Sydney, May 28, 2018 AEST (ABN Newswire) - American Pacific Borate and Lithium ( ASX:ABR) ("ABR" or the "Company") is pleased to announce it has entered into an earn in Agreement (the "Agreement") to acquire, on the incurrence of US$3m of Project expenditures, a 100% interest in the Salt Wells North and Salt Wells South borate and lithium exploration projects in Nevada, USA (the "Projects"), suitably located in close proximity to the Company's flagship Fort Cady project.

ASX:ABR) ("ABR" or the "Company") is pleased to announce it has entered into an earn in Agreement (the "Agreement") to acquire, on the incurrence of US$3m of Project expenditures, a 100% interest in the Salt Wells North and Salt Wells South borate and lithium exploration projects in Nevada, USA (the "Projects"), suitably located in close proximity to the Company's flagship Fort Cady project.

- Consistent with ABR's strategy to become a globally significant producer of borates, the Company has agreed an "earn in" to acquire a 100% interest in the Salt Wells North and Salt Wells South borate and lithium exploration projects in Nevada, USA on the incurrence of US$3m of Project expenditures

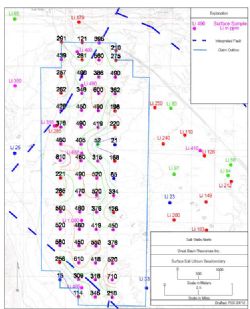

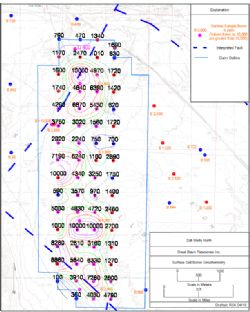

- Both projects are prospective for borates and lithium with surface salt sampling results received on 18 April 2018 from Salt Wells North delivering up to 810 ppm Lithium and over 1% Boron (over 5.2% boric acid equivalent)

- Borates were previously produced from Salt Wells North from surface salts

- No modern exploration activities have been completed on either project to test the salt horizon for borates and lithium and the brines for lithium

- Modest early year expenditure ensures Company's focus remains on taking its flagship Fort Cady borate project into production

Under the terms of the Agreement, ABR may spend US$3m on the Projects over a five year period, modest expenditure commitments are required in the first two years. In addition to the US$3m expenditure commitment, ABR is required to pay US$100k upfront to reimburse the vendor's Project costs. The Company is also required to pay all claim related expenditure which is estimated to be US$300k over the five year period. Once in commercial production, ABR will be required to make a one-off payment of US$1m and an ongoing royalty of 3% of gross revenues.

ABR expects that it can run near term exploration activities on these two new project from its head-office in Apple Valley, California.

American Pacific Borate and Lithium, CEO, Michael Schlumpberger commented:

"We are very excited to be acquiring the rights to earn in to both the Salt Wells North and Salt Wells South borate and lithium exploration projects in Nevada. The elevated levels of lithium and boron in surface salts from recent sampling suggest an opportunity to establish either a borate project hosted in the sediments or a lithium and/or boron project hosted in the brines, or both.

Importantly, under the earn in agreement, we only have modest expenditure commitments in the first two years. This ensures our focus will continue to be on advancing our Fort Cady borate project into production. The close proximity of the project to our office in Apple Valley also allows us to keep expenditure to a minimum. The acquisition is consistent with our stated objective to become a globally significant producer of borates."

The Projects

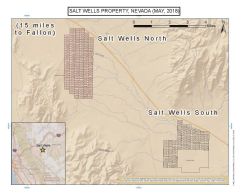

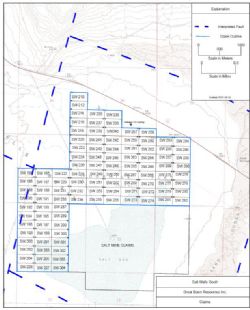

The Salt Wells North and Salt Wells South projects are located in Churchill County, Nevada, USA. The Projects are within short proximity to major highways and within 25 kilometres of the town of Fallon that has a population of over 8,500 people.

The Projects lie in what is believed to be an internally drained, fault bounded basin that appears similar to Clayton Valley, Nevada, where lithium is currently produced by Abermarle Corporation, the only current production source of lithium in the USA. The basin covers an area of around 110 square kilometres. Borates were produced from surface salts in the 1800's from the Salt Wells North site. With the exception of recent surface salt sampling from the Salt Wells North project, no modern exploration has been completed. The Projects are prospective for borates and lithium in the sediments (salt horizon) and lithium and boron brines within the structures of the basin.

Salt Wells North

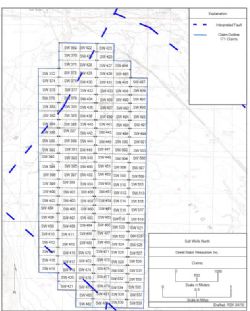

The Salt Wells North project includes 171 claims of 20 acres (8.1 hectares) for a total project size of 13.8 square kilometres. The project sits in the shallow north eastern section of the basin.

