Review of Q1 2017 Activities

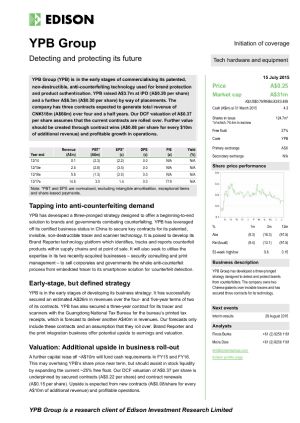

Sydney, May 1, 2017 AEST (ABN Newswire) - Brand Protection and Customer Engagement solutions company YPB Group Ltd ( ASX:YPB) is pleased to provide a summary of activities for the quarter ended 31 March 2017.

ASX:YPB) is pleased to provide a summary of activities for the quarter ended 31 March 2017.

- Cash generation and costs largely in line with preceding quarter

- Breakeven by end June and $5m pre-tax profit for 2017 still expected

- Financial transformation is imminent as contract closures progress

The quarter showed similar financial operating results to the preceding quarter. Cash receipts were down slightly as were costs.

Net cash used in operating activities fell slightly primarily due to lower cost-of-goods-sold.

The cost out programme is on track with annual overhead expected to fall from $11.1m as at end 2016 to $6.5m (annualised) by end June. The cash benefit of the cost out will not be apparent until Q3 2017 as the cash impact of restructuring is felt in both Q1 and in Q2. In terms of this cost out programme it is noteworthy that 41% of the cost reduction is headcount related. In addition, the cash costs of the Board will fall by 46% and total Board costs will fall by 57%. The Executive Chairman has voluntarily reduced his salary by 33%.

Contract closures in the quarter lagged original expectations, with delays being mainly procedural or clients adjusting their preferred solutions as contract negotiations progressed.

Achieving breakeven by end June and $5m pre-tax profit for 2017 (pre-restructuring charges) remains our current expectation and the highest probability case. It is, however, dependant on contract closures meeting the present timetable with a number of significant closures due prior to end June.

Even though it is not our present expectation, further slippage in contract closures is possible. Should timing slip again then breakeven will extend beyond June but the profit target will remain achievable due to the size of a number of key contracts. All effort is presently devoted to converting pipeline into revenue. The focus is not on growing the pipeline, which remains at $110m of potential annual revenues.

The most salient point that should be emphasised is not expectations for 2017. It is that if a number of major contracts can be closed, as is the present expectation, then the company will rapidly become profitable. There is intense effort to ensure this occurs and present indications are that we are on the cusp of a profound financial transformation. Contract delivery is the key.

Key achievements for the quarter included:

- The award of Board of Investment Status by the Government of Thailand which provides the company substantial tax and other cost advantages.

- Supply of forensic technical equipment to the Bank of Thailand (Thailand's Central Bank).

- Singing Le Mac as a channel partner for the PROTECT range of products. Le Mac is the market leader in Australia in shrink sleeve technology for product protection producing hundreds of millions of shrink sleeves per annum.

- Publication by the US Patent Office of a patent granted in China for "On the Go" wireless connectivity for YPB's scanners.

- Signing Guanzhou Panyu MCP Industries as a channel partner for the full YPB solution suite. Guanzhou Panyu is a division of CPMC Holdings the largest manufacturer of metal packaging products in China and one of the core business divisions of Chinese State Owned Enterprise and Fortune 500 Company COFCO.

FINANCIAL SUMMARY

Q1 2017 cash flows were below expectations due to the slower contract closure noted above. Cash receipts for Q1 were $0.770m, largely in line with the average of 2016 but down from $0.930m in Q4. Cash receipts in Q2 are likely to fall a little more but then clearly improve in Q3.

Business operating cash outflows were approximately $0.088m lower than Q4. Net operating cash outflow was $0.353m higher due to lower revenue and a $0.183m R&D tax rebate not recurring in the current quarter.

R&D spend remained elevated as expected as the upgraded CONNECT platform was completed. R&D spend will reduce in the current quarter and fall further in Q3.

Staff costs rose in Q1 due to termination payments. This will again be a factor in Q2 but cash spend on staff costs should fall sharply in Q3. COGS fell due to lower shipments of Retail Anti-Theft products during the quarter.

Cash at end Q1 was $0.680m down from $2.752m at end Q4.

Please note that the Appendix 4C (see the link below) includes "estimated cash outflows for next quarter" at item 9. Please be aware that this is a gross cash outflows forecast and should not be compared to the net cash flow figure in item 1 of the Appendix 4C (see the link below). Q2 2017 gross cash outflows are likely to be down approximately 10% on Q1 2017 and gross cash outflows are likely to fall a further 20% in Q3 2017.

YPB Executive Chairman John Houston said: "While Q1 2017 frustratingly showed minimal financial improvement with delayed contract closures, the company is in the strongest operating position it has ever been in. Financial success is imminent if important contract can be successfully concluded as we presently expect".

To view tables and figures, please visit:

http://abnnewswire.net/lnk/71WM807V

About YPB Group Ltd

DEACTIVATED

| ||

|