Reptile Basement Target Offers Resource Upgrade Opportunity

Perth, Oct 7, 2021 AEST (ABN Newswire) - Since late 2016, current management of Deep Yellow Limited ( ASX:DYL) (

ASX:DYL) ( JMI:FRA) (

JMI:FRA) ( DYLLF:OTCMKTS) have focused on the progression of a dual-pillar growth strategy involving organic growth of the Company's Namibian project portfolio and inorganic growth through targeted merger and acquisitions, to establish a global, multi-platform 5-10Mlb per annum, low-cost, tier one uranium producer.

DYLLF:OTCMKTS) have focused on the progression of a dual-pillar growth strategy involving organic growth of the Company's Namibian project portfolio and inorganic growth through targeted merger and acquisitions, to establish a global, multi-platform 5-10Mlb per annum, low-cost, tier one uranium producer.

- Tumas DFS resource upgrade drilling completed, now enabling consideration of a 20+ years LOM operation

- Tumas Project remains the ongoing priority, with key focus on progression and completion of the current DFS

- Exploration can now start on the next major Reptile exploration target, the Omahola Project, to unlock further value

- Previous exploration between 2009-2013 at Omahola established a Measured, Indicated and Inferred Resource base of 45Mlb at 420ppm U3O8

- Sparse pre-2016 semi-regional drilling indicates strong potential for additional discoveries. Best intersections from previous semi-regional drilling include:

o INCR454: 65m @ 550ppm eU3O8 from 1m

o INCR430: 11m @ 1973ppm eU3O8 from 44m

o INCH138: 14m @ 633ppm eU3O8 from 38m

o ALAD1612: 24m @ 258ppm eU3O8 from 77m

- A shallow RC drilling program of 7,100m and 200 holes commenced 5 October and is aimed at identifying new mineralised areas outside existing deposits for follow-up drilling

The Company has experienced excellent growth through the successful execution of its unique strategy, particularly through the organic pillar and exploring and developing shallow targets occurring within the Tumas palaeochannel (located within EPLs 3496 and 3497), which has resulted in a near four-fold increase in the Mineral Resource, demonstrating similar characteristics to Langer Heinrich-style deposits (see Figure 1*).

The Tumas Project is the priority focus for Deep Yellow with the continued progression of the DFS, which is expected to be completed during the latter part of CY2022.

From 2009 to 2013 previous management of Deep Yellow identified significant uranium mineralisation in basement lithologies, having alaskite association of Rossing/Husab style.

Three discrete deposits were discovered, collectively called the Omahola Project and located on EPL 3496, which is held by Deep Yellow through its wholly owned subsidiary Reptile Uranium Namibia (Pty) Ltd (RUN).

OMAHOLA BASEMENT PROJECT (OMAHOLA)

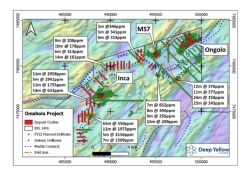

Omahola (Figure 1*) has a current Measured, Indicated and Inferred Resource base of 45Mlb U3O8 at 420ppm (Annexure 1), occurring from a depth of 20m to 250m, which is typical for these types of deposits. Omahola provides Deep Yellow with another significant exploration target due to the significant accumulation of uranium and the partially drilled nature of the extensive prospective target zone extensions which remain underexplored, with potential for resource expansion.

Exploration work will focus on establishing the full potential of the basement targets associated with the Omahola project to unlock further value for Deep Yellow.

Deep Yellow will commence exploration through initiation of a shallow RC drilling program at Omahola, targeting the NW portion of EPL 3496.

Omahola occurs within the highly prospective "Alaskite Alley" corridor within which major uranium deposits including Rossing, Husab, Etango and Valencia deposits are located. These deposits contain in excess of 800Mlb U3O8 with the Rossing mine alone having produced in excess of 200Mlb U3O8.

Omahola occupies a 35 x 14km northwest-southeast trending zone within the Alaskite corridor (see Figure 1*).

