Option Agreement to Acquire Ni-Cu-Co-PGM-Au Projects, Sudbury, Canada

Option Agreement to Acquire Ni-Cu-Co-PGM-Au Projects, Sudbury, Canada

Perth, Aug 9, 2018 AEST (ABN Newswire) - Rumble Resources Ltd ( ASX:RTR) ("Rumble" or "the Company") is pleased to announce that in line with its clear strategy to proactively generate a pipeline of quality high grade base and precious metal projects, critically review them against stringent criteria, provide optionality to complete low cost systematic exploration to drill test for high grade world class discoveries on multiple projects, it has signed a binding option agreement to acquire up to 100% of the Long Lake and Panache Projects from well-known local (Sudbury) prospector, Gordon Salo.

ASX:RTR) ("Rumble" or "the Company") is pleased to announce that in line with its clear strategy to proactively generate a pipeline of quality high grade base and precious metal projects, critically review them against stringent criteria, provide optionality to complete low cost systematic exploration to drill test for high grade world class discoveries on multiple projects, it has signed a binding option agreement to acquire up to 100% of the Long Lake and Panache Projects from well-known local (Sudbury) prospector, Gordon Salo.

Highlights

Long Lake Project - Gold-Copper-Nickel-PGM, Sudbury, Canada

- Potential for nickel-copper-PGM mineralisation and deposits associated with Sudbury Basin style Offset Dyke ore systems.

o Project area lies some 10km southwest of the Kelly Lake Ni-Cu-PGM deposit (10.5Mt @ 1.77% Ni, 1.34% Cu, 3.6 g/t PGM reserve) which lies at the southern end of the major Copper Cliff Mine Sequence (Copper Cliff Offset Dyke).

o Fieldwork (including a single shallow diamond drill-hole) has highlighted Sudbury Breccia and quartz diorite (known host for Sudbury Basin deposits) occurrences over several km of strike. The occurrence is inferred to be the faulted southern extension of the Copper Cliff Offset Dyke.

o No deep penetrating ground TEM surveys have been conducted to test for Ni - Cu - PGM massive sulphide mineralisation.

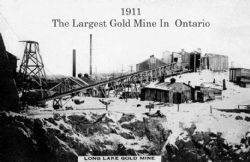

- The Long Lake Project also hosts the historic Lake Gold Mine which produced 57,000 ounces of gold from over 200,000 tonnes of ore mined in the periods 1910-1916 and 1932-1939, with an average recovered mill grade of 9 g/t Au.

Panache Project - Cobalt-Nickel-Copper-Gold-PGM, Greater Sudbury, Canada

- Potential mineralised feeder dykes associated with layered gabbroic intrusions (Nipissing Age - not related to the Sudbury basin) have been identified by mapping and surface geochemistry. No ground TEM has been completed.

o Rock chip assays of up to 1.1% Co, 6.01% Cu, 1.47%, Ni, 3.5 g/t Pgm and 524 g/t Au collected from surface sampling.

Rumble Exploration Strategy

- Long Lake Project - Target blind Sudbury "Offset Dyke" style massive Ni - Cu - PGM type deposits by using high power ground TEM to generate potential conductors

- Panache Project - Target high order base metal with PGM surface anomalism inferred to be potential feeders to gabbroic intrusions using high power ground TEM to generate potential conductors

- Conduct diamond drilling to test conductors that may represent massive Ni-Cu-PGM sulphide mineralisation/deposit.

Rumble is at an exciting stage for shareholders, having recently drilled the Munarra Gully high grade Cu-Au Project (awaiting assays) and the Nemesis high grade Au project (awaiting assays), is scheduled to drill the flagship high grade Braeside Zn-Pb-Cu-Ag -V Project in August and the Earaheedy High Grade Zn Project in September, and is fully funded with $3.8m cash in the bank.

The Long Lake and Panache Projects have met the stringent criteria and will provide shareholders with another near-term opportunity to find a world class base and precious metal deposit.

