Melbourne, July 10, 2019 AEST (ABN Newswire) - Environmental Clean Technologies Limited ( ASX:ECT) (ECT or Company) is pleased to provide the following update on the completion of the acquisition of a new waste-to-energy (WTE) technology and requests the resumption of trading in its securities.

ASX:ECT) (ECT or Company) is pleased to provide the following update on the completion of the acquisition of a new waste-to-energy (WTE) technology and requests the resumption of trading in its securities.

Key points:

- Completion of the acquisition of assets related to the CDP Group of companies

- New technology to provide direct exposure to the waste-to-energy sector, through existing project opportunities and integration with ECT's Latrobe Valley Coldry project

- As a result of completion of the transaction, the Company has requested the resumption of trading in its securities

- Update on Company's key commercialisation projects including:

o CDP 'Waste-to-Energy' technology commercialisation program

o India Matmor, Coldry and CDP opportunities

o Latrobe Valley project

o Steam and boiler package program

o COHgen hydrogen technology strategy

Further to previous announcements on 7 and 13 June, and 2 July 2019 the Company is pleased to confirm the completion of the transaction with liquidators McGrath Nichol for the acquisition of the CDP Group's 'Waste-to-Energy' (WTE) technology.

The Catalytic De-Polymerisation (CDP) technology is capable of producing automotive diesel from a range of hydrocarbon-based inputs including various waste and hydrocarbon streams such as waste timber, endof- life plastics and low-rank coal.

The completion of this transaction delivers significant opportunities and advantages for the ECT Group and its commercialisation program, linking existing projects and commercialisation activities to new, and higher margin sectors of the energy market.

As part of the previous project development work by the CDP Group the WTE technology has a number of prospective standalone projects poised to progress to the commercial demonstration stage. ECT will be working with a range of interested parties to build upon this position over the coming months to quantify and qualify the commercial potential of these new projects.

In addition, and as a key focus point for ECT during the recent due diligence process, the CDP WTE technology presents significant potential synergies with the Company's lignite drying process; Coldry, including:

- The CDP WTE process performance, efficiency and yield can benefit from the blending of Coldry with waste to provide improved feedstock consistency and process reaction conditions

- The Coldry process can benefit technically and financially via the harvesting of free waste heat from the CDP process, while enabling bankability of the overall project via exposure to the higher value liquid fuel market, compared to the international coal market.

Further to the above, the integration of CDP with Coldry may elicit a deeper and broader acceptance or 'social license' for the future use of brown coal in Australia.

In line with these substantial opportunities the Company is pleased to announce that it will be pursuing the development of a vertically integrated, Coldry-enabled, CDP-WTE solution for the production of diesel fuel as a part of its Latrobe Valley project.

Chairman Glenn Fozard commented, "As stated previously, this acquisition has been seven months in the making and we are very pleased to have successfully concluded the process for transfer of the assets and commencement of our onboarding program. Given the clear opportunities and potential benefits in commercialisation of our broader technology offering, we've wasted no time in implementing initial R&D activities with the University of Queensland in assessing the pathway for integration of the Coldry and CDP technologies. It's fair to say that together with our continued work on HydroMOR and COHgen, we are looking forward to a very exciting couple of months ahead."

Over the next 4-6 weeks, ECT will onboard the full array of technical and background documentation into its knowledge management system as well as commence the restructuring of the $6 million Cooperative Research Centre - Project (CRC-P) funding agreement between ECT, the Department of Industry Innovation and Science, University of Queensland and other supporting partners, included as part of the transaction.

Further, ECT will also assess the engineering design and process guarantees attached to a commercial demonstration project in Queensland, previously proposed and prepared by the CDP Group, and drawing from this the direct points of transfer to and integration with the Latrobe Valley Coldry project, along with engaging experienced parties to develop other projects that are not connected to the Latrobe Valley project and continue the momentum of interest from project proponents for the application of this type of WTE technology.

Mr Fozard continued, "This acquisition increases the Company's potential exposure to higher margins via the deployment of value-added downstream technology within the Latrobe Valley Coldry project currently under feasibility.

"We intend to develop the CDP technology for deployment globally, both as an integrated Coldry-enabled plant in markets with suitable lignite reserves and as a stand-alone WTE application using other waste feedstocks, as had been the plan for the former CDP Group of companies prior to their liquidation.

