Grants Lithium Resource Increased by 42% ahead of DFS

Grants Lithium Resource Increased by 42% ahead of DFS

Adelaide, Oct 22, 2018 AEST (ABN Newswire) - Emerging Northern Territory lithium developer, Core Exploration Ltd ( ASX:CXO) ("Core" or the "Company") is pleased to announce a substantial Resource upgrade for its Grants Lithium Deposit at the Finniss Lithium Project in the Northern Territory.

ASX:CXO) ("Core" or the "Company") is pleased to announce a substantial Resource upgrade for its Grants Lithium Deposit at the Finniss Lithium Project in the Northern Territory.

HIGHLIGHTS

- Core's high grade Grants Lithium Resource has been upgraded, adding 42% more tonnes to the inventory at the high-grade of 1.5% Li2O

- Two-thirds of the Grants Lithium Resource is now classified as Measured or Indicated

- Finniss Project Lithium Resource now stands at 4.3 Mt at 1.4% Li2O

- Considerable scope remains to further increase the mining inventory given the many additional lithium-rich pegmatites identified within Core's large >400km2 of tenure at Finniss

- Resources for the nearby BP33 deposit being updated currently, with a new estimate expected to be reported later this quarter

- The additional mining inventory defined is expected to result in a longer mine life at the Finniss Project, and further enhance the robust economics

- Recent Grants resource drilling results show consistent grade and geological character and include: 48m @ 1.59% Li2O from 224m (FRC179)

- The Finniss project Definitive Feasibility Study (DFS) remains on track for completion in late November 2018

- DFS focussed on mining and production of high-grade lithium concentrate near Darwin, with development planned to commence in 2019

- Finniss Project Lithium Resource is one of the highest-grade undeveloped lithium deposits in Australia

The resource tonnes have increased by 42% in size at a high grade of 1.5% Li2O, with over one-third classified in the Measured Mineral Resource category - the highest resource confidence classification (see Table 1 in link below).

The increase in the size of the estimate and confidence of the Resource, following successful drilling in recent months, provides the Company with great conviction that Finniss Project has potential to deliver robust returns, which is expected to be confirmed by the Definitive Feasibility Study (DFS).

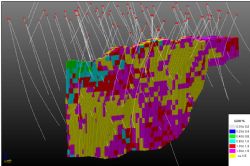

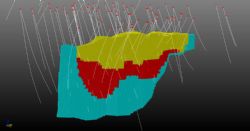

The Grants Lithium Resource estimate currently comprises 2.89Mt @ 1.5% Li2O (see Table 1 in link below) and is one of the highest-grade spodumene resources in Australia. Two-thirds of the Grants Lithium Resource is now classified in the Measured or Indicated category (see Figures 1-4 in link below).

The global Mineral Resource for the Finniss Project is now 4.3Mt @ 1.4% (see Table 1 in link below) and is expected to grow further in coming weeks when a new resource estimate is announced for BP33.

Core is in the final stages of completing a Definitive Feasibility Study ("DFS") for the development of a spodumene concentrate operation from the Finniss Lithium Project and expects to deliver the DFS in late November 2018.

Core is targeting commencement of mining and construction mid-2019 and first production of high quality spodumene concentrate in late 2019.

The DFS is expected to dramatically build on the strong financial outcomes highlighted in the Pre-Feasibility Study (PFS) ($140M NPV and 142% IRR; ASX 25/06/18). The DFS is likely to consider substantially expanded resources and longer mine life, optimised recoveries and increased grade of product as well as further confirmation of offtake and customer prepayment finance.

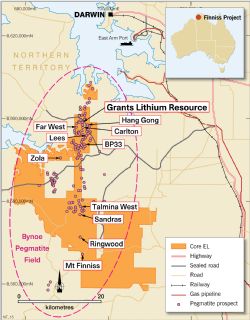

The Finniss Lithium Project has arguably the best supporting infrastructure and logistics chain to Asia of any Australian lithium project. The Project is within 25km of port, power station, gas, rail and 1 hour by sealed road to workforce accommodated in Darwin and importantly to Darwin Port - Australia's nearest port to Asia.

