Recommended All-Cash Takeover Offer from Shandong Gold

Perth, July 27, 2020 AEST (ABN Newswire) - Cardinal Resources Limited ( ASX:CDV) (

ASX:CDV) ( C3L:FRA) (

C3L:FRA) ( CRDNF:OTCMKTS) (

CRDNF:OTCMKTS) ( TSE:CDV) refers to its announcement dated 22 July 2020 in relation to the revised and improved proposal for an off-market takeover offer from Shandong Gold Mining (HongKong) Co., Limited ("Shandong Gold") pursuant to which Shandong Gold will offer to acquire all of the shares in Cardinal it does not presently own at a cash price of A$0.70 per Share (the "Revised Shandong Gold Offer").

TSE:CDV) refers to its announcement dated 22 July 2020 in relation to the revised and improved proposal for an off-market takeover offer from Shandong Gold Mining (HongKong) Co., Limited ("Shandong Gold") pursuant to which Shandong Gold will offer to acquire all of the shares in Cardinal it does not presently own at a cash price of A$0.70 per Share (the "Revised Shandong Gold Offer").

Recommended Revised Shandong Gold Takeover Bid

After careful consideration of the Revised Shandong Gold Offer and Nord Gold S.E.'s ("Nordgold") unconditional on-market takeover offer for Cardinal at A$0.66 cash per share ("Nordgold Bid"), Cardinal's Board of Directors (in consultation with the Special Committee, its financial and legal advisors), unanimously recommends that Cardinal shareholders:

- ACCEPT the Revised Shandong Gold Offer (in the absence of a superior proposal); and

- REJECT the Nordgold Bid.

The recommended Revised Shandong Gold Offer of A$0.70 cash per share values Cardinal at approximately A$395 million on a fully diluted basis and represents an attractive premium of approximately 6.1% to the Nordgold Bid of A$0.66 cash per share announced on 15 July 2020.

The Board of Directors considered the Nordgold Bid closely and in the context of the Revised Shandong Gold Offer and took into account, amongst other matters, the price and conditionality of the two offers.

Whilst the Board acknowledges that the Nordgold Bid is unconditional, based on the information available to it at the date of this announcement, the Board has no reason to believe the conditions of the Revised Shandong Gold Offer (which include, amongst other conditions, 50.1% minimum acceptance by Cardinal shareholders and Foreign Investment Review Board (FIRB) approval), cannot be satisfied within a reasonable timeframe. Cardinal understands that Shandong Gold has received all necessary Chinese regulatory approvals, with the result that the Revised Shandong Gold Offer is no longer conditional on any Chinese egulatory approvals.

The Board also notes that there is the potential for certain shareholders to be aggrieved by the structure of the Nordgold Bid (namely those Shareholders holding Cardinal Shares in non-Australian depositaries or on branch registers). While the Nordgold Bidder's Statement alludes to a practical mechanism whereby such Cardinal Shares can be moved to an Issuer Sponsored Holding or CHESS Holding in Australia in order to accept the Nordgold Bid, it is possible that the Nordgold Bid could be subject to regulatory issues (particularly in Canada) which could result in it being prevented from proceeding in the absence of corrective steps taken by Nordgold.

As the Directors have determined to continue to unanimously recommend that Cardinal Shareholders accept the Shandong Gold Offer (in the absence of a Superior Proposal), the Bid Implementation Agreement requires Cardinal and Shandong Gold to use their best endeavours to agree any amendments to the Bid Implementation Agreement which are reasonably necessary or desirable to reflect the revised and improved Shandong Gold Offer. Cardinal anticipates entering into an appropriate amending agreement to give effect to such amendments imminently.

Timetable and Next Steps

Detailed information relating to the Revised Shandong Gold Offer will be set out in the Bidder's Statement and Target's Statement, which are now expected to be dispatched to Cardinal shareholders in early August 2020. The Bidder's Statement and Target's Statement will set out important information, including how to accept the Revised Shandong Gold Offer, information about Shandong Gold and the key reasons as to why Cardinal Shareholders should accept the Revised Shandong Gold Offer.

Target's Statement in respect of Nordgold Bid

Cardinal has today lodged its Target's Statement in relation to the Nordgold Bid which sets out important information in relation to the Nordgold Bid. Cardinal encourages all shareholders to read the document in detail as it contains important information.

Advisers

Cardinal's joint financial advisers are Maxit Capital LP, BMO Capital Markets, Hartleys Limited and Canaccord Genuity Corp. Cardinal's legal advisers are HopgoodGanim Lawyers (Australia) and Bennett Jones LLP (Canada).

About Shandong Gold

Shandong Gold is principally engaged in the exploration, mining, refining and sale of gold and non-ferrous metals. Shandong Gold is listed on the main board of both the Shanghai and Hong Kong Stock Exchanges. Shandong Gold had a market capitalisation of approximately US$14.5 billion as at 18 June 2020. In 2019, Shandong Gold produced mined gold of 1.273 million ounces and generated revenue of US$9.0 billion and EBITDA of US$771 million. As of 31 December 2019, Shandong Gold controlled total resources of 35.5 million ounces. Shandong Gold is 48% owned by Shandong Gold Group Co., Ltd ("Shandong Gold Group"), which is ultimately controlled by the State-owned Assets Supervision and Administration Commission of Shandong Province of China ("Shandong SASAC").

To view tables and figures, please visit:

https://abnnewswire.net/lnk/9R7Y1157

About Cardinal Resources Ltd

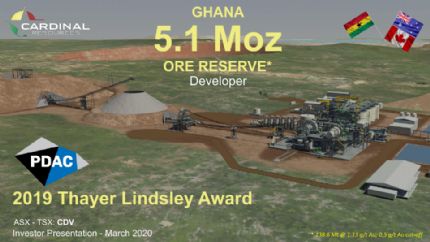

Cardinal Resources Ltd (ASX:CDV) (TSE:CDV) (OTCMKTS:CRDNF) is a West African gold exploration and development Company that holds interests in tenements within Ghana, West Africa.

Cardinal Resources Ltd (ASX:CDV) (TSE:CDV) (OTCMKTS:CRDNF) is a West African gold exploration and development Company that holds interests in tenements within Ghana, West Africa.

The Company is focused on the development of the Namdini Project with a gold Ore Reserve of 5.1Moz (0.4 Moz Proved and 4.7 Moz Probable) and a soon to be completed Feasibility Study.

Exploration programmes are also underway at the Company's Bolgatanga (Northern Ghana) and Subranum (Southern Ghana) Projects.

Cardinal confirms that it is not aware of any new information or data that materially affects the information included in its announcement of the Ore Reserve of 3 April 2019. All material assumptions and technical parameters underpinning this estimate continue to apply and have not materially changed.

| ||

|