Tumas and Mulga Rock Update

Perth, Nov 25, 2022 AEST (ABN Newswire) - Deep Yellow Limited ( ASX:DYL) (

ASX:DYL) ( JMI:FRA) (

JMI:FRA) ( DYLLF:OTCMKTS) is pleased to provide an update on the progress of the Tumas Definitive Feasibility Study (DFS) status and the evaluation work undertaken on Mulga Rock Project since the merger with Vimy Resources Limited (Vimy) occurred on 5 August 2022.

DYLLF:OTCMKTS) is pleased to provide an update on the progress of the Tumas Definitive Feasibility Study (DFS) status and the evaluation work undertaken on Mulga Rock Project since the merger with Vimy Resources Limited (Vimy) occurred on 5 August 2022.

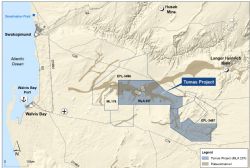

Tumas DFS (Namibia)

The Tumas DFS has been completed, and the draft of the study document is under internal review by management and Board (see location Figure 1*).

The preliminary results indicate the Tumas Project remains commercially attractive despite capital and cost inflation consistent with the global mining environment. Examination of the draft financial model has indicated areas which can be further optimised to deliver increased value, before the DFS is finalised.

The optimisation program will focus on the pre-production mining plan and its associated schedule to deliver a further uplift in value through a final detailed review of the development schedule and costs.

The expectation at this stage is that the DFS results will be ready for release to the market in February 2023.

The Company anticipates the optimisation outcome will provide a sound basis for preparation to proceeding with Front-End Engineering Design (FEED) in early CY2023.

Mulga Rock (Australia)

As advised in its September quarter activities report, Deep Yellow initiated an evaluation program after identifying, from its pre-merger due diligence work, the strong potential that a significant value uplift could be achieved for this project by increasing focus on recovery of critical minerals associated within the Mulga Rock deposit.

This re-appraisal included an assessment of minerals such as copper, nickel, cobalt, zinc, and rare earths (particularly neodymium and praseodymium) known to be present in these deposits in potentially economic quantities.

The study investigated the possibility of achieving further value to that identified by previous studies on this project by considering a less selective mining approach within and immediately below the existing pit designs.

This less selective approach considers all the economic mineral endowment (in-pit value) existing in these polymetallic deposits, rather than focussing solely on uranium. To date the work has been restricted to the Ambassador and Princess deposits, (Mulga Rock East deposits shown in Figure 2*) as these appear to have the highest critical mineral endowment and are the main sources of ore reserves for the Vimy 2018 DFS where a 15-year life of mine was determined.

The 2018 study was restricted to a highly selective mining model that considered only uranium value to generate the ore reserves and then the base metals consequentially contained within this reserve inventory. It is important to note that base metals recovery is a condition of the current mining approvals, and this work is being undertaken to maximise the value of this mandated material recovery.

The assessment work carried out by Deep Yellow on the Mulga Rock has focussed on incorporation of all the base metals and rare earth elements within the expanded uranium resource concentrating on the Mulga Rock East deposits. The work indicates potential for significant increase in project value and the strong likelihood that the project life beyond 20 years can be achieved from these deposits alone.

The preliminary model optimisation on in-pit value adds considerably to the to the overall resource potential compared to that identified in the 2018 DFS. This excludes any possible future benefits that could be derived from the nearby Emperor and Shogun deposits (Mulga Rock West-see Figure 2*).

In addition, the re-evaluation work completed to date also identified the potential to increase the overall uranium resource within these deposits due to the inclusion of peripheral lower grade uranium associated with base metals dominated zones.

This work has demonstrated the need to reconsider the project approach and consider all minerals that could have economic potential in the revised DFS now being undertaken. Only preliminary test work has been completed by Vimy to demonstrate the recovery aspects of the non-uranium minerals available in the Mulga Rock East deposits. The current 80-hole geometallurgical drilling programme that is underway, is targeted to provide sample material to use for metallurgical analysis to provide an indication of the potential processing recoveries and costs possible for the base metals and rare earth minerals that are present.

In addition, in H1 CY2023 a 600-hole air-core drilling program is planned to better define reserve/resource variability factors, upgrading of the resource base for uranium and critical minerals and provide additional material for metallurgical analysis. This drilling will be carried out in parallel with the revised DFS work which has now been fully scheduled and is anticipated to be completed by mid-2024.

With these findings the revised DFS offers the potential to identify a project of much higher value and longer life, whilst remaining within the approval guidelines that have been established for the Mulga Rock Project.

*To view tables and figures, please visit:

https://abnnewswire.net/lnk/5F4Z0964

About Deep Yellow Limited

Deep Yellow Limited (ASX:DYL) (OTCMKTS:DYLLF) is successfully progressing a dual-pillar growth strategy to establish a globally diversified, Tier-1 uranium company to produce 10+Mlb p.a.

Deep Yellow Limited (ASX:DYL) (OTCMKTS:DYLLF) is successfully progressing a dual-pillar growth strategy to establish a globally diversified, Tier-1 uranium company to produce 10+Mlb p.a.

The Company's portfolio contains the largest uranium resource base of any ASX-listed company and its projects provide geographic and development diversity. Deep Yellow is the only ASX company with two advanced projects - flagship Tumas, Namibia (Final Investment Decision expected in 1H/CY24) and MRP, Western Australia (advancing through revised DFS), both located in Tier-1 uranium jurisdictions.

Deep Yellow is well-positioned for further growth through development of its highly prospective exploration portfolio - ARP, Northern Territory and Omahola, Namibia with ongoing M&A focused on high-quality assets should opportunities arise that best fit the Company's strategy.

Led by a best-in-class team, who are proven uranium mine builders and operators, the Company is advancing its growth strategy at a time when the need for nuclear energy is becoming the only viable option in the mid-to-long term to provide baseload power supply and achieve zero emission targets.

Importantly, Deep Yellow is on track to becoming a reliable and long-term uranium producer, able to provide production optionality, security of supply and geographic diversity.

| ||

|