Potential for a New Gold Camp Emerging

Recent Diamond Drilling Returns New Gold Intercepts

Perth, April 26, 2017 AEST (ABN Newswire) - Helix Resources Limited ( ASX:HLX) is pleased to provide an update with regard to its recent diamond drilling program at the Cobar Gold Project in NSW.

ASX:HLX) is pleased to provide an update with regard to its recent diamond drilling program at the Cobar Gold Project in NSW.

Highlights

- Recent drilling at Helix's Cobar Gold Project in NSW has returned significant gold intercepts from shallow depths at two additional prospects:

Battery Tank Prospect:

Diamond hole HRDD005 drilled down dip of the discovery hole has returned

- 10m @ 3.3 g/t Au (incl. 3.3m @ 5.2g/t Au) and

- 5m @ 2.4g/t Au

within an overall intercept of 54.5m @ 1g/t Au.

Discovery hole 1m re-sampling has returned 14m @ 2.8g/t Au and 4m @ 13.3g/t Au within 43m @ 2.3g/t Au from surface to EOH.

Sunrise Prospect:

Diamond hole HRDD006 has intersected multiple gold bearing structures including:

- 8m @ 3.3g/t Au (incl. 3m @ 6.1g/t Au)

- 2m @ 3.5 g/t Au

- 7m @ 1.3g/t Au and

- 7m @ 1.2g/t Au

within an overall 88m @ 0.7g/t Au intercept of gold mineralisation from surface.

- Identification of gold bearing quartz vein arrays and breccia zones perpendicular to the regional northwest trends is an important geological breakthrough for the project. This indicates that the size and grade of the known gold mineralisation has the potential to increase significantly with further drill testing.

- Similarities have been identified between the gold mineralising controls in the nearby Peak gold trend (approx. 4 million ounce gold endowment) and the Cobar Gold Project.

- A follow-up RC drilling program is being formulated and planned. It is likely to include:

1. Infill drilling at Sunrise and Good Friday targeting the high-grade gold in northeast trending structures.

2. Step-out drilling at Battery Tank, Good Friday and Boundary Prospects to test extent of strike and dip of gold bearing structures.

3. First-pass drill testing of several regional targets.

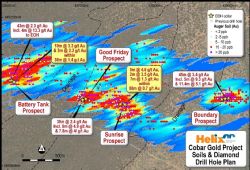

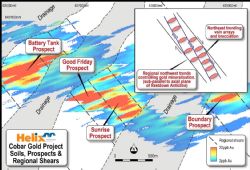

Cobar Gold Project

The Cobar Gold Project is located approximately 40km southeast of the mining hub of Cobar in Central NSW. Helix's 750km2 of tenements cover an entire goldfield hosted in a regionally significant anticline, where northwest regional trends appear to control gold-bearing structures in highly altered sediments. Gold mineralisation was targeted by a series of historic shafts and pits when the area was mined in the late 1800's. The goldfield was only abandoned due to a lack of water to process the gold ore at the time. The goldfield has small historic gold workings scattered over a 13km x 5km area, demonstrating the potentially extensive gold mineralised system present in the area. The area has had only limited drilling to a maximum depth of 120m from surface at four prospects (Battery Tank, Good Friday, Sunrise and Boundary).

Recent diamond drilling has intersected further gold bearing structures, in addition to previously identified gold structures, with associated quartz vein arrays and breccias, within wide zones of gold mineralisation commencing from surface or very near surface.

The encouraging gold drill results have been returned from a direction perpendicular to the northwest regional trends now at all four prospects (Battery Tank, Good Friday, Sunrise and Boundary) that have been subject to initial drill testing to date.

This new geological and structural interpretation provides scope for potential linkage between these prospects, both along strike and under shallow cover in drainage channels.

It also assists in planning drilling targeting dip/plunge extents, particularly where northwest and northeast structures intersect.

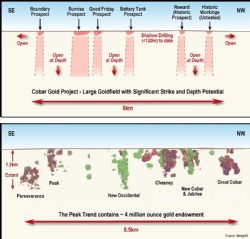

A regional structural review has highlighted similarities between the mineralising controls in the nearby (30km northwest) Peak gold trend, which has around a 4 million ounce gold endowment over an 8 kilometre strike length, and the gold mineralising structural controls present within the Cobar Gold Project.