"By example, having completed the transaction, we will shortly be presenting the opportunities for project development to our strategic partner NLC India Limited (NLCIL)."

The Asset Sale Agreement (ASA) was finalised and signed on 2 July 2019 and the further completion period allowed for transfer of the assets and satisfaction of all pre-conditions, including final inspection of the assets and payment.

Since our announcement on 7 June 2019, the purchase price has increased by $7,501 as the Company agreed to purchase additional assets. The total purchase price is therefore $227,501 inclusive of GST. This acquisition has been financed by a partial redraw of the Challenge Roofing and Bricks Pty Ltd loan.

Mr Fozard continued, "The CDP Group of companies have invested upwards of AUD $10M in developing this technology and would appear that they became the victim of growing too fast for their working capital to keep up, with the former owners on the verge of a very interesting project in Brisbane which had gained support from government, large engineering firms and included conditional off-take agreements from major fuel distributors."

"At first, when we approached the CDP Group, we were really only interested in licencing the WTE technology to support our Latrobe Valley project, but as we applied our substantial knowledge in R&D legislation and funding, we were able to structure a deal that allowed us to acquire all the IP without substantial cost. This way, we still get to apply the technology to the Latrobe Valley project and also own the future commercialisation benefits. We also have little in the way of historical development costs to defend, so we can engage promoters and developers of other projects that don't require or can't use Coldry as a feedstock, faster and more dynamically."

The CDP assets acquired, including all technology, licencing rights and IP, will be vended into a fully owned subsidiary, ECT Waste-to-Energy Pty Ltd. This will allow for greater flexibility in developing future strategic relationships tied specifically to this technology and allows for future capital decisions (e.g. divestment, market spin-out etc) to be made as and when the market drivers present themselves.

The Company has remained in Voluntary Suspension pending the completion of this acquisition and as such requests the ASX lift the suspension.

Latrobe Valley Project

- Energy Australia - coal supply agreement expected to be completed in July ahead of second stage infrastructure upgrades at Yallourn power station

- Basic engineering program scope and structure nearing completion ahead of investment platform finalisation and information memorandum preparation

The Latrobe Valley project has been a key development focus of the Company for the past two years.

Over this time, the Company has completed the pre-feasibility program which, in response to market demand, provided an indicative capital estimate (in our 29 November 2018 announcement 'Technology Commercialisation Strategy and Revenue Model Overview') of AUD $210M for 600,000 tonnes per annum (tpa) capacity.

These initial estimates for a multi-module development have been further refined and, as referenced in our 12 April 2019, the Company is now focused on initially deploying as a single module at a scale of 170,000- 300,000 tpa. This scale will form the unit basis of development for the Latrobe Valley project moving forward.

In line with this, the next stage of the feasibility program, to be completed over the coming months, has focused on a detailed, in-depth assessment of specific site requirements at Yallourn power station (coal supply, waste heat integration and electrical tie-ins) and scope refinement for the engineering design program, led by the ECT engineering team.

The feasibility program is expected to be completed within 8 weeks and deliver the necessary detail for a tender program and delivery of the plant design and refined capital and operating costs estimates.

ECT expect the basic engineering will then be completed in a further 16 weeks and take the project to investment-ready stage.

In parallel, ECT has been developing the investment structure for funding of the 170,000 - 300,000 tpa proposed project, including preparation of an information memorandum (IM). The Company expects that the project will be developed within a project Special Purpose Vehicle (SPV), and project funding raised by equity capital from external investor group/s in this separate entity.

A key component of the IM will be the basic engineering report, delivered by independent, external, wellregarded engineering design firms, and together with the project investment model will form the basis of an investment program through to financial close.

The current estimated timeframe to financial close for equity capital raising in the project SPV is the first half of 2020, with construction to begin by December 2020.

The addition of the CDP technology to the Latrobe Valley Coldry Project (LVCP) is intended to provide significant potential margins to Coldry solid fuel pellets via the conversion to higher value products, including diesel, bitumen and asphalt.

