Quarterly Activities and Cashflow Reports Dec 2016

Quarterly Activities and Cashflow Reports Dec 2016

Sydney, Feb 1, 2017 AEST (ABN Newswire) - Broken Hill Prospecting Ltd ( ASX:BPL) are pleased to provide the Company's latest Quarterly Activities and Cashflow Reports for the period ended 31 December 2016.

ASX:BPL) are pleased to provide the Company's latest Quarterly Activities and Cashflow Reports for the period ended 31 December 2016.

Highlights:

Corporate

- Successful ASX spin-off of Cobalt Blue raised $10m to fund the Thackaringa Cobalt Project through to production

- BPL shareholders received in-specie IPO distribution, including loyalty options and priority offer entitlement

- BPL shareholders hold approximately 37% of Cobalt Blue's capital

- Farm-In and Royalty agreement signed

Projects

Thackaringa Cobalt | Broken Hill, NSW

- 8 diamond holes for 1,483m completed

- Holes designed to twin previous RC holes to support metallurgical test program

- Visual results in line with expectations; assays due in March

- Approvals received for major RC resource infill and expansion program planned for Q1 2017

- Cobalt price increase 67% yoy to hit new 5 year high

Heavy Mineral Sands | Murray Basin, NSW

- Copi North Pre-feasibility study bulk metallurgical testing nearing completion with positive results

- Engineering studies to commence on design of mobile mining units

- Advance plans to commence drilling priority targets on BPL's 100% tenements

SUCCESSFUL SPIN-OFF AND $10M IPO FOR COBALT BLUE

The successful spin-off of Cobalt Blue Holdings Limited ( ASX:COB) was completed after the end of the quarter, with investors submitting offers for COB securities exceeding the $10 million maximum being offered. The deal was an important initiative for BPL to realise significant value from its Thackaringa Cobalt Project. Security allocations are complete, and listing of COB's shares and options on the Australian Securities Exchange is scheduled for 11am AEDT Thursday 2 February 2017.

ASX:COB) was completed after the end of the quarter, with investors submitting offers for COB securities exceeding the $10 million maximum being offered. The deal was an important initiative for BPL to realise significant value from its Thackaringa Cobalt Project. Security allocations are complete, and listing of COB's shares and options on the Australian Securities Exchange is scheduled for 11am AEDT Thursday 2 February 2017.

The IPO provided BPL shareholders with an entitlement to retain a combined direct shareholding in COB of approximately 37%. That gave them the opportunity to retain a direct interest in the development of the potentially world-class cobalt resource that BPL discovered at Thackaringa. BPL distributed its shareholding of 35 million COB shares inspecie to eligible BPL shareholders. In addition, COB issued loyalty options on the basis of one option for every four COB shares received.

Another important part of the spin-off was that BPL entered a detailed farm-in joint venture agreement with COB to finance and undertake an extensive exploration and development program at Thackaringa. COB can earn 100% of the project if it completes a set of milestones before 30 June 2020. There are four stages to the farm-in.

- Stage 1 requires at least $2 million to be spent on an approved, in-ground exploration program to define an Inferred Mineral Resource of 100 Mt and completion of a Scoping Study by 30 June 2017. In addition, COB will make an $800,000 payment to hold a 51% beneficial interest in the project.

- Stage 2 requires COB to fund a minimum $2.5 million in-ground exploration program to define an Indicated Mineral Resource and complete a Pre-feasibility Study of the technical, commercial and economic feasibility of development and mining of cobalt by 30 June 2018. That work would earn COB an additional 19% interest.

- Stage 3 stipulates COB can earn a further 15% interest in by 30 June 2019 if it spends a minimum $5 million on an in-ground exploration program to define a Measured Mineral Resource and Ore Reserve and complete a Bankable Feasibility Study.

- Stage 4 enables COB to earn the final 15% interest in Thackaringa if it makes a decision to mine; procures necessary project approvals including financing; achieves financial close; and pays BPL $7.5 million in cash no later than 30 June 2020.

BPL has also been granted a 2% net smelter royalty on all cobalt produced from the Thackaringa tenements for the life of the mine. It retains the base and precious metal exploration rights over the tenements, where it has previously actively explored for Broken Hill style mineralisation.

THACKARINGA COBALT - PYRITE PROJECT, BROKEN HILL, NSW

Metallurgical & Resource Drilling

During the reporting period, a significant metallurgical diamond drilling program commenced at the Thackaringa Cobalt project with eight (8) drill holes for a total of 1,483 metres completed to date. Drilling targeted the three main zones of mineralisation at Pyrite Hill, Railway and Big Hill with results to support future scoping studies.

Mineralised intersections were noted to visually coincide with adjacent historical RC holes with assay results due in early March. Metallurgical studies will commence immediately following receipt of assays.

