Quarterly Activities and Cashflow Report

Sydney, Nov 1, 2016 AEST (ABN Newswire) - Atrum Coal NL ("Atrum" or the "Company") ( ASX:ATU) (

ASX:ATU) ( ATRCF:OTCMKTS) is pleased to provide its Quarterly Activities Report for the period ending 30 September 2016.

ATRCF:OTCMKTS) is pleased to provide its Quarterly Activities Report for the period ending 30 September 2016.

HIGHLIGHTS

- Atrum secures an additional 42 coal licences from the British Columbia Government, following conversion of all license applications, for its Groundhog Anthracite Project, more than doubling the area of exclusive coal exploration and development rights.

- Atrum signs Joint Exploration Agreement with Japan Oil, Gas & Metals National Corporation (JOGMEC) to conduct exploration work at Atrum's Panorama North coal tenure in the western area of the Groundhog North Project in British Columbia.

- Successful drilling program at Panorama North concludes in the Second Quarter with coal samples from four core holes being sent for testing.

- Atrum commenced due diligence regarding possible takeover of Atlantic Carbon Group PLC (ACG), however is no longer considering an acquisition of the shares in ACG.

- Atrum secures up to 100,000 tonnes of anthracite from ACG to sell to potential long term international customers.

Bob Bell, Executive Chairman of Atrum commented:

"It has been a very busy and productive Quarter for Atrum. The multi-year exploration agreement with JOGMEC to finance an exploration program at our Panorama North tenure is already paying dividends as we have been able to complete the first year drilling program. No drilling has ever been done in the Panorama North area before, other than shallow auger holes, and we look forward to releasing the results, after coal testing is complete, and to undertaking an expanded program in 2017 with the support of JOGMEC and our Aboriginal Partners."

"Atrum entered an agreement during the Quarter to acquire a 26.68 per cent stake in Atlantic Carbon Group PLC (ACG), a public, but unquoted, anthracite mining company operating in Pennsylvania, USA. The