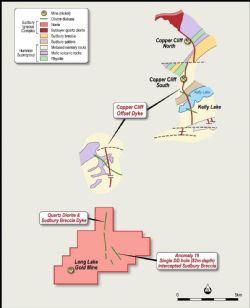

Overview of Sudbury Mining Camp, Ontario Canada - Image 2 (see link below)

Since 1883, the Sudbury mining field has been globally significant with the Sudbury Basin the second-largest supplier of nickel ore in the world, and new discoveries continuing to be made. It is one of the most productive nickel-mining fields in the world with over 1.7 billion tonnes of past production, reserves and resources.

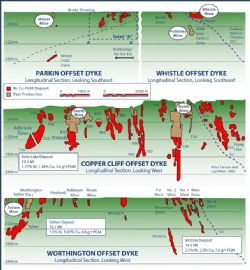

Nickel-copper and platinum group metals ("PGM") bearing sulphide minerals occur in a 60 km by 27 km elliptical igneous body called the Sudbury Igneous Complex ("SIC"). The current model infers the SIC was formed some 1,844 million years ago after sheet-like flash/impact melting of nickel and copper bearing rocks by a meteorite impact. The SIC is within a basin like structure (Sudbury Basin) which had been covered by later sediments and has subsequently been eroded to the current level. Mineralization occurs within the SIC as well as in the neighbouring country rocks in close association with breccias and so-called 'Offset Dykes'. Offset Dykes with metamorphosed (hot) Sudbury breccias have become the target of progressively more intense exploration interest in recent years following the discovery of blind economic deposits. Offset dykes are typically quartz-diorite in composition and extend both radially away from and concentric to the SIC. It is important to note that the Offset Dykes developed downwards from the impact melt sheet. Melt material migrated down into the fractures caused by the impact below the SIC. The melt carried metal sulphides that accumulated into deposits within the Offset Dykes by gravity and pressure gradients (impact rebound). Nearly half of the nickel ore at Sudbury occurs in breccias and Offset Dykes in the footwall rocks of the SIC.

The Copper Cliff Offset Dyke System (see Images 2 - 4 in link below)

The Copper Cliff South (producing) and the Copper Cliff North mine have yielded some 200 million tonnes of ore along the north-south trending offset dyke system. Vale Limited's Clarabelle mill, Copper Cliff smelter and Copper Cliff nickel refinery are all located close to the Copper Cliff Offset dyke.

The southernmost deposit discovered to date is at Kelly Lake which lies south of the Copper Cliff South mine (see image 2 and 4 in link below). The Kelly Lake reserve is 10.5 Mt @ 1.77% Ni, 1.34% Cu and 3.6 g/t PGM. Note that IGO's Nova - Bollinger Deposit which lies in the Albany Fraser Province of Western Australia has a reserve of 13.3 Mt @ 2.06% Ni and 0.83% Cu (2017).

The Long Lake Project (see images 2 and 4 in link below) lies some 10km southwest of the Kelly Lake deposit.

Long Lake Project

The Long Lake Project comprises of the historic Long Lake Au mine and over four km of Sudbury breccia/quartz diorite outcrops which are interpreted to be part of the prospective "Copper Cliff Offset Dyke" system that has been moved west by later regional faults. The area of tenure is approximately 19 km2.

Nickel - Copper - PGM Potential

Exploration by previous explorers (including the current owner - Gordon Salo) has highlighted the occurrence of north-south and northwest striking Sudbury Breccia style dykes with quartz diorite. Petrography and a single shallow diamond drill-hole (82m depth - 2011) has confirmed the presence of moderately metamorphosed Sudbury Breccia with elevated PGM (relative to the surrounding rocks) at a location called Anomaly 19 (see image 4 in link below). The location is coincident with a moderate VTEM conductor. Reconnaissance prospecting and petrography has confirmed the presence of numerous quartz diorite north trending dykes over 4km in strike.

Electromagnetic surveys have been limited to VLF (1987) and VTEM (2008). Technical review of both surveys suggests the likely depth penetration for these systems is shallow at approximately 100m. Given there is a moderate VTEM conductor at Anomaly 19 (not explained), the use of high power ground TEM will be Rumbles priority in generating deeper conductive targets.

Gold Potential

- The Long Lake Gold Mine produced 57,000 ounces of gold from over 200,000 tonnes of ore mined in the periods 1910-1916 and 1932-1939. The average recovered mill grade was 9 g/t Au.

