Strong Growth Continues at Reptile

Perth, Nov 18, 2019 AEST (ABN Newswire) - Deep Yellow Limited ( ASX:DYL) (

ASX:DYL) ( JMI:FRA) (

JMI:FRA) ( DYLLF:OTCMKTS) is pleased to announce an updated Mineral Resource Estimate (MRE) for the Tumas 1 East deposit (Tumas 1 East), located within the Reptile Project.

DYLLF:OTCMKTS) is pleased to announce an updated Mineral Resource Estimate (MRE) for the Tumas 1 East deposit (Tumas 1 East), located within the Reptile Project.

At a 200ppm eU3O8 cut-off, Tumas 1 East has Inferred Mineral Resources of 24.8Mlb at 319ppm eU3O8, resulting in a 34% increase from the MRE announced in March 2019.

Total combined measured, indicated and inferred calcrete resources in the Tumas palaeochannel (Tumas 1E,1, 2, 3 and Tubas Red Sands/calcrete deposits) now stand at 92.5Mlb at 303ppm eU3O8.

These deposits occur on EPLs 3496 and 3497, held by Deep Yellow's wholly owned subsidiary, Reptile Uranium Namibia (Pty) Ltd. The MRE was undertaken using various cut-off grades using a minimum thickness of 1m and conforms to the 2012 JORC Code of Mineral Resource Reporting.

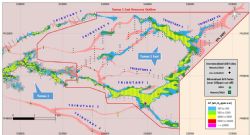

Resource extension RC drilling programs, carried out in April, July and August 2019, succeeded in closing off the Tributary 5 deposit (see Figures 1 and 2*). This work also included some limited infill drilling within the Tributary 4 channel. Of the total 591 RC holes drilled for 6,281m during the Tumas 1 East drilling campaigns, 291 holes returned positive results, a pleasing overall success rate of 50%.

Commenting on the significant increase in resource at Tumas 1 East, Deep Yellow Managing Director and Chief Executive Officer, John Borshoff said:

"We continue to successfully develop our Namibian project portfolio. Deep Yellow is focused on executing its unique and differentiated dual-pillar strategy, which includes building a project with significant size and scale in Namibia as a critical component of this strategy.

We are fortunate enough to have a proven and experienced management team that understand the requirements of building a successful uranium operation - a factor that will continue to contribute to the remarkable turnaround in improving the potential offered by the Reptile Project. This has already enabled us to triple the resource at Reptile in a short space of time, importantly at a discovery cost of around $0.11/lb.

Results to date strongly justify our increased effort both in exploration to further increase the resource base and in evaluating the economic potential of this project with the initiation of a Scoping Study due for completion in December 2019. We fully expect this to progress to commencement of a prefeasibility study in late January 2020".

The uranium mineralisation defined to date in the Tumas palaeochannel system occurs as three distinct mineralised bodies: the Tumas 1 and 2 deposits, now including the Tumas 1 East tributary extensions, the Tumas 3 deposit and the Tubas Red Sands/calcrete deposits (see Figure 1*).

The Tumas 1 East deposit expansion and the associated new MRE are the subject of this announcement.

The combined overall Tumas palaeochannel resource now totals 92.5Mlb eU3O8 at 303ppm over EPLs 3496/97. With this addition to the Tumas palaeochannel uranium resource base, the Company's overall total surficial calcrete-related Mineral Resources across its Namibian projects have more than doubled to 110.5Mlb U308.

The successful, low-cost development of the project portfolio fully vindicates the change of focus implemented in November 2016 from which the extensive, regionally occurring prospective palaeochannel system was identified.

Drilling programs completed at these highly prospective palaeochannels continue to produce extremely positive resource outcomes. The extensive channel system occurring away from the identified deposits has only been sparsely drilled with large sections remaining completely untested.

Exploration Target

As previously reported, Deep Yellow has identified 125km of highly prospective palaeochannel systems. To date, only 65km of these systems have been adequately tested, delivering an almost 3-fold increase in the resource base.

This provides Deep Yellow with a significant opportunity to increase the current resource base at Reptile through targeted exploration across the remaining 60km of channels yet to be tested.

Since November 2016, exploration and resource drilling has only focused on the eastern and central parts of the Tumas palaeochannel system. This work has been highly successful producing a cumulative 79.8Mlb eU3O8 at 347ppm calcrete-type resource associated within this 100% owned palaeochannel.

With the 34% increase to the Tumas 1 East calcrete-associated resource, Deep Yellow continues to advance towards its stated Exploration Target1 of 100M to 150Mlb at a grade range of 300ppm to 500ppm U3O8 for this type of uranium mineralisation.

Deep Yellow's total JORC compliant uranium Mineral Resources on its Namibian projects are shown in Appendix 1*.

Tumas 1 East Mineral Resource Estimate Summary

Exploration and infill resource drilling carried out in conjunction with geological studies in 2017 and 2018 has substantially improved the Company's understanding of the palaeochannel-associated calcrete-type targets and its uranium mineralisation. The upgraded MRE over the Tumas 1 East deposit, incorporating newly discovered tributaries, is the result of positive 2018 and 2019 drilling programs.

The MRE was estimated by Ordinary Kriging. Cut-off grades used for the expanded MRE included 100, 150, 200, and 250 ppm eU3O8 and the Measured, Indicated and Inferred Mineral Resource Estimates derived from these cut-off grades indicate the mineralisation remains robust and consistent. Table 1* shows the MRE results at various cut-offs and Table 2* shows the MRE results for the combined Tumas 1, 2 and 3 resource at a 200 ppm eU3O8 cut-off in comparison to the previous MRE.

The new MRE for the extended Tumas 1, 2 and 3 deposits at a 200ppm cut-off gives a combined Measured, Indicated and Inferred Mineral Resource of 79.8Mlb at 347ppm eU3O8 as shown in Table 2*. The 200ppm eU3O8 cut-off has been selected as being the most appropriate for headline reporting of the resource estimations. When the Tubas Red Sands/calcrete and the Aussinanis deposits are included, this totals 110.5Mlb for all the palaeochannel-associated targets.

*To view tables and figures, please visit:

https://abnnewswire.net/lnk/C0B22ALI

About Deep Yellow Limited

Deep Yellow Limited (ASX:DYL) (OTCMKTS:DYLLF) is successfully progressing a dual-pillar growth strategy to establish a globally diversified, Tier-1 uranium company to produce 10+Mlb p.a.

Deep Yellow Limited (ASX:DYL) (OTCMKTS:DYLLF) is successfully progressing a dual-pillar growth strategy to establish a globally diversified, Tier-1 uranium company to produce 10+Mlb p.a.

The Company's portfolio contains the largest uranium resource base of any ASX-listed company and its projects provide geographic and development diversity. Deep Yellow is the only ASX company with two advanced projects - flagship Tumas, Namibia (Final Investment Decision expected in 1H/CY24) and MRP, Western Australia (advancing through revised DFS), both located in Tier-1 uranium jurisdictions.

Deep Yellow is well-positioned for further growth through development of its highly prospective exploration portfolio - ARP, Northern Territory and Omahola, Namibia with ongoing M&A focused on high-quality assets should opportunities arise that best fit the Company's strategy.

Led by a best-in-class team, who are proven uranium mine builders and operators, the Company is advancing its growth strategy at a time when the need for nuclear energy is becoming the only viable option in the mid-to-long term to provide baseload power supply and achieve zero emission targets.

Importantly, Deep Yellow is on track to becoming a reliable and long-term uranium producer, able to provide production optionality, security of supply and geographic diversity.

| ||

|