Quarterly Activities Report 31 December 2017

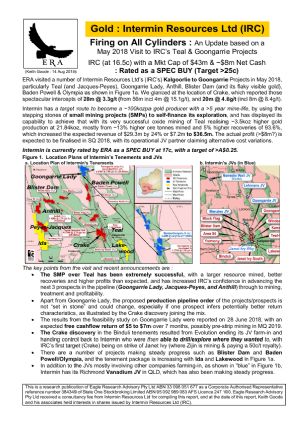

Perth, Jan 30, 2018 AEST (ABN Newswire) - Intermin Resources Limited ( ASX:IRC) ("Intermin" or the "Company") provides the December 2017 Quarterly Activities Report. Intermin is a gold exploration and development company with a key focus in the Kalgoorlie region of Western Australia (see Figure 1 in link below).

ASX:IRC) ("Intermin" or the "Company") provides the December 2017 Quarterly Activities Report. Intermin is a gold exploration and development company with a key focus in the Kalgoorlie region of Western Australia (see Figure 1 in link below).

HIGHLIGHTS

- Ore mined from Teal a record 65,200t grading 3.53g/t for 7,400 ounces

- Gold production of 5,214 fine ounces at C1 costs of $680/oz (see Note 1 below) and an AIC of $,1,292/oz (see Note 2 below) inclusive of $1.64 million ($315/oz) in Teal Stage 2 pre-strip expenditure

- Final ore treatment and sales at Paddington Mill completed successfully with 1,287 fine ounces produced and final reconciled payments made (see Note 3 below)

- First toll treatment campaign at Lakewood commenced with 34,700dt processed grading 3.67g/t Au and 96% recovery for 3,927ozs produced by Quarter end

- $8.3 million received from gold sales at an average gold price of $1,664/oz

- Cash and tradeable securities increase to $8.7 million

- Intercepts returned from the Anthill gold project included (see Note 4 below):

o 41m at 2.63g/t Au from 69m and 30m at 2.98g/t Au from 73m

o 11m at 3.72g/t Au from 46m and 29m at 1.84g/t Au from 49m

o 17m at 5.3g/t Au from 137m and 6m at 11.15g/t Au from 110m

- Intercepts returned from the Jacques Find prospect within the Teal gold project included (see Note 5 below):

o 26m at 7.8g/t Au from 48m and 16m at 5.3g/t Au from 86m

o 27m at 4.16g/t Au from 53m

o 8m at 11g/t Au from 53m and 9m at 7.1g/t Au from 89m

- Over 26,000m drilled across 8 key project areas in 2017 with up to 60,000m planned in 2018 commencing in February

- Drilling at the Binduli gold project by JV partner Evolution Mining Limited ( ASX:EVN) comprised 38 holes for 4,006m with results expected in the March Quarter 2018 (see Note 6 below)

ASX:EVN) comprised 38 holes for 4,006m with results expected in the March Quarter 2018 (see Note 6 below)

- Drilling at the Nanadie Well Cu-Au-Ni-PGE project by JV partner Mithril Resources Limited ( ASX:MTH) returned an encouraging intercept of 4m @ 12.76g/t Au from 20m (see Note 7 below)

ASX:MTH) returned an encouraging intercept of 4m @ 12.76g/t Au from 20m (see Note 7 below)

- Metallurgical testwork from the Richmond Vanadium Project underway in China under supervision of JV partner AXF Resources Pty Ltd with initial results expected in the June Quarter 2018

- Janet Ivy Mining Royalty payments of $0.50/t now due after treated tonnages exceeded the prepayment threshold with regular quarterly payments expected through CY2018

MARCH QUARTER ACTIVITES

- Ore mining, haulage, processing and cash flow from Teal

- Blister Dam and Binduli JV exploration drilling results

- Commencement of 50,000-60,000m discovery and resource growth program

- Anthill JORC 2012 Mineral Resource Estimate and mining pipeline Feasibility program

- Richmond Vanadium metallurgical test work and updated Mineral Resource estimate

Notes:

1 C1 cash costs exclude pre-strip of Teal Stage 2

2 AIC cash costs include pre-strip, production, exploration and all overheads.

3 As announced to the ASX on 27 July 2016

4 As announced to the ASX on 24 October 2017

5 As announced to the ASX on 15 & 29 November 2017

6 As announced to the ASX on 21 November 2017

7 As announced to the ASX on 13 October, 6 & 14 November and 8 December 2017.

To view the full report, please visit:

http://abnnewswire.net/lnk/4137ZHO1

About Horizon Minerals Limited

Horizon Minerals Limited (ASX:HRZ) is a gold exploration and mining company focussed on the Kalgoorlie and Menzies areas of Western Australia which are host to some of Australia's richest gold deposits. The Company is developing a mining pipeline of projects to generate cash and self-fund aggressive exploration, mine developments and further acquisitions. The Teal gold mine has been recently completed.

Horizon Minerals Limited (ASX:HRZ) is a gold exploration and mining company focussed on the Kalgoorlie and Menzies areas of Western Australia which are host to some of Australia's richest gold deposits. The Company is developing a mining pipeline of projects to generate cash and self-fund aggressive exploration, mine developments and further acquisitions. The Teal gold mine has been recently completed.

Horizon is aiming to significantly grow its JORC-Compliant Mineral Resources, complete definitive feasibility studies on core high grade open cut and underground projects and build a sustainable development pipeline.

Horizon has a number of joint ventures in place across multiple commodities and regions of Australia providing exposure to Vanadium, Copper, PGE's, Gold and Nickel/Cobalt. Our quality joint venture partners are earning in to our project areas by spending over $20 million over 5 years enabling focus on the gold business while maintaining upside leverage.

| ||

|