High grade, low processing costs and cheap haulage make Core's Finniss Project potentially one of the least capital intensive and most cost competitive spodumene operations in Australia.

In the context of recently reported Year-on-Year (YoY) growth of Electric Vehicle (EV) sales in US of 65%, China 44% and Europe of 42. Core is well placed to be the next high-quality lithium concentrate producer in Australia in 2019.

Grants Lithium Resource

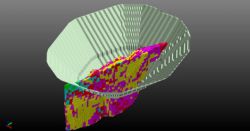

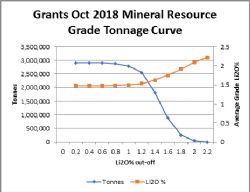

The results of the Mineral Resource Estimate are provided in Table 1 and Figures 1-4(see link below). The Mineral Resources are reported at a high cut-off of 0.75% Li2O.

The Grants ore-body averages 25m wide, is over 300m long and characterised by consistent, high grade spodumene mineralisation from one wall to the other (see Figure 1 in link below). These characteristics and scale of orebody enable a simple open pit operation producing consistent high grade with low dilution utilising the efficiencies of bulk mining equipment.

Dr Graeme McDonald (BSc PhD MAusIMM) was contracted by Core to undertake the Mineral Resource Estimate for the Grants Lithium Deposit. As part of the preparation of the Resource Estimate, Dr McDonald developed a geological interpretation based on cross sections, generated a 3D geological interpretation from interpreted cross sections, created domain interpretations for lithium, developed a block model of the deposit, undertook a geostatistical analysis of the data and estimated lithium grades.

Dr McDonald's report notes that fresh pegmatite at Grants is composed of coarse spodumene, quartz, albite, microcline and muscovite. Spodumene, a lithium bearing pyroxene (LiAl(SiO3)2), is the predominant lithium bearing phase (see Figure 2 in link below) and displays a diagnostic red-pink UV fluorescence. The pegmatite is not strongly zoned, apart from a thin (1-2m) quartz-mica-albite wall facies. Overall the lithium content throughout the pegmatite is notably consistent.

Grants has a flat Grade-Tonnage curve at the 1.5% Li2O "sweetspot" for spodumene production (see Figure 5 in link below). A high 0.75% Li2O cut-off grade results in no significant reduction in the contained tonnes, demonstrating the consistent high-grade nature of the Mineral Resource.

Recent Resource drill results at Grants

Drill results emanating from the resource definition program at Grants leading to the resource upgrade include:

- 40m @ 1.54% Li2O from 81m (FRC149) including:

o 8m @ 2.00% Li2O from 99m

- 40m @ 1.52% Li2O from 210m (FRC176) including:

o 13m @ 2.17% Li2O from 233m

- 48m @ 1.59% Li2O from 224m (FRC179) including:

o 15m @ 2.18% Li2O from 253m

Summary of Mineral Resource Estimate and Reporting Criteria

Geology and geological interpretation

The Grants Lithium Deposit is hosted within a rare element pegmatite that is a member of the Bynoe pegmatite field. The Bynoe Pegmatite Field is situated 15km south of Darwin and extends for up to 70km in length and 15 km in width. Over 100 pegmatites are known within clustered groups or as single bodies. Individual pegmatites vary in size from a few metres wide and tens of metres long up to larger bodies tens of metres wide and hundreds of metres long.

The pegmatites are predominantly hosted within the early Proterozoic metasedimentary lithologies of the Burrell Creek Formation and are usually conformable to the regional schistosity. The Bynoe pegmatites are classified as LCT (Lithium-Caesium-Tantalum) type and are believed to have been derived from the ~ 1845 Ma S-Type Two Sisters Granite which outcrops to the west.

Fresh pegmatite at Grants is composed of coarse spodumene, quartz, albite, microcline and muscovite (in decreasing order of abundance). Spodumene, a lithium bearing pyroxene (LiAl(SiO3)2), is the predominant lithium bearing phase and displays a diagnostic red-pink UV fluorescence. The pegmatite is not strongly zoned, apart from a thin (1-2m) quartz-mica-albite wall facies. Overall the lithium content throughout the pegmatite is consistent.

