Thackaringa Drilling Uncovers Higher Cobalt Grades

Thackaringa Drilling Uncovers Higher Cobalt Grades

Sydney, May 4, 2017 AEST (ABN Newswire) - Broken Hill Prospecting Ltd ( ASX:BPL) is pleased to announce Thackaringa drilling uncovers higher cobalt grades ahead of resource upgrade.

ASX:BPL) is pleased to announce Thackaringa drilling uncovers higher cobalt grades ahead of resource upgrade.

Highlights

- Major drilling program uncovers higher cobalt grades in greater widths beneath existing resources, lifting expectations for the Resource Upgrade due in May 2017

- Best grades include:

o 17THR008 (Railway) - 41m at 1319ppm Co, 12.2% S & 11.2% Fe from 37m

o 17THR011 (Railway) - 53m at 1116ppm Co, 12% S & 10.9% Fe from 30m

o 17THR017 (Pyrite Hill) - 58m at 1383ppm Co, 13.2% S & 12.8% Fe from 54m

-- including 29m at 2042ppm Co, 18.3% S & 15.8% Fe from 56m

o 17THR013 (Big Hill) - 54m at 888ppm Co, 5.4% S & 5% Fe from 19m

-- including 10m at 2576ppm Co, 8.8% S & 7.7% Fe from 19m

- Continuity of mineralisation has been confirmed over 52 holes for 6,472 meters (RC: 4,675m, Diamond: 1,797m)

- Extensive metallurgical and engineering programs underway to support a Scoping Study due 30 June 2017

- Farm-In and Royalty Agreement means Cobalt Blue Holdings Ltd ( ASX:COB) (COB) can earn 100% if it completes a four-stage farm-in by committing $9.5 million project expenditure by 30 June 2020, and pays BPL $7.5 million in cash

ASX:COB) (COB) can earn 100% if it completes a four-stage farm-in by committing $9.5 million project expenditure by 30 June 2020, and pays BPL $7.5 million in cash

- BPL will receive a 2% net smelter royalty on all cobalt produced from the Thackaringa tenements for the life of mine

- BPL retains the base and precious metal exploration rights over the Thackaringa tenements, where it is actively exploring for Broken Hill style (Pb-Zn-Ag) mineralisation

BPL's Chief Executive Office, Trangie Johnston, commented:

"Completion of over 6,400m of drilling at the Thackaringa Cobalt Project is a major milestone for the Company. The latest assay results continue to impress, with confirmation of grade and continuity of mineralisation in the outcropping ridge-line deposits. Technical studies are well advanced to support the Scoping Study due by the end of June 2017."

Drilling Programs and Technical Studies

A major drilling program consisting of 1,797m Diamond and 4,675m Reverse Circulation (RC) was completed during March. The campaign reflects a significant step in Cobalt Blue's fulfilment of requirements under the Farm In agreement.

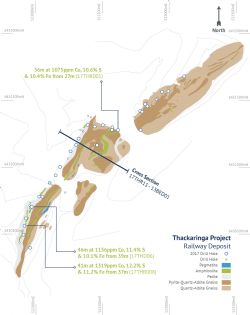

The drilling program was designed to provide representative samples for metallurgical test work and to support a Mineral Resource upgrade across all three deposits: Railway, Pyrite Hill and Big Hill.

The extensive stratabound cobalt-pyrite mineralisation at each deposit is hosted by quartz-albite gneiss, and drilling results announced today and on 28 March 2017 confirm continuity and grade of the cobalt-pyrite mineralisation. Additional assay results are expected to be announced in late May 2017.

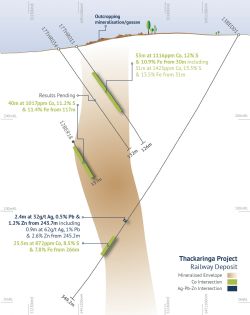

At Railway, assays confirm broad intersections of high-grade mineralisation - with potential to add to the existing resource.

Mineralised intercepts include:

- 17THD06 - 46m at 1136ppm Co, 11.4% S & 10.1% Fe from 39m

- 17THR001 - 36m at 1075ppm Co, 10.6% S & 10.4% Fe from 27m

- 17THR005 - 20m at 1053ppm Co, 12.8% S & 12.6% Fe from 52m

- 17THR008 - 41m at 1319ppm Co, 12.2% S & 11.2% Fe from 37m

- 17THR011 - 53m at 1116ppm Co, 12% S & 10.9% Fe from 30m

o including 31m at 1423ppm Co, 15.5% S & 13.5% Fe from 31m

At Pyrite Hill, mineralised intercepts include:

-17THD01 - 89m at 982ppm Co, 9.4% S & 8.7% Fe from 34m

o including 41m at 1366ppm Co, 11.8% S & 11% Fe from 81m

- 17THR016 - 49m at 1096ppm Co, 12.9% S & 13.4% Fe from 66m

- 17THR017 - 58m at 1383ppm Co, 13.2% S & 12.8% Fe from 54m

o including 29m at 2042ppm Co, 18.3% S & 15.8% Fe from 56m

- 17THR021 - 20m at 1204ppm Co, 13.1% S & 12.7% Fe from 44m

At Big Hill, mineralised intercepts include:

- 17THR013 - 54m at 888ppm Co, 5.4% S & 5% Fe from 19m

o including 10m at 2576ppm Co, 8.8% S & 7.7% Fe from 19m

- 17THD04 - 9m at 1033ppm Co, 8.6% S & 8% Fe from 20m

Mineralisation at the three deposits has a combined strike length of 4.5 kilometres, with widths varying from 25 metres to 100 metres. The increased thickness is typically due to the extensive development of isoclinal folding within the pyritic horizon. All holes were drilled at inclinations between 40 and 60 degrees into the steeply-dipping host lithology.