On 18 April 2018, assays results were received from surface salt samples demonstrating elevated levels of lithium and borates. The highest recorded lithium reading was 810ppm with several other readings above 500ppm recorded over a wide area.

Salt Wells South

The Salt Wells South project includes 105 claims of 20 acres (8.1 hectares) for a total project size of 8.5 square kilometres. The project sits in the deeper south eastern section of the basin.

Earn In Agreement

The counterparty to the Agreement is Great Basin Resources Inc, ("GBR"), a company registered in Nevada, USA.

ABR will "earn in" to acquire 100% of the Projects under the following terms:

a. Upon signing the Agreement, ABR will pay US$74k to enable GBR to formally register the Projects' claims;

b. ABR will make an upfront payment to GBR of US$100k as a reimbursement for some of the Project expenses to date payable within seven days of formal claim registration for both Projects;

c. ABR will pay all direct claim expenses including initial registration fees and annual ongoing fees;

d. In addition to the above fees, ABR will commit to spending, at its absolute discretion, the following amounts each year for the next five years subject to any over expenditure in a year being applied to expenditure requirements for following years:

Progressive and Cumulative Projects' Expenditure Requirements

Year 1 - US$100k, cumulative - US$100k

Year 2 - US$300k, cumulative - US$400k

Year 3 - US$600k, cumulative - US$1,000k

Year 4 - US$800k, cumulative - US$1,800k

Year 5 - US$1,200k, cumulative - US$3,000k

e. ABR may choose to complete the required US$3,000k expenditure earlier than the proposed 5 year term. In either case, GBR will immediately transfer the claims to ABR upon satisfaction ABR has expended at least US$3,000k on the Projects;

f. ABR will pay GBR US$1m within 28 days of first production at commercial scale (a plant capable of producing sufficient product to derive annual revenues of at least US$60m); and

g. ABR will pay GBR a net smelter royalty of 3% of gross revenues on an ongoing basis once commercial scale operations have been achieved.

Budget

The budget for the Projects is presented in the link below.

Referral Fee

The Company has agreed to pay a project referral fee to a consultant totalling 250,000 ordinary shares.

Program

The Company has formed a steering group consisting of the Company's CEO, Michael Schlumpberger and Strategic Advisor, Jerry Aiken to determine the work program. It is expected this program will be prepared over the coming weeks with the expectation of works on site commencing in the second half of this year.

To view figures, please visit:

http://abnnewswire.net/lnk/KUIU2JC0

To view the Video Audio, please visit:

http://www.abnnewswire.net/press/en/93305/abr

About American Pacific Borates Ltd

American Pacific Borate and Lithium Limited (ASX:ABR) is focused on advancing its 100%-owned Fort Cady Boron and Lithium Project located in Southern California, USA. Fort Cady is a highly rare and large colemanite deposit with substantial lithium potential and is the largest known contained borate occurrence in the world not owned by the two major borate producers Rio Tinto and Eti Maden. The Project has a JORC mineral estimate of 120.4 Mt at 6.50% B2O3 (11.6% H3BO3, boric acid equivalent) & 340 ppm Li (5% B2O3 cut-off) including 58.59 Mt at 6.59% B2O3 (11.71% H3BO3) & 367 pmm Li in Indicated category and 61.85 Mt @ 6.73% B2O3 (11.42% H3BO3) & 315 ppm Li in Inferred category. The JORC Resource has 13.9 Mt of contained boric acid. In total, in excess of US$50m has historically been spent at Fort Cady, including resource drilling, metallurgical test works, well injection tests, permitting activities and substantial pilot-scale test works.

American Pacific Borate and Lithium Limited (ASX:ABR) is focused on advancing its 100%-owned Fort Cady Boron and Lithium Project located in Southern California, USA. Fort Cady is a highly rare and large colemanite deposit with substantial lithium potential and is the largest known contained borate occurrence in the world not owned by the two major borate producers Rio Tinto and Eti Maden. The Project has a JORC mineral estimate of 120.4 Mt at 6.50% B2O3 (11.6% H3BO3, boric acid equivalent) & 340 ppm Li (5% B2O3 cut-off) including 58.59 Mt at 6.59% B2O3 (11.71% H3BO3) & 367 pmm Li in Indicated category and 61.85 Mt @ 6.73% B2O3 (11.42% H3BO3) & 315 ppm Li in Inferred category. The JORC Resource has 13.9 Mt of contained boric acid. In total, in excess of US$50m has historically been spent at Fort Cady, including resource drilling, metallurgical test works, well injection tests, permitting activities and substantial pilot-scale test works.

About The Ellis Martin Report

The Ellis Martin Report (TEMR) and Money Talk Radio feature interviews with industry leaders in mining, biotech, energy, and technology. The program is globally syndicated through multiple financial platforms and streaming services.

The Ellis Martin Report (TEMR) and Money Talk Radio feature interviews with industry leaders in mining, biotech, energy, and technology. The program is globally syndicated through multiple financial platforms and streaming services.

| ||

|