- Long Lake historically was the largest gold mine in Ontario

- Mine tailing dumps (200,000 tonnes) remain on site

- The Long Lake gold deposit is a quartz - sulphide composite vein pipelike system hosted in quartzite with dolerite/gabbroic intrusions. The mineralisation was truncated by a low angle fault. Drilling in 1936 encountered high grade ore in unexploited areas beneath the fault which included intersections of 6m @ 13.8g/t Au with further drilling in 1970s intersecting 5.7m grading 27.5g/t Au & 1980s drill hole intersecting: 4.1m grading 14.8g/t Au.

- Exploration from 2010 to 2012 focused on interpreted fault extensions and EM targets generated by a VTEM survey (2008). A number of targets were tested. The best intercept was 35m @ 2 g/t Au from 27m, which was located only 15m from the historic open cut.

Panache Project

The Panache Project (approximately 30km2 in area) is located 40km southwest of the city of Sudbury, Ontario, Canada. The project hosts a large portion of the Panache gabbro intrusion which is part of the regional extensive Nipissing Gabbro Suite (2215 million years old). Prospecting operations by the project owner, Gordon Salo, has uncovered a series of prospects associated with disseminated to massive sulphides (pyrrhotite - pentlandite - chalcopyrite - pyrite) along gabbro contact margins. Massive sulphide pipes have also been discovered along fault corridors intercepting gabbro. High grade gold mineralisation (at surface) has been associated with gabbro/metasediment contact zones (tectonic). Refer table 3 (see link below) for detail on historical rock chip results.

Area A (see image 6 in link below)

Prospecting activities have exposed a set of massive sulphide pipes in metasediments. The gabbro intrusion appears to be truncated by a regionally extensive southwest trending fault corridor. Rock chip results include up to:

- 6.01% Cu, 1.47% Ni, 1.6 g/t PGM and 0.49% Co

Area B (see image 6 in link below)

Trenching with grab sampling has highlighted strong base metal mineralisation with PGM's along the basal zone to a gabbro intrusion. Wide widths of gossan have been exposed (10m in width). Grab sampling has returned up to:

- 1.61% Cu, 0.49% Ni, 1.1% Co, 1.64 g/t Au, 1.64 g/t Pt and 1.58 g/t Pd.

Area C (see image 6 in link below)

Grab sampling and petrography has identified a 2.5km zone of strong base metal and precious metal anomalism associated with an inferred gabbroic feeder. Grab sampling has returned up to:

- 0.59% Cu, 0.16% Ni, 524.3 g/t Au, 0.45% Co, 0.64 g/t Pt, 1.18 g/t Pd.

The grab sampling results are considered very significant as the average disseminated sulphide percentage for the gabbroic rock chips was approximately 5% indicating the sulphide is well endowed with base and precious metals.

During 2006, airborne TEM (AeroTEM) was conducted in Area C on 100m line spacing. Numerous conductors correlating with the inferred feeder dyke trend and associated anomalous geochemistry were identified and a IP survey was planned, however, it was not completed. In general, the three zones of interest have not had ground TEM or subsequent drilling.

Rumble Exploration Strategy

Rumble considers both the Long Lake and Panache projects as very prospective for high grade Ni - Cu deposits

No deep penetrating ground TEM has been conducted over the main targets of interest which include:

Long Lake Project

- North-south and northwest trending Sudbury breccia/quartz diorite outcrops which have been interpreted as "offset dykes".

Panache Project

- All three target areas strong Ni - Cu - PGM geochemistry with supporting petrography.

Next Steps

- Rumble plans to conduct a deep penetrating ground TEM survey over these targets with the aim of generating high order conductors for subsequent diamond drill testing.