The addition of CDP to the feasibility planning of the LVCP was intentionally targeted to maximise the commercial potential of the smallest commercial Coldry plant size (170,000 tpa), where Coldry's competitive advantage of low temperature, low pressure drying enables higher value downstream product offerings.

Ashley Moore, ECT's head engineer commented, "To understand the reasons behind integrating CDP into the LVCP is to recognise lignite for what it really is - a valuable chemical feedstock source."

"For too long the broader community has been fixated on the old paradigm of what a beneficiated lignite needed to be, namely utilising a high temperature, high pressure, high cost approach to make dried, compressed briquettes. Coldry shifts the paradigm to a low temperature, low pressure, zero-CO2 'gateway' process, efficiently dealing with the biggest inhibitor to further downstream use - moisture, whilst also retaining the unique chemical qualities left present in a dewatered lignite product."

"Dried briquetted lignite processes spend too much energy placing it into a physical state that requires even more energy (often needing to be crushed) for it to be utilised downstream. Briquettes support the logistics chain but almost all downstream uses (even thermal applications) are improved by increased surface area contact with the lignite to promote greater efficiencies in the chemical reaction, including gasification, combustion, pyrolysis and depolymerisation."

Alternative routes to market considered prior to CDP were less attractive, featuring lower margins, higher transport costs, increased exposure to CO2 pricing uncertainty and single-partner off-take risk.

Prospectively, the integration of CDP into the LVCP, when compared to an export grade, briquetted Coldry fuel market, maintains its status as a commercial demonstration plant whilst reducing capital costs by half, doubling operational cashflows and having a threefold improvement in return on capital.

The greatest commercial strength of the Coldry process and product is its unique low-energy approach to drying. The Coldry process delivers a homogenous, continuous supply of feedstock with desirable physical characteristics. For example, the Coldry feedstock is able to be crushed to fine particle size with relative ease and low energy consumption, and the fine particle size increases reactive surface area, enhancing downstream process like CDP.

COO, Jim Blackburn, commented, "WTE projects all suffer from the one key challenge - access to long-term and continuous feedstock supplies. Coupling Coldry with CDP will help to respond to this challenge as Coldry will serve as a baseload chemical feedstock, assuring continuous production and allowing alternative waste feedstocks to be sourced as and when they are feasibly accessible. This will also demonstrate to the broader community and the government how Victoria's world-class lignite reserves can integrate with other processes as a more valuable chemical feedstock instead of it simply being burned as a direct thermal energy source to make electricity."

The Company maintains the vision that low emission technologies like Coldry and CDP will better define the future use of brown coal in Victoria, and globally, as well as helping Australia bolster its energy independence whilst simultaneously mitigating the 'great waste crisis' we currently face.

Finally, Chairman Glenn Fozard highlighted, "there is enough chemical feedstock in the Latrobe Valley to turn Victoria into the nation's waste recycler and largest diesel refiner for decades to come. Add to that the hydrogen potential currently being pursued by both levels of government and the Japanese and ECT is positioned to be the leading provider of cutting-edge technology solutions for the future, low-emissions, use of brown coal."

India

As shareholders will be aware, ECT has been pursuing a strategic program in India for several years, across its Coldry and Matmor technologies, and inclusive of the proposed Matmor Project with NLCIL and NMDC Limited (NMDC).

During that time the Company completed the initial Tripartite Agreement (TPA) (6 months), Techno- Economic Feasibility study (TEF) (6months), basic engineering program (12months), Project Agreement (MOU) (6 months) and Research Collaboration Agreement (RCA) (6 months), amounting to 3 years of planning and preparation.

This acknowledges slippage of 6 months due to delays by NMDC in approving the TPA and a further 6 months waiting for NMDC approval of the RCA, which did not eventuate.

Irrespective of the partners to the project, each of these phases of work have been essential to validate the role of Coldry and Matmor in India and prepare for commencement of major projects in the region. Having recently concluded that NMDC will not be continuing and having formally withdrawn the offer to extend the MOU, ECT and NLCIL are now able to explore partnerships with other interested parties.

Over the past 4 years, ECT has engaged with a number of other India based steel industry organisations who have expressed a keen interest in the Matmor technology. ECT personnel have met with and presented to several relevant organisations at each of the major conferences previously attended, yet under the TPA and MOU agreements, had no need to pursue these broader relationships until now.

