Half Yearly Financial Report - 31 December 2017

Perth, Mar 14, 2018 AEST (ABN Newswire) - Intermin Resources Limited ( ASX:IRC) present their report on the consolidated financial statements for the half-year ended 31 December 2017.

ASX:IRC) present their report on the consolidated financial statements for the half-year ended 31 December 2017.

EXPLORATION AND DEVELOPMENT ACTIVITIES

During the half year the Company made progress on a number of fronts. Key developments were as follows:

Mine Development

Open pit mining of ore and waste continued during the Period at Teal Stage 1 with ore processing at third party processing plants in close proximity. The pre stripping of waste was completed and ore mining totalled approximately 120,000 tonnes with a mine claimed grade of 3.5g/t Au. Gold sales generated $11.8m in revenue with the project cash positive during the Period.

During the period, Teal Stage 2 was approved and commenced comprising a cut back on the east wall to access additional ore. Both stages of the pit are expected to produce 18,000 - 20,000 ounces with completion of mining scheduled for the March Quarter 2018 and final ore processing in the June Quarter 2018.

Development studies for the Goongarrie Lady and Teal Stage 3 gold projects advanced during the Period with Feasibility Study completion expected in the June Quarter 2018.

Exploration

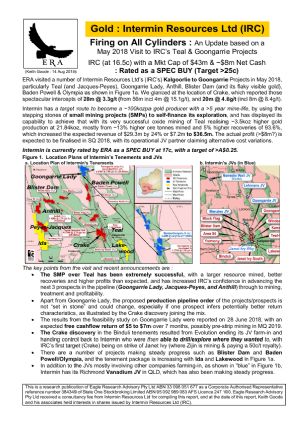

Exploration activities continued during the period across Intermin's 100% owned tenure in the Goldfields of Western Australia. Over 20,000m of drilling was completed focussing on resource extension and new discovery targeting ahead of the large scale program planned for 2018. The drilling was highly successful and identified three key project areas, the Teal gold camp, Anthill and Blister Dam.

For details on the drilling programs, we refer you to the announcements released on the ASX and on the Intermin website (www.intermin.com.au).

Results from the drilling are now being compiled with resource updates expected at the Anthill gold project in the March Quarter 2018 and Teal in the June Quarter 2018.

Menzies Gold Project Joint Venture

In 2016, Intermin executed a binding Heads of Agreement ("HoA") with Eastern Goldfields Limited ( ASX:EGS) ("EGS") to form a strategic joint venture ("EGS JV") covering Intermin's projects in the Menzies and Goongarrie region (refer ASX announcement dated 5 September 2016).

ASX:EGS) ("EGS") to form a strategic joint venture ("EGS JV") covering Intermin's projects in the Menzies and Goongarrie region (refer ASX announcement dated 5 September 2016).

Further exploration activities are planned for 2018 at these prospects and will be managed and funded by EGS as part of the joint venture.

Binduli North Gold Project Joint Venture

During the Period, joint venture partner Evolution Mining Limited completed 38 holes for 4,006m testing priority geochemical and structural targets at the Coot and Crake and Honey Eater prospects. Results and follow up plans are expected in the March Quarter 2018.

Janet Ivy (M26/446) Production Royalty

Intermin owns a $0.50/t mining royalty that relates to ore mined and treated from ML26/446 currently owned by Norton Gold Fields Ltd. During the period, the prepayment threshold was reached and royalty payments are now payable with potential for $600,000 in royalties in the March and June Quarters.

Nanadie Well Copper - Gold Project Joint Venture

Joint Venture partner Mithril Resources Ltd announced new priority regional targets at the Nanadie Well project during the period and reported some excellent results including extensions to Cu-Ni-PGE massive sulphide mineralisation at the Stark prospect. Excellent drilling results were also returned from the Kombi gold prospect with follow up on both projects planned for the first half of 2018. For details we refer you to the Mithril Resources ASX releases for the period ( ASX: MTH).

ASX: MTH).

Richmond Vanadium - Molybdenum Project

In December 2016, Intermin executed a binding Heads of Agreement ("HoA") with AXF Resources Pty Ltd ("AXF") to form a strategic joint venture ("AXF JV") covering Intermin's Richmond Vanadium - Molybdenum project in Queensland (refer ASX announcement dated 13 December 2016).

During the period activities included data compilation and review for a Resource update accounting for changes in tenement boundaries and to ensure compliance with JORC 2012 reporting. In addition, AXF collected samples for dispatch to two research laboratories in China for initial pre-treatment metallurgical test work.

The resource update and the initial results from the test work are expected in the March and June Quarters respectively.

To view the full report, please visit:

http://abnnewswire.net/lnk/IW0XIE98

About Horizon Minerals Limited

Horizon Minerals Limited (ASX:HRZ) is a gold exploration and mining company focussed on the Kalgoorlie and Menzies areas of Western Australia which are host to some of Australia's richest gold deposits. The Company is developing a mining pipeline of projects to generate cash and self-fund aggressive exploration, mine developments and further acquisitions. The Teal gold mine has been recently completed.

Horizon Minerals Limited (ASX:HRZ) is a gold exploration and mining company focussed on the Kalgoorlie and Menzies areas of Western Australia which are host to some of Australia's richest gold deposits. The Company is developing a mining pipeline of projects to generate cash and self-fund aggressive exploration, mine developments and further acquisitions. The Teal gold mine has been recently completed.

Horizon is aiming to significantly grow its JORC-Compliant Mineral Resources, complete definitive feasibility studies on core high grade open cut and underground projects and build a sustainable development pipeline.

Horizon has a number of joint ventures in place across multiple commodities and regions of Australia providing exposure to Vanadium, Copper, PGE's, Gold and Nickel/Cobalt. Our quality joint venture partners are earning in to our project areas by spending over $20 million over 5 years enabling focus on the gold business while maintaining upside leverage.

| ||

|