Key Commercial Terms of the Long Lake and Panache Binding Option Agreements

Rumble has signed an option agreement and agreed to enter a joint venture agreement to acquire 100% of the title and interest in the Long Lake and Panache Projects from the vendor Gordon Salo on the below terms:

Long Lake Project - 100%

a. Rumble to pay Cad$20,000 Cash and 200,000 RTR ordinary shares on exercising the option agreement.

b. Rumble to spend a minimum of Cad$50,000 in expenditure in first 12 months.

c. Rumble to make payment of Cad$20,000 Cash and 200,000 RTR ordinary shares before the 12 month period ends.

d. Rumble will need to spend a minimum of Cad$50,000 in expenditure in the second 12 month period.

e. Rumble to make payment of Cad$30,000 Cash and 300,000 RTR ordinary shares before the 24 month period ends.

f. Rumble will need to spend a minimum of Cad$50,000 in expenditure in the third 12 month period.

g. Rumble to make final payment of Cad$70,000 Cash and 2,000,000 RTR ordinary shares before the 36 month period ends, to earn 100%.

h. Gordon Salo is free carried to decision to mine.

i. Following a decision to mine, Rumble will pay a 3% NSR to Gordon Salo. Rumble can secure 1% NSR buy back for cash payment of Cad$1,500,000 to Gordon Salo. Rumble can secure a further 1% NSR buyback for Cad$1,500,000 to Gordon Salo.

Panache Project - 100%

a. Rumble to pay Cad$20,000 Cash and 200,000 RTR ordinary shares on exercising the option agreement.

b. Rumble will also need to spend a minimum of Cad$50,000 in expenditure in first 12 months.

c. Rumble to make payment of Cad$20,000 Cash and 200,000 RTR ordinary shares before the 12 month period ends.

d. Rumble will need to spend a minimum of Cad$50,000 in expenditure in the second 12 month period.

e. Rumble to make payment of Cad$30,000 Cash and 300,000 RTR ordinary shares before the 24 month period ends.

f. Rumble will need to spend a minimum of Cad$50,000 in expenditure in the third 12 month period.

g. Rumble to make final payment of Cad$70,000 Cash and 2,000,000 RTR ordinary shares before the 36 month period ends to earn 100%.

h. Gordon Salo is free carried to decision to mine.

i. Following a decision to mine, Rumble will pay a 3% NSR to Gordon Salo. Rumble can secure 1%NSR buy back for cash payment of Cad$1,500,000 to Gordon Salo. Rumble can secure a further 1% NSR buyback for Cad$1,500,000 to Gordon Salo.

Upon completing minimum expenditure for each period, Rumble can walk away from the Agreements at any time without further obligation.

To view tables and images, please visit:

http://abnnewswire.net/lnk/F5ID1T89

About Rumble Resources Ltd

Rumble Resources Limited (ASX:RTR) (FRA:20Z) is an Australian based exploration company, officially admitted to the ASX on the 1st July 2011. Rumble was established with the aim of adding significant value to its current gold and base metal assets and will continue to look at mineral acquisition opportunities both in Australia and abroad.

Rumble Resources Limited (ASX:RTR) (FRA:20Z) is an Australian based exploration company, officially admitted to the ASX on the 1st July 2011. Rumble was established with the aim of adding significant value to its current gold and base metal assets and will continue to look at mineral acquisition opportunities both in Australia and abroad.

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

ASX:RTR) ("Rumble" or "the Company") is pleased to announce that in line with its clear strategy to proactively generate a pipeline of quality high grade base and precious metal projects, critically review them against stringent criteria, provide optionality to complete low cost systematic exploration to drill test for high grade world class discoveries on multiple projects, it has signed a binding option agreement to acquire up to 100% of the Long Lake and Panache Projects from well-known local (Sudbury) prospector, Gordon Salo.

ASX:RTR) ("Rumble" or "the Company") is pleased to announce that in line with its clear strategy to proactively generate a pipeline of quality high grade base and precious metal projects, critically review them against stringent criteria, provide optionality to complete low cost systematic exploration to drill test for high grade world class discoveries on multiple projects, it has signed a binding option agreement to acquire up to 100% of the Long Lake and Panache Projects from well-known local (Sudbury) prospector, Gordon Salo.  Rumble Resources Limited (ASX:RTR) (FRA:20Z) is an Australian based exploration company, officially admitted to the ASX on the 1st July 2011. Rumble was established with the aim of adding significant value to its current gold and base metal assets and will continue to look at mineral acquisition opportunities both in Australia and abroad.

Rumble Resources Limited (ASX:RTR) (FRA:20Z) is an Australian based exploration company, officially admitted to the ASX on the 1st July 2011. Rumble was established with the aim of adding significant value to its current gold and base metal assets and will continue to look at mineral acquisition opportunities both in Australia and abroad.