As such, the Company has a ready-made project, with completed techno-economic feasibility and basic engineering design, a comprehensive financial, legal and intellectual property structure, and a committed partner in NLCIL. This is the basis from which the partners will now actively pursue an iron ore or steel industry partner.

Discussions have already been initiated through ECT India CMD Selvakumar, whose knowledge, experience and networks within industry and government will enable ECT to now broaden its base of potential partners and ensure Coldry, Matmor and now CDP, have a clear path and timeframe to commercialisation in India.

By example, and supported by the approval by NLCIL for additional coal shipments to Australia, ECT will pursue current project opportunities for Coldry and Waste-to-Energy, directly with NLCIL.

ECT and NLCIL will formally meet to evaluate these further project opportunities, including:

- Coldry - Stand alone and integrated pilot/demonstration plant

- Matmor - Proposed pilot plant with new steel industry partner

- Waste-to-Energy - Proposal for a test/pilot plant integrated with Coldry

Steam and Boiler Package Program (Coldry Commercialisation)

The Company recently announced (12 April 2019) the launch of its steam and boiler package division with a focus on providing integrated solutions to the steam, hot water and process heating industry.

This initiative leverages the output from the Company's Coldry High Volume Test Facility (HVTF), creating a compelling value proposition through vertical integration of fuel supply, plant & equipment, finance and service offerings in a market with long term scale and demand dynamics.

ECT's steam and boiler package division aims to deliver an integrated approach to the production of steam, hot water and process heat requirements, through the provision of solid fuel, installation of multifeedstock biomass boiler systems and the operation and maintenance of new and existing systems.

The aim is to deliver a total cost saving of 15% to the customer.

Steam, hot water and process heating are critical inputs for many industries. They are intended to provide convenient, reliable and cost-effective energy essential to business processes.

Being such an indispensable part of a business requires these systems be run at their optimum efficiency, providing the best performance, safety and energy efficiency possible.

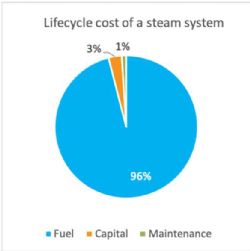

The chart (in link below) highlights that the cost of fuel consumption in a steam system accounts for most of the lifetime cost of ownership. It makes good business sense therefore to run an energy-efficient system and to ensure a thorough lifetime cost of ownership analysis when deciding whether to upgrade existing or invest in new plant.

The benefit of investing in a new boiler system with multi-feedstock capability is the ability to substitute Coldry solid fuel for expensive natural gas or LPG, significantly lowering the lifetime cost of ownership.

New equipment requires a substantial capital outlay to realise the fuel cost savings over time, so ECT has partnered with finance firm BE Power to deliver a zero upfront cost solution for new systems and upgrades, factored into one monthly contract fee.

The Victorian industrial energy market is defined by the price and availability of appropriate energy sources. Until 2014, brown coal briquettes dominated the local market, followed by gas and biomass. The closure of the Morwell brown coal briquette plant in 2014 saw many businesses switch to gas and biomass.

The price of gas has since doubled or tripled for many companies. Availability of biomass is variable, reducing the reliability of supply. Biomass typically has a lower energy density, and its ash contains elements that foul boiler systems, resulting in lower efficiency and increased downtime for maintenance.

Coldry solid fuel is an ideal fuel for businesses requiring large volumes of process heat. Further, Coldry doesn't conflict with the Victorian government's renewable energy target, as neither wind nor solar are suitable for generating reliable, affordable process heat to such industries.

In this respect, the Company is competing directly with the availability and prices of natural gas and biomass alternatives, which given the current supply-demand profile, look like remaining high and possibly escalating, well into the future.

Compared to biomass, Coldry is the lower emission choice. Compared to natural gas, Coldry is the lower cost choice, representing an ideal balance between affordability and CO2 intensity.

Coldry performs well as a high performance standalone solid fuel or in a blend to improve the efficiency of other biomass fuels such as woodchip, pyrethrum, sawdust, crop stubble and bagasse.

Coldry can also be infused with anti-fouling agents to counteract some of the boiler performance issues experienced when using certain biomass feedstock (like pyrethrum, crop stubble and bagasse).