Uranium mineralisation at Omahola occurs across three deposits including Ongolo, MS7 and Inca and amounts to a Measured, Indicated and Inferred Resource base of 45.1Mlb U3O8 at 420ppm as shown in Figure 2.

Uranium mineralisation is associated with sheeted leucogranites, known locally as alaskites, and hydrothermal skarn formation. Details of the current JORC Mineral Resource status of Omahola are listed in Appendix 1.

Results of Historic Data Re-Interpretation

Historical results from the sparse, pre-2016 semi-regional drilling program carried out away from the known deposits, based on >1km spaced lines, indicates very strong potential for new discoveries to be made along this highly prospective zone (Figure 2*). In several areas, the previous drilling intersected significant mineralisation in multiple drillholes.

A comprehensive review of existing data is showing both the alaskite and skarn hosted uranium mineralisation is fundamentally structurally controlled. Apart from presence of mineralised intersections, key criteria guiding delineation of this prospective zone includes the importance of structurally weak zones e.g. marble-gneiss contacts and the localisation of deposits near fold hinge zones. Approximately 15km of the favourable horizon has been adequately tested. The re-interpretation has shown the remaining area has clearly been inadequately tested, leaving significant scope for both expansion of existing deposits and discovery of new deposits in what is seen to be a major prospective zone of 50 km strike length.

Re-evaluation of existing data indicates significant upside for the discovery of additional resources over a medium-term timeframe.

A study of the historical drill results to identify the minimum drilling depth required to isolate the geochemical footprint of the existing deposits (Ongolo, MS7, Inca), showed that general outlines of the deposits are recognisable at a drilling depth of 25m.

SHALLOW RC DRILLING PROGRAM

To date, only a minor strike length of prospective lithological contacts has been drill-tested. To identify areas hosting potential deposits, Deep Yellow will complete a shallow 7,100m ~200-hole program on generally 400m x 50m hole spacing drilling to a 25m depth.

The drill program commenced on 5 October and, as a first pass, will cover the structural target zone occurring between the known deposits of the Omahola Project which are under cover extending over a 10km strike length toward the SSE. This program is expected to be completed by early December 2021.

Concurrent Work

Together with the shallow drilling program, the following workstreams have also been commenced at Omahola to assist in reaching a better understanding of the prospective basement target zone:

i. Review and digitisation of existing geological mapping with targeted field verification.

ii. Photography of selected core holes aimed at sampling key intersections for further investigation, to ascertain the relationship between uranium and alteration, mineralogy/geochemistry, and structure.

iii. Resource re-estimation work to upgrade the currently identified uranium resources from JORC 2004 to JORC 2012 reporting status.

*To view tables and figures, please visit:

https://abnnewswire.net/lnk/CYIVU2P8

About Deep Yellow Limited

Deep Yellow Limited (ASX:DYL) (OTCMKTS:DYLLF) is successfully progressing a dual-pillar growth strategy to establish a globally diversified, Tier-1 uranium company to produce 10+Mlb p.a.

Deep Yellow Limited (ASX:DYL) (OTCMKTS:DYLLF) is successfully progressing a dual-pillar growth strategy to establish a globally diversified, Tier-1 uranium company to produce 10+Mlb p.a.

The Company's portfolio contains the largest uranium resource base of any ASX-listed company and its projects provide geographic and development diversity. Deep Yellow is the only ASX company with two advanced projects - flagship Tumas, Namibia (Final Investment Decision expected in 1H/CY24) and MRP, Western Australia (advancing through revised DFS), both located in Tier-1 uranium jurisdictions.

Deep Yellow is well-positioned for further growth through development of its highly prospective exploration portfolio - ARP, Northern Territory and Omahola, Namibia with ongoing M&A focused on high-quality assets should opportunities arise that best fit the Company's strategy.

Led by a best-in-class team, who are proven uranium mine builders and operators, the Company is advancing its growth strategy at a time when the need for nuclear energy is becoming the only viable option in the mid-to-long term to provide baseload power supply and achieve zero emission targets.

Importantly, Deep Yellow is on track to becoming a reliable and long-term uranium producer, able to provide production optionality, security of supply and geographic diversity.

| ||

|