A schematic long section (refer Figure 3 in the link below) demonstrates the exploration potential of this relatively underexplored goldfield; with existing prospects currently only limited by the lack of exploration drilling. A comparison long section of the Peak Trend is also shown (refer Figure 3 in the link below).

Recent Diamond Drilling Program

The recent drill program was designed to assess alternate controls for gold mineralisation at the known prospects and confirm the presence of perpendicular (northeast trending) gold bearing structures in the broader regional northwest trends seen in the goldfield.

The 710m diamond drill program (refer Tables 1 and 2 in the link below) comprised:

- four new diamond holes (two at the Battery Tank and two at the Sunrise Prospects); and

- four diamond tail extensions of previous holes (two at the Good Friday and two at the Boundary Prospects).

In addition, selected portions of sample intercepts from the December 2016 aircore drilling at Battery Tank, including discover hole HRCA0018, were re-sampled on a 1 metre basis (refer Table 3 in the link below). The initial sampling was undertaken on the basis of 4 metre composites and was reported in January.

Following detailed geological and structural logging of the holes, the significant assays received from the program are described below.

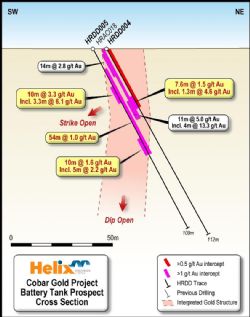

Battery Tank Prospect

HRDD004: 1.3m @ 4.3g/t Au within 7.6m @ 1.5g/t Au from 29m, within a broader zone of 45m @ 0.4g/t Au from 0m. The hole was collared nearby and drilled at an oblique angle to the discovery hole. The hole has intersected the discovery zone up-dip.

HRDD005: 10m @ 3.3g/t Au from 23m incl. 3.3m @ 5.2g/t Au from 28m and 5m @ 2.4g/t Au from 54m within 54m @ 1g/t Au from 9.2m. The hole was drilled down-dip of HRAC018 and shows good vertical continuity of gold bearing structures within the holes, grade tenor in this hole may also be affected by core recovery and winnowing.

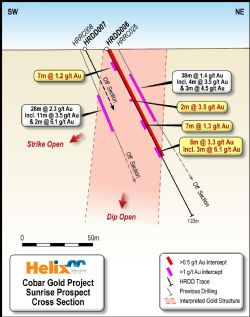

Sunrise Prospect

HRDD006: 7m @ 1.2g/t Au from 8m, 2m @ 3.5g/t Au from 39m and 7m @ 1.3g/t Au from 54m and 8m @ 3.3g/t Au incl. 3m @ 6.1g/t Au from 80m within 88m @ 0.7g/t Au from Surface.

HRDD007: It is interpreted that this hole drilled over the top of the targeted structure with anomalous gold at the top of the hole (6m @ 0.2g/t from surface). This interpretation is based upon the lithologies and limited structure intersected within the hole, and the zone behind and down dip of HRDD007 previously returning strong gold mineralisation including 11m @ 3.5g/t Au within 28m @ 2.3g/t Au, in HRRC008.

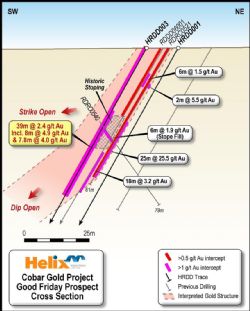

Good Friday Prospect

The extended diamond tail assay results from HRDD003 have expanded the gold interval to 39m @ 2.4g/t Au from 29m (from 28.8m @ 3.0g/t Au reported November 2016), within a broader interval of 66m @ 1.5g/t Au from 2m.

This interval includes two zones of high-grade gold located higher in the hole that were previously reported. The high-grade gold zones included 8m @ 4.9g/t Au from 30m and 7.8m @ 4.0g/t Au from 50m.

The extensional drilling of HRDD003 has increased the high-grade zone at the Good Friday Prospect by approximately 10m, whilst HRDD001 extension is interpreted to be drilled underneath the mineralised shoot (refer figure 5 in the link below). The new structural interpretation provides scope for this zone to extend along a north-easterly strike with a possible plunge component to the higher grade gold.

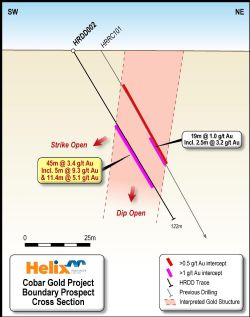

Boundary Prospect

Results are best in the previously released RC holes (HRRC101 - 19m @ 1g/t Au incl. 2m @ 3.2g/t Au and HRRC103 - 20m @ 1.2g/t Au). A strongly brecciated zone in the diamond tail returned anomalous gold (>0.1g/t Au) over 7m from 106m.

Based on the structures intersected in HRDD002 (43m @ 3.4g/t Au) and the geology identified in the cored tails of these holes, the better target zones are likely to be behind and down dip of these holes. This target zone is planned to be tested down dip and along strike in a follow-up RC drilling program.

Battery Tank Aircore 1m Re-Sampling

Selected 1m re-sampling from the December 2016 aircore drilling at Battery Tank confirmed the initial 4m composites reported in January (refer Table 3 in the link below).

The Battery Tank discovery aircore hole HRCA0018, was re-sampled at 1m intervals. The re-splits from HRAC018 returned 14m @ 2.8g/t Au from surface and 4m @ 13.3g/t Au to EOH within 43m @ 2.3g/t Au to EOH. This results shows good consistency with the original result of 43m @ 2.3g/t Au including 11m @ 5.1g/t to EOH.

The maximum 1m sample returned was an outstanding 19.5g/t Au at 39-40m downhole.

Planned Work

A follow-up RC drilling program is being formulated and planned. It is likely to include:

1. Infill drilling at Sunrise and Good Friday targeting the high-grade in northeast trending gold structures.

2. Step-out drilling at Battery Tank, Good Friday and Boundary to test extent of strike and dip of gold bearing structures.

3. First-pass drill testing of several recently identified regional targets.

New Structural Framework

At the Prospect scale, the recent structural review at the Cobar Gold Project carried out with the assistance of an experienced structural geological consultant has also observed the northeast trending structures perpendicular to the main northwest trends, the direction that appears to control high grade gold within the prospects (Battery Tank, Good Friday, Sunrise and Boundary) tested to date (refer Figure 8 in the link below).

This geological interpretation provides scope for potential linkage between these prospects, both along strike and under shallow drainage. It will assist in targeting dip/plunge extent also, particularly where northwest and northeast structures intersect.

Multiple targets at these Prospects have now been identified by Helix and with further drill testing, this reinterpretation of the gold controls has the potential to increase the gold grades and volume of mineralisation across the known prospects significantly and increase potential deposit scale.

Regional Targets

Findings from the regional structural review indicates that potential exists for a large gold system to be present at the Cobar Gold Project.

The review also reinforces the idea of a common genetic relationship between gold mineralisation in the Peak Gold Trend, which has around a 4 million ounce gold endowment over an 8 kilometres strike length, and the Restdown-Canbelego-Mt Boppy region, which hosts the Cobar Gold Project (refer Figure 3 in the link below).

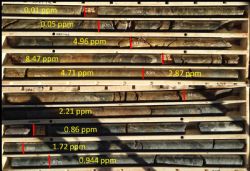

Gold Mineralisation

Below shows a typical example of the Cobar Gold Project gold mineralisation, from 78.6m in HRDD006. This high grade intersection is one of the deeper gold intercepts in the goldfield to date in relatively competent rock. The gold mineralisation in this intercept is associated with quartz and iron-rich veinlets/veins and breccias, in a highly deformed structural zone hosted in strongly sericite altered sediments (refer Photo 1 in the link below).

To view tables and figures, please visit:

http://abnnewswire.net/lnk/2WAS3594

About Helix Resources Ltd

Helix Resources Limited (ASX:HLX) is a successful minerals exploration company focused on the identification, acquisition and development of projects in prospective jurisdictions with established infrastructure.

Helix Resources Limited (ASX:HLX) is a successful minerals exploration company focused on the identification, acquisition and development of projects in prospective jurisdictions with established infrastructure.

The Company's main focus is the exciting Collerina Copper-Zinc & Cobar Gold Projects both located in Central NSW. The Company's key objective for 2017 is to advance these discoveries.

Helix's Board and Management team are focused on creating opportunities to increase shareholder value from the quality assets in the Company's project portfolio.

| ||

|