Shandong Gold Provides Further Improved Offer

Perth, Sep 7, 2020 AEST (ABN Newswire) - Cardinal Resources Limited ( ASX:CDV) (

ASX:CDV) ( C3L:FRA) (

C3L:FRA) ( CRDNF:OTCMKTS) (

CRDNF:OTCMKTS) ( TSE:CDV) refers to its announcement of 3 September 2020 regarding the competing takeover offers for the Company from Shandong Gold Mining (HongKong) Co., Ltd. ("Shandong Gold") and Nord Gold S.E. ("Nordgold").

TSE:CDV) refers to its announcement of 3 September 2020 regarding the competing takeover offers for the Company from Shandong Gold Mining (HongKong) Co., Ltd. ("Shandong Gold") and Nord Gold S.E. ("Nordgold").

Further Improved Shandong Gold Offer

As noted in Cardinal's prior announcements of 2 and 3 September 2020, the matching rights provisions of the Bid Implementation Agreement provide Shandong Gold with the opportunity (but not the obligation) to provide a matching or superior proposal to the revised Nordgold on-market takeover offer for Cardinal at A$0.90 cash per share ("Nordgold Takeover Bid").

Cardinal advises that it has received a further improved offer from Shandong Gold whereby Shandong Gold has confirmed that it remains committed to acquiring 100% of the Shares in Cardinal and that it intends to increase the Offer Price of the Shandong Gold Offer to A$1.00 per share ("Further Improved Offer").

Cardinal notes while the Further Improved Offer is no longer subject to Chinese Regulatory Approvals or FIRB Approval, it remains subject to a number of conditions, including the minimum acceptance condition of 50.1%.

These conditions are set out in Cardinal's announcement of the Bid Implementation Agreement announced on 18 June 2020 and varied on 29 July 2020.

The Further Improved Offer from Shandong Gold is now being carefully considered in detail by the Board, together with the Special Committee and its financial and legal advisers. Cardinal will also continue to engage with Shandong Gold in respect of the Further Improved Offer.

Cardinal will provide a further update to shareholders in this regard as soon as it is able to do so.

Take no action

In light of the Further Improved Offer, and noting the Nordgold Takeover Bid announced on the ASX on 15 July 2020 and varied on 2 September 2020, shareholders are advised to TAKE NO ACTION in relation to their shares at this time. The Company will provide an update to shareholders as soon as practicable.

Advisors

Cardinal's joint financial advisers are Maxit Capital LP, BMO Capital Markets, Hartleys Limited and Cannacord Genuity Corp. Cardinal's legal advisers are HopgoodGanim Lawyers (Australia) and Bennett Jones LLP (Canada).

About Cardinal Resources Ltd

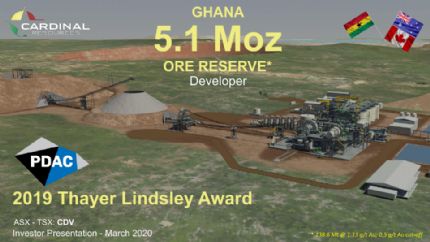

Cardinal Resources Ltd (ASX:CDV) (TSE:CDV) (OTCMKTS:CRDNF) is a West African gold exploration and development Company that holds interests in tenements within Ghana, West Africa.

Cardinal Resources Ltd (ASX:CDV) (TSE:CDV) (OTCMKTS:CRDNF) is a West African gold exploration and development Company that holds interests in tenements within Ghana, West Africa.

The Company is focused on the development of the Namdini Project with a gold Ore Reserve of 5.1Moz (0.4 Moz Proved and 4.7 Moz Probable) and a soon to be completed Feasibility Study.

Exploration programmes are also underway at the Company's Bolgatanga (Northern Ghana) and Subranum (Southern Ghana) Projects.

Cardinal confirms that it is not aware of any new information or data that materially affects the information included in its announcement of the Ore Reserve of 3 April 2019. All material assumptions and technical parameters underpinning this estimate continue to apply and have not materially changed.

| ||

|