Drilling techniques and hole spacing

The Grants drill hole database used for the MRE contains a total of 95 holes for 13,794m of drilling. Comprising 74 RC holes, 17 DD holes and 4 AC holes.

The majority of holes have been drilled at angles of between 55deg - 70deg either due east or west, with a small proportion drilled vertically. The 4 vertical AC holes were only used to assist with the interpretation of the geology and depth of the weathering profile. The assays were not used as part of the MRE due to the higher risk of cross contamination issues associated with the AC drilling technique. Geological and assay data for RC and diamond drill holes was used in the geological interpretation and MRE. The only exception being the assay data for 3 recently completed diamond holes had not been received prior to the MRE being undertaken.

Sampling and sub-sampling

Samples were collected from RC drilling and when submitted for assay typically weighed 2-5kg over an average 1m interval. RC sampling of pegmatite for assays is done on a 1 metre basis. 1m-sampling continued into the barren wall-zone of the pegmatite and then a 3m composite was collected from the immediately surrounding barren phyllite host rock. RC samples were homogenised and subsampled by cone splitting at the drill rig.

Drill core was collected directly into trays, marked up by metre marks and secured as the drilling progressed. Core was cut firstly into half longitudinally along a consistent line, ensuring no bias in the cutting plane. Again, without bias, half core was then cut into two further segments. A quarter was then collected on a metre basis where possible but not less than 0.3m in length, determined by geological and lithological contacts.

All samples were sent to North Australian Laboratories (NAL) in Pine Creek for analysis.

Sample analysis method

Sample Preparation - The samples have been sorted and dried. Primary preparation has been by crushing the whole sample. The samples have been split with a riffle splitter to obtain a sub-fraction which has then been pulverised to 95% passing 100microns m.

A 0.3 g sub-sample of the pulp is digested in a standard 4 acid mixture and analysed via ICP-MS and ICP-OES methods for the following elements: Li, Cs, Rb, Sr, Nb, Sn, Ta, U, As, K, P and Fe.

In 2016-2017, all samples were also analysed via the fusion method - a 0.3g sub-sample is fused with a Sodium Peroxide Fusion flux and then digested in 10% hydrochloric acid. ICP-OES is used for the following elements: Li, P and Fe. Exhaustive checks of this data suggested an excellent correlation exists, so in 2018 a 3000 ppm Li trigger was set to process that sample via a fusion method.

Selected drill core samples were also run for the following additional elements to provide a broader suite: Al, Ca, Mg, Mn, Si, LOI, SG (immersion), SG (pychnometer) and various trace elements.

Standards, blanks and duplicates have all been applied in the QAQC methodology. Sufficient accuracy and precision have been established for the type of mineralisation encountered and is appropriate for QAQC in the Resource Estimation.

Cut-off grades

The current Mineral Resource Inventory for the Grants Deposit has been reported at a cut-off grade of 0.75% Li2O which based on current modelling approximates the current break even operating cost estimate for an open pit development. No top cuts were applied.

Estimation methodology

Geology and mineralisation wireframes were generated in Micromine software using drill hole data supplied by Core. Resource data was flagged with unique lithology and mineralisation domain codes as defined by the wireframes and composited to 1m lengths. The composites were analysed and no top-cuts applied.

Grade continuity analysis was undertaken in Micromine software for Li2O for the mineralised domain and models were generated in all three directions. Parameters were used in the block model estimation. A block model with a parent block size of 5 x 10 x 10m with sub-blocks of 1.25 x 2.5 x 2.5m has been used to adequately represent the mineralised volume, with sub block estimated at the parent block scale.

Density data was supplied by Core and is consistent with expected values for the lithologies present and the degree of weathering. Within the block model, density has been assigned based on lithology and weathering state.