Coldry can be tailored specifically to suit the application, from highly dense briquettes to a higher-porosity 'baseline' pellet. The objective is to expend as little energy as required to produce the right product for the application. This benefit is passed on to the customer in the form of improved fuel combustion and increased boiler efficiency.

Coldry is sourced from local, abundant brown coal supplies and features a consistent specification. Supply agreements in place with Energy Australia (Yallourn) and Maddingley Brown Coal (Bacchus Marsh).

The Company is actively pursuing the establishment of further steam service contracts while developing capacity at its HVTF northwest of Melbourne. The Company has highlighted its strategic program for infrastructure upgrades at its Bacchus March site (currently in phase 3 of 4), leading through the current market development phase.

As sales are achieved and contracts are implemented, the intent is to drive the development of the Latrobe Valley project to support further scale and revenue opportunities in the local market.

COHgen R&D Program

COHGen is an emerging Hydrogen technology currently under development by ECT. It aims to efficiently generate hydrogen via application of unique mineral based catalysts at low cost with minimal waste and emissions. With excellent global market potential, it enables lignite resources to be used to generate hydrogen, meet energy requirements and create valuable by-products usable in a wide range of industrial applications.

Critically, it can do so with very low CO2 emissions, with the bulk of the carbon remaining as a valuable solid by-product. This capability is in stark contrast the current technologies under development which release significant quantities of CO2.

COHgen leverages ECT's knowledge of lignite, its chemistry, and the potential for catalytic actions to provide beneficial outcomes in lignite utilisation. Successful development would add enormous commercial value to the Latrobe Valley project developments and support a new Australian export industry.

Current research programs include:

- Reaction characterisation, including evaluation of catalysts and catalyst manufacturing

- Evaluation of process parameters and formulations on hydrogen evolution rates and amounts

- By-product characterisation and application assessments

- Catalyst recovery & reuse

- Materials and energy balance, and how this varies with formulation & process parameters

Following the current works, ECT expects to finalise patent applications for COHGen, and begin scale up and commercialisation options evaluations.

ECT is currently developing an expanded collaboration program with a number of strategic partners including:

- University of Newcastle - One of several strategic university partners and testing facilitator

- EcoWise (David Wilson) - longstanding design services engineers

The collaboration project is to be delivered over a 2-year period and divided into 4 key phases (milestones) including:

Milestone 1: Process chemistry determination

Determine process responses to varying formulations (lignite, critical mineral catalyst) and thermal cycles needed to achieve the highest value combination of outputs (highest hydrogen, lowest CO2, and commercially attractive solid residues). Analysis to be achieved by a range of testing protocols plus full characterisation of off-gas streams.

Milestone 2: Catalyst selection and catalyst manufacturing process development

Building on the results of milestone 1, assessments will be made of alternative catalyst materials. This may involve some repeat or additional works and will be carried out in tandem with milestone 1.

Milestone 3: By-product characterisation and application development

Characterisation of solid residues through a range of analyses; reviews of potential application of these materials to manufacturing and pollution mitigation processes. Lines of enquiry include catalyst recovery and recycling; carburisation additive for iron and steel production; and an activated carbon material for liquid or gaseous waste treatment.

Milestone 4: Generate test vessel to move from batch operations at bench scale to semi-continuous in nature

Identify the most prospective combination of raw materials, formulations, and process conditions in the testing program (milestones 1, 2 & 3), and develop a process and mechanical design for a scale up to semi-continuous production, in direct support for next scale up step to a fully continuous operating pilot plant. Once the design is developed, generate a business case for the building and construction of the test scale facility.

Represented in this more intensive focus on its hydrogen technology, is the Company's awareness of the significant increase in State and Federal government support for hydrogen industry development in Australia, driven in large part by Japanese energy policy and investment. As such the Company will pursue discussions with potential strategic partners globally, in parallel to completion of the current R&D and patent activities.

Capital Management Plan

As outlined, ECT's planned activities have working capital solutions which can be broadly summarised to include the following:

- 43.5% of eligible R&D activities rebateable under the R&D refund scheme and paid via the existing Brevet R&D financing facility. Currently the Brevet facility is capped at $3.6M with a current balance of AUD $1M.