Diamond drilling re-commenced in late January with an additional 1,500 metres to be completed during the first quarter of 2017.

Approvals for a major reverse circulation (RC) drilling program were received late January 2017. The program will target resource growth through infill and extensional drilling of the upper (shallow) portions of the mineralised bodies and support future resource upgrades.

Drilling will focus on high grade zones within the broader mineralised trend with significant opportunity to increase the shallow resource base in a largely unexplored terrain. Detailed geological mapping has delineated more than 10km of mineralised outcrop, of which approximately 75% remains untested. This drilling is planned to commence in early March 2017.

HEAVY MINERAL SANDS PROJECTS, MURRAY BASIN, NSW

BPL is targeting the establishment of a sustainable pipeline of high grade, low tonnage deposits amendable to processing through mobile plant equipment that could be deployed across the broader Murray Basin project area.

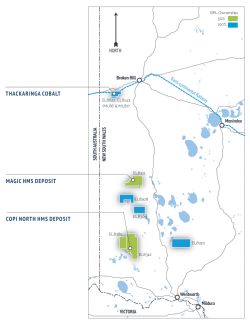

BPL has accumulated a substantial portfolio of Heavy Mineral Sands Projects (6 tenements) in the Murray Basin, NSW (Figure 1, see link below). Recent drilling and technical studies at three of these tenements was funded by a joint venture (JV) with Relentless Resources Limited (RRL). RRL has contributed a total of $2M to earn a 50% interest in three Heavy Mineral Sands tenements (EL 8311, EL 8312 and EL 8385).

Current JV activities are focused on advancing the Copi North Pre-feasibility Study (PFS). Bulk metallurgical test work is nearing completion with a final report expected shortly. Early results are very encouraging with clean separation of heavy minerals with slimes and oversize less than 2%. Engineering and plant design studies will commence in February 2017.

BPL is continuing to assess the exploration potential on its currently 100% held tenements outside of the Joint Venture, being EL8308 (Nanya North), EL8309 (Springwood) and EL8310 (Milkengay) (Figure 2, see link below). Each tenement offers excellent opportunity for the delineation of high-grade, near surface heavy mineral sand deposits based on historical exploration data and regional analysis. BPL is seeking regulatory approvals to commence drilling in March 2017.

To view the full Quarterly Report, please visit:

http://abnnewswire.net/lnk/R8CE668A

About Broken Hill Prospecting Ltd

Broken Hill Prospecting Ltd (ASX:BPL) is an Australian exploration company focussed on the discovery and development of strategic mineral resources across two primary geographical areas; the Murray Basin Region (Heavy Mineral Sands) and the Broken Hill Region (industrial, base and precious metals, including the Thackaringa Cobalt & Base/Precious Metal Project).

Broken Hill Prospecting Ltd (ASX:BPL) is an Australian exploration company focussed on the discovery and development of strategic mineral resources across two primary geographical areas; the Murray Basin Region (Heavy Mineral Sands) and the Broken Hill Region (industrial, base and precious metals, including the Thackaringa Cobalt & Base/Precious Metal Project).

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

ASX:BPL) are pleased to provide the Company's latest Quarterly Activities and Cashflow Reports for the period ended 31 December 2016.

ASX:BPL) are pleased to provide the Company's latest Quarterly Activities and Cashflow Reports for the period ended 31 December 2016.  ASX:COB) was completed after the end of the quarter, with investors submitting offers for COB securities exceeding the $10 million maximum being offered. The deal was an important initiative for BPL to realise significant value from its Thackaringa Cobalt Project. Security allocations are complete, and listing of COB's shares and options on the Australian Securities Exchange is scheduled for 11am AEDT Thursday 2 February 2017.

ASX:COB) was completed after the end of the quarter, with investors submitting offers for COB securities exceeding the $10 million maximum being offered. The deal was an important initiative for BPL to realise significant value from its Thackaringa Cobalt Project. Security allocations are complete, and listing of COB's shares and options on the Australian Securities Exchange is scheduled for 11am AEDT Thursday 2 February 2017.  Broken Hill Prospecting Ltd (ASX:BPL) is an Australian exploration company focussed on the discovery and development of strategic mineral resources across two primary geographical areas; the Murray Basin Region (Heavy Mineral Sands) and the Broken Hill Region (industrial, base and precious metals, including the Thackaringa Cobalt & Base/Precious Metal Project).

Broken Hill Prospecting Ltd (ASX:BPL) is an Australian exploration company focussed on the discovery and development of strategic mineral resources across two primary geographical areas; the Murray Basin Region (Heavy Mineral Sands) and the Broken Hill Region (industrial, base and precious metals, including the Thackaringa Cobalt & Base/Precious Metal Project).