Classification criteria

The resource classification has been applied to the Mineral Resource Estimate based on the drilling data spacing, grade and geological continuity, and data integrity. Portions of the model that have drill spacing of better than 25m by 30m, and where the confidence in the geology, mineralisation and resource estimation is considered high and would allow the application of modifying factors in a technical and economic study have been classified as Measured Mineral Resources. Areas that have drill spacing of greater than 25m by 30m, and/or with lower levels of confidence in the geology, mineralisation and resource estimation or potential impact of modifying factors have been classified as Indicated Mineral Resources. Areas that have drill spacing of greater than 25m by 30m, and with low levels of confidence in the geology, mineralisation and resource estimation or potential impact of modifying factors have been classified as Inferred Mineral Resources.

The classification reflects the view of the Competent Person.

Mining, Metallurgy and Environment

Throughout the PFS (released to the ASX on 25/6/2018) a number of assumptions were made that are still considered valid; including:

- Mining Recovery - 95%

- Mining Dilution - 5%

- Mining Cost/tonne of conc. - AUD$208.70

- Processing Cost/tonne of conc. - AUD$71.19

- Haulage Cost/tonne of conc. - AUD$11.47

- G & A Cost/tonne of conc. - AUD$8.00

- Port Costs/tonne of conc. AUD$7.50

- Total unit operating Costs/tonne of conc. AUD$372 (incl. royalties)

- Price - US$649/ tonne of 5.0 % Li2O conc.

The PFS concluded that the traditional open cut mining method of drill, blast, load and haul will be used and that the operation would produce a concentrate with a target grade of 5.0% Li2O. Further metallurgical test work has demonstrated a concentrate grade of 5.5% Li2O is achievable with recoveries of 79% (as described in an ASX announcement on 02/08/2018). This occurs via a simple process of crushing, screening and dense media separation. As part of the PFS preliminary mine planning and scheduling was undertaken considering possible waste and process residue disposal options and environmental impacts.

As part of the current DFS, geotechnical studies have been undertaken as well as waste characterisation, groundwater modelling and further metallurgical test work. A mining lease application has been submitted and is being processed and an Environmental Impact Statement (EIS) is being prepared ready for submission.

Eventual Economic Extraction

It is the view of the Competent Person that at the time of estimation there are no known issues that could materially impact on the eventual extraction of the Mineral Resource.

To view tables and figures, please visit:

http://abnnewswire.net/lnk/K4510G6H

About Core Lithium Ltd

Core Lithium Ltd (ASX:CXO) is an Australian hard-rock lithium company that owns the Finniss Lithium Operation on the Cox Peninsula, south-west and 88km by sealed road from the Darwin Port, Northern Territory. Core's vision is to generate sustained shareholder value from critical minerals exploration and mining projects underpinned by strong environmental, safety and social standards.

Core Lithium Ltd (ASX:CXO) is an Australian hard-rock lithium company that owns the Finniss Lithium Operation on the Cox Peninsula, south-west and 88km by sealed road from the Darwin Port, Northern Territory. Core's vision is to generate sustained shareholder value from critical minerals exploration and mining projects underpinned by strong environmental, safety and social standards.

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

ASX:CXO) ("Core" or the "Company") is pleased to announce a substantial Resource upgrade for its Grants Lithium Deposit at the Finniss Lithium Project in the Northern Territory.

ASX:CXO) ("Core" or the "Company") is pleased to announce a substantial Resource upgrade for its Grants Lithium Deposit at the Finniss Lithium Project in the Northern Territory.  Core Lithium Ltd (ASX:CXO) is an Australian hard-rock lithium company that owns the Finniss Lithium Operation on the Cox Peninsula, south-west and 88km by sealed road from the Darwin Port, Northern Territory. Core's vision is to generate sustained shareholder value from critical minerals exploration and mining projects underpinned by strong environmental, safety and social standards.

Core Lithium Ltd (ASX:CXO) is an Australian hard-rock lithium company that owns the Finniss Lithium Operation on the Cox Peninsula, south-west and 88km by sealed road from the Darwin Port, Northern Territory. Core's vision is to generate sustained shareholder value from critical minerals exploration and mining projects underpinned by strong environmental, safety and social standards.