- Government grants including CRC grants, one of which was outlined in the CDP acquisition, which are additional to the government's R & D rebate. There are a number of applications submitted and the specifics of these will be advised to the market when the outcome is known.

- Repayment of the wholesale loan connected to ECT Finance's Equity Lending Facility (ELF) loan repayments which recently raised repayments of AUD $1.5M and has raised a total of AUD $2.7M since its inception. The continued use of this option will be supported by price sentiment.

- Securitisation loans - these are loans secured to assets including the ELF loan book and the WTE assets, which are then paid to ECT by ECT Finance via repayment of the wholesale loan. Over AUD $2M has been raised, liability limited to the secured assets and an asset coverage of the loans at over 10 times.

- Equipment and project financiers (like BE Finance and banks) whom are willing to finance steam and boiler packages where ECT acts as the operator supplying fuel to generate steam for the installed equipment.

- Specific project funding solutions like the IM for the Latrobe Valley Coldry project which would seek to raise project capital likely via direct equity investment into the project SPV. This targeted capital raise would be to finance the proposed construction, commissioning and operations of a 170,000- 300,000 tpa Coldry plant capacity and CDP co-located plant. Capital estimates for this plant will be advised to the market as we complete designs for engineering, procurement and construction.

- Overseas ruling under the R & D legislation for the Indian Coldry plant still available to ECT to support the financing of this project in the absence of NMDC's contribution.

- Available cash (as at 9 July) of $401,000 and cash equivalent (undrawn R & D debtor) of $291,000.

- Primary market share issues.

Should the Company require any additional funding, in addition to the above identified sources of financing, ECT has at its disposal market aligned options including ELF loan repayments, securitisation loans, primary market issues and co-investment by strategic investors. These options are currently available and have been proven to be accessible recently despite the suspension of trading ($800K LJ & K Thomson Pty Ltd loan & $287K Challenge Roofing and Bricks Pty Ltd CDP acquisition loan). Decisions on which of these options to take will be a function of ongoing assessment of the prevailing market conditions and subsequent updates to the market.

The Company can confirm that it is in compliance with ASX Listing Rule 3.1.

The Company looks forward to providing further details on the integration on the CDP assets into its Latrobe Valley project, and the commercialisation of Coldry, HydroMOR and COHgen suite of technologies, through its current and planned projects, in due course.

To view tables and figures, please visit:

https://www.abnnewswire.net/lnk/AY6QO280

About Environmental Clean Technologies Ltd

Environmental Clean Technologies Limited (ASX:ECT) bridges the gap between the current high emission reality and the zero-emission world of the future. ECT's technology aims to play a key role in the transitional pathway to net zero by utilising abundant low rank and waste fuel sources in a new, clean way. ECT's technology suite creates clean and reliable applications and products for the energy, agricultural and industrial sectors.

Environmental Clean Technologies Limited (ASX:ECT) bridges the gap between the current high emission reality and the zero-emission world of the future. ECT's technology aims to play a key role in the transitional pathway to net zero by utilising abundant low rank and waste fuel sources in a new, clean way. ECT's technology suite creates clean and reliable applications and products for the energy, agricultural and industrial sectors.

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

ASX:ECT) (ECT or Company) is pleased to provide the following update on the completion of the acquisition of a new waste-to-energy (WTE) technology and requests the resumption of trading in its securities.

ASX:ECT) (ECT or Company) is pleased to provide the following update on the completion of the acquisition of a new waste-to-energy (WTE) technology and requests the resumption of trading in its securities.  Environmental Clean Technologies Limited (ASX:ECT) bridges the gap between the current high emission reality and the zero-emission world of the future. ECT's technology aims to play a key role in the transitional pathway to net zero by utilising abundant low rank and waste fuel sources in a new, clean way. ECT's technology suite creates clean and reliable applications and products for the energy, agricultural and industrial sectors.

Environmental Clean Technologies Limited (ASX:ECT) bridges the gap between the current high emission reality and the zero-emission world of the future. ECT's technology aims to play a key role in the transitional pathway to net zero by utilising abundant low rank and waste fuel sources in a new, clean way. ECT's technology suite creates clean and reliable applications and products for the energy, agricultural and industrial sectors.