications in South Australia ("Acquisition Agreement"). Refer to Figure 1* for the location of the projects.

ASX:OKR) is pleased to advise that the Company has entered into a binding heads of agreement to acquire Bulk Mineral Holdings Pty Ltd ("Bulk Minerals") which holds two (2) granted exploration licenses in Western Australia and four (4) exploration licence applications in South Australia ("Acquisition Agreement"). Refer to Figure 1* for the location of the projects.

Highlights

- Okapi to acquire large scale Kaolin Halloysite and Heavy Mineral Sands Projects across SA and WA with a combined land package of ~2,127 km2

- The tenement package includes two (2) granted exploration licences located near Kojonup, Western Australia, known as the Holly Kaolin Project

- Recent site visits at the Holly Kaolin Project confirmed widespread outcropping Kaolin mineralisation

- Drilling programs in 1995-1996 intersected 5-15m zones of bright white Kaolin

- Historical drill results include high brightness Kaolin intercepts > 85%

- Okapi to commence exploration work immediately at the Holly Kaolin Project, followed by a drilling program

- The package also includes four (4) exploration licence applications prospective for Heavy Mineral Sands and high purity Halloysite on the western Eyre Peninsula in South Australia bordering Andromeda's ( ASX:ADN) Camel Lake Project and neighbouring Andromeda's Mt Hope deposit

ASX:ADN) Camel Lake Project and neighbouring Andromeda's Mt Hope deposit

Okapi's Executive Director Mr David Nour said: "The Board of Okapi is excited to embark on this exciting new chapter for the Company. This acquisition puts Okapi in a highly prospective ground in the heart of major known kaolin halloysite deposits neighbouring the likes of Andromeda Metals. Additionally, historical drill results show the potential of the Holly Kaolin Project in which we will commence exploration work immediately to confirm the quality of the project."

"With the fast-moving technological advances in kaolin halloysite, potential application extends beyond traditional uses to now include batteries and super capacitors, hydrogen storage and construction."

"We are also excited about Okapi's upcoming drilling campaign at our Enmore Gold Project where we aim to drill an initial 8-12 holes to confirm further gold mineralisation."

White Knight Kaolin-Halloysite Project in South Australia

The White Knight Kaolin-Halloysite Project comprises 4 Exploration Licence Applications that span over 1,943 km2 in western and southern South Australia (Refer to Figure 2).

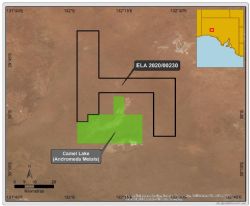

ELA 2020/00230 is prospective for Heavy Mineral Sands ("HMS") and Kaolin Halloysite. The tenement borders the Andromeda Metals Limited ( ASX:ADN) ("Andromeda") Camel Lake Project (EL 6128 & ELA 2019/00073).

ASX:ADN) ("Andromeda") Camel Lake Project (EL 6128 & ELA 2019/00073).

At Camel Lake, white, translucent clay with occasional patches of reddish-purple iron oxides is present below the thin gypsum cover. Halloysite makes up between 9 to 72% of the clay sediment. Electron microscopy of raw samples show the halloysite crystallised as regular tubules showing a high degree of alignment. The clay is readily dispersed to give tubules 0.5-4.0 micronm in length and 0.05- 0.08 micronm in diameter (Keeling et al., 2010).

The halloysite occurrence at Andromeda's Camel Lake is high grade and appears to be several metres in thickness. It is interpreted to have formed at the top of the Eocene sands immediately below Miocene carbonate.

A brief review of drill sections across the Barton and Paling sand ranges shows Eocene Ooldea Sand to be overlain almost exclusively by Quaternary dune sand. In two drillholes (BD068 and BD069) there is limestone overlying clay at the top of the interpreted Hampton Formation within the Eocene sand sequence. Like Camel Lake, it is considered that the best potential for kaolin halloysite development is between the barrier dune ranges and possibly the Wilkinson Lakes area to the northeast.

The potential for the Kaolin-Halloysite mineralisation to extend from the Camel Lake project area north into the White Knight tenement will be a focus for Okapi when the tenement is granted.

ELA 2020/00230 is also considered prospective for HMS style mineralisation along the Barton Range and Paling Range and this was the focus of a considerable amount of drilling in the period 2005-2009 by Rio Tinto and from 2009 to 2017 by Iluka Resources.

On the southern Eyre Peninsula, ELA 2021/00014, ELA 2021/00015, and ELA 2021/00016 are viewed as prospective for Kaolin Halloysite and neighbouring tenements have reported discoveries. The ELA 2021/00014 and ELA 2021/00015 tenements are located near the OAR Resources Limited ( ASX:OAR) Gibraltar Project tenements.

ASX:OAR) Gibraltar Project tenements.

ELA 2021/00016 is approximately 30km east from the recently acquired PepinNini Minerals Limited ( ASX:PNN) Hillside Halloysite and Kaolinite Project and circa 40km east of Andromeda's Mount Hope Project.

ASX:PNN) Hillside Halloysite and Kaolinite Project and circa 40km east of Andromeda's Mount Hope Project.

Holly Kaolin Project in Western Australia

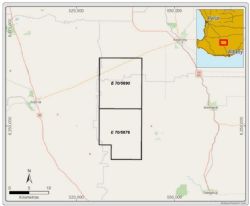

The Holly Kaolin Project comprises two (2) granted exploration licence E70/5676 and E70/5690 which are located approximately 20km east on Broomehill - Kojonup Road, Western Australia, covering a total area of circa 184km2.

Regional Geology of the Holly Kaolin Project

The kaolin occurrences that occur throughout the project area are classified as primary deposits formed by in-situ weathering of the felsic granites.

In the nomenclature of the Kaolin industry, the kaolin is classified as primary deposits formed by in-situ weathering of felsic igneous and metamorphic rocks. Bedrock throughout the Project area consists of Archaean coarse grained porphyritic granite and adamellite, and leucocratic granofels of granitic admellitic composition.

Outcropping Kaolin mineralisation is present along Nookanellup and Warrenup Roads (Figures 7 & 8*). These areas have been deeply weathered, forming an intensely leached kaolinised zone.

Zones with high Fe content mapped as a lateritic duricrust (high Fe %) which forms a relict cap over the top of the Kaolinised zones are commonly associated with high topographic features.

Historical Drilling at Holly Kaolin Project

A large-scale air core drilling program was completed over the project area in January 1995 by CRA Exploration Pty Ltd. The wide spaced reconnaissance drill results included many high brightness kaolin intercepts (crude brightness values greater than 85%). Based on historical drilling data (Refer to Appendix 1), the average depth to the top of the mineralisation appears to be approximately 5m. Previous drilling in 1996 identified a 11-metre thickness of white clay.

Acquisition Details

Okapi has entered into a binding heads of agreement setting out the terms and conditions upon which it will acquire 100% of the shares in Bulk Mineral. Bulk Mineral is the sole shareholder of five (5) subsidiaries which, together, hold two (2) granted exploration tenements in the Holly Kaolin Project located in Western Australia and has applied for four (4) exploration licence in the White Knight Kaolin-Halloysite Project located in South Australia.

The consideration of $1,491,000 will be satisfied by the issue of fully paid ordinary shares in the capital of Okapi at a deemed price of $0.21 (being a total of 7,100,000 Okapi shares), which will require Okapi's shareholders' approval. The vendors to the transaction are Seattle Capital Pty Ltd ATF Seattle Trust and Snowball Capital Investments Pty Ltd ATF Augustus Family Trust (Vendors), neither of whom are related parties of Okapi.

Subject to the conditions precedent set out in the summary of the Acquisition Agreement below, the transaction will be completed in two stages:

Stage 1: The issue of 4,600,000 Okapi shares to the Vendors ("Initial Consideration Shares").

Stage 2: The Issue of 2,500,000 Okapi shares to the Vendors following the successful grant of the 4 tenements - White Knight Kaolin-Halloysite Project in South Australia ("Milestone 1 Shares").

Subject to completion of Stage 1, a joint venture ("JV") between Okapi, the Vendors and the relevant Subsidiaries will be established in relation to the Holly Kaolin Project and subject to completion of Stage 2, between Okapi, the Vendors Subsidiaries will be established in relation to the White Knight Kaolin-Halloysite Project. The Vendors will incorporate a new entity ("Newco") for participation in the JV for exploration of the Projects. Okapi will hold 80% in the JVs and 20% will be held by Newco. The Newco interest will be free carried until a decision to mine the Projects, at which point an 80:20 mining joint venture would be established. Okapi would continue as the Manager of the JV and the parties to contribute to the JV according to their respective shares.

The key terms and conditions of the Acquisition Agreement are set out in the link below*.

Board and Management Changes

The Company is pleased to advise that Mr David Nour and Mr Leonard Math have been appointed as Executive Directors of the Company.

Mr David Nour has been Okapi's Non-Executive Director since November 2019 and has been instrumental to the Company. Mr Nour comes from private business and has a strong commercial background having worked in private wealth management and professional investment over the past 25 years with CBA & Bluestone Group. Mr Nour is a substantial shareholder of the Company with 6.95%.

Mr Leonard Math is a Chartered Accountant with more than 15 years of resources industry experience. He previously worked as an auditor at Deloitte and is experienced with public company responsibilities including ASX and ASIC compliance, control and implementation of corporate governance, statutory financial reporting and shareholder relations. Mr Math was the Chief Financial Officer and Company Secretary of one of the largest lithium hard rock deposit, AVZ Minerals Limited ( ASX:AVZ) for more than two and a half years. Mr Math also previously held Company Secretary and directorship roles for a number of ASX listed companies. Mr Math has been Okapi's Company Secretary since April 2019.

ASX:AVZ) for more than two and a half years. Mr Math also previously held Company Secretary and directorship roles for a number of ASX listed companies. Mr Math has been Okapi's Company Secretary since April 2019.

Mr Nour and Mr Math's engagement terms are summarised below.

Associated with the board changes Mr Andrew Shearer and Mr Rhoderick Grivas have resigned as directors of Okapi with immediate effect, due to the potential conflict of interests.

As advised on 13 April 2021, Mr Shearer will continue to complete his 2-month notice period as a consultant to assist with the with the existing Mount Day (WA) and Enmore Gold (QLD) Projects. Mr Grivas will also consult on the existing projects.

The Company also advises that Mr Raymond (Jinyu) Liu has resigned as Non-Executive Director of Okapi to allow this new transition of Board and management to progress. Mr Liu has been Okapi's director since October 2017.

Non-Executive Director, Mr Peretz Schapiro will take on the role as Interim Chairman.

Executive Director Mr David Nour commented: "On behalf of the Company and shareholders, I would like to thank Andrew, Rhod and Raymond for their contribution. I wish them well for their future endeavours."

"Leonard's broad corporate and financial knowledge will be invaluable to this growing Company. The Board will also commence searching for a technical person to join the Board."

Subject to shareholders approval, the Company will issue 6,200,000 Performance Rights to Directors under the Company's proposed Performance Rights Plan. The Performance Rights will vest subject to achievement of the following goals:

Tranche 1: Market Capitalisation achieving $20M for 20 trading days;

Tranche 2: Market Capitalisation achieving $35M for 20 trading days;

Tranche 3: Market Capitalisation achieving $50M for 20 trading days;

In the event of a takeover or change of control, the vesting conditions will be deemed to have been achieved.

Okapi Raises $700,000

The Company is pleased to advise that it has received firm commitments for a placement of fully paid ordinary shares in the Company ("New Shares") to eligible sophisticated and professional investors to raise a total of $700,000 (before costs) at an offer price of 21 cents per Share ("Placement"). The offer price represents a 11.72% premium to the 20-day VWAP of 18.79 cents prior to the Company entering into a trading halt.

GBA Capital Pty Ltd (GBA) acted as Lead Manager for the Placement.

Strong demand for the Placement was evident with a final scale-back of allocations to $700,000.

Subject to shareholders approval, newly appointed Executive Director, Mr Leonard Math will participate for a total of $50,000 in the Placement.

The Placement will comprise an issue of 3,333,334 New Shares at an issue price of $0.21 per New Share with one (1) free attaching Listed Option for every one (1) New Share subscribed.

The Listed Options (OKRO) have an exercise price of $0.30 each and expire on 31 March 2023.

The New Shares and free attaching Listed Options will be issued under the Company's existing placement capacity under Listing Rule 7.1.

The New Shares will rank equally with existing fully paid ordinary shares in the Company.

Funds raised will be used to pay the costs associated with the acquisition of the White Knight Kaolin-Halloysite Project and the Holly Kaolin Project, exploration on the Kaolin/Halloysite projects and general working capital.

*To view key terms, tables and figures, please visit:

https://abnnewswire.net/lnk/PYBNMQH7

About Okapi Resources Limited

Okapi Resources Limited (ASX:OKR) recently acquired a portfolio of advanced, high grade uranium assets located in the United States of America and in the Athabasca Basin, Canada.

Okapi Resources Limited (ASX:OKR) recently acquired a portfolio of advanced, high grade uranium assets located in the United States of America and in the Athabasca Basin, Canada.

Assets include a strategic position in one of the most prolific uranium districts in the USA - the Tallahassee Creek Uranium District in Colorado. The Tallahassee Uranium Project contains a JORC 2012 Mineral Resource estimate of 27.6 million pounds of U3O8 at a grade of 490ppm U3O8 with significant exploration upside. The greater Tallahassee Creek Uranium District hosts more than 100 million pounds of U3O8 with considerable opportunity to expand the existing resource base by acquiring additional complementary assets in the district.

The portfolio of assets also includes an option to acquire 100% of the high-grade Rattler Uranium Project in Utah, which includes the historical Rattlesnake open pit mine. The Rattler Uranium Project is located 85km from the White Mesa Uranium Mill, the only operating conventional uranium mill in the USA hence provides a near term, low-capital development opportunity.

In January 2022, Okapi acquired a portfolio of high-grade exploration assets in the world's premier uranium district, the Athabasca Basin. The Athabasca Basin is home to the world's largest and highest-grade uranium mines.

Okapi's clear strategy is to become a new leader in North American carbon-free nuclear energy by assembling a portfolio of high-quality uranium assets through accretive acquisitions and exploration.

| ||

|