A total Inferred Mineral Resource of 33.1Mt at 833ppm cobalt (500ppm Co cut-off) has previously been estimated at the Thackaringa Cobalt Project (COB Replacement Prospectus released 31 January 2017).

Extensive metallurgical test work and engineering studies have commenced to support the Scoping Study due on the 30 June 2017.

Cobalt Blue Farm in Joint Venture

The successful spin-off of Cobalt Blue was completed in February 2017, with investors seeking shares exceeding the $10 million maximum being offered. The deal is an important initiative for BPL to realise significant value from its Thackaringa Cobalt Project.

The IPO gave BPL shareholders an entitlement to retain a combined direct shareholding in COB of approximately 37%. In addition, COB issued bonus options on the basis of one option for every four COB shares received.

Another important part of the spin-off was that BPL entered a detailed farm-in joint venture agreement for COB to finance and undertake an extensive exploration and development program at Thackaringa. COB can earn 100% of the project if it completes a set of milestones before 30 June 2020.

There are four stages to the farm-in:

Stage 1 or COB to receive a 51% beneficial interest in the project requires at least $2 million to be spent by COB on an approved, in-ground exploration program to define an Inferred Mineral Resource of 100 Mt and completion of the Scoping Study by 30 June 2017.

Stage 2 requires COB to fund a minimum $2.5 million in-ground exploration program to define an Indicated Mineral Resource and complete a Pre-feasibility Study of the technical, commercial and economic feasibility of development and mining of cobalt by 30 June 2018. That work would earn COB an additional 19% interest.

Stage 3 stipulates COB can earn a further 15% interest by 30 June 2019 if it spends a minimum $5 million on an in-ground exploration program to define a Measured Mineral Resource and Ore Reserve and complete a Bankable Feasibility Study.

Stage 4 enables COB to earn the final 15% interest in Thackaringa if it makes a decision to mine; procures necessary project approvals including financing; achieves financial close; and pays BPL $7.5 million in cash no later than 30 June 2020.

BPL has also been granted a 2% net smelter royalty on all cobalt produced from the Thackaringa tenements for the life of the mine.

Base & Precious Metal Rights

BPL retains the base and precious metal exploration rights over the Thackaringa tenements and is currently reviewing targets in context of the revised geological model. The Company considers the geological setting to be prospective for mineralisation styles additional to cobaltiferous-pyrite including:

- Stratiform Broken Hill Type (BHT) Copper-Lead-Zinc-Silver

- Copper-rich BHT

- Epigenetic Gold and Base metals

Anomalous mineralisation has been intersected by earlier drilling completed by BPL with results including:

- 13BED01 - 2.4m at 32g/t Ag, 0.5% Pb & 1.2% Zn from 243.7m

o including 0.9m at 62g/t Ag, 1% Pb & 2.6% Zn from 245.2m

To view tables and figures, please visit:

http://abnnewswire.net/lnk/8N3JOD97

About Broken Hill Prospecting Ltd

Broken Hill Prospecting Ltd (ASX:BPL) is an Australian exploration company focussed on the discovery and development of strategic mineral resources across two primary geographical areas; the Murray Basin Region (Heavy Mineral Sands) and the Broken Hill Region (industrial, base and precious metals, including the Thackaringa Cobalt & Base/Precious Metal Project).

Broken Hill Prospecting Ltd (ASX:BPL) is an Australian exploration company focussed on the discovery and development of strategic mineral resources across two primary geographical areas; the Murray Basin Region (Heavy Mineral Sands) and the Broken Hill Region (industrial, base and precious metals, including the Thackaringa Cobalt & Base/Precious Metal Project).

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

ASX:BPL) is pleased to announce Thackaringa drilling uncovers higher cobalt grades ahead of resource upgrade.

ASX:BPL) is pleased to announce Thackaringa drilling uncovers higher cobalt grades ahead of resource upgrade.  ASX:COB) (COB) can earn 100% if it completes a four-stage farm-in by committing $9.5 million project expenditure by 30 June 2020, and pays BPL $7.5 million in cash

ASX:COB) (COB) can earn 100% if it completes a four-stage farm-in by committing $9.5 million project expenditure by 30 June 2020, and pays BPL $7.5 million in cash  Broken Hill Prospecting Ltd (ASX:BPL) is an Australian exploration company focussed on the discovery and development of strategic mineral resources across two primary geographical areas; the Murray Basin Region (Heavy Mineral Sands) and the Broken Hill Region (industrial, base and precious metals, including the Thackaringa Cobalt & Base/Precious Metal Project).

Broken Hill Prospecting Ltd (ASX:BPL) is an Australian exploration company focussed on the discovery and development of strategic mineral resources across two primary geographical areas; the Murray Basin Region (Heavy Mineral Sands) and the Broken Hill Region (industrial, base and precious metals, including the Thackaringa Cobalt & Base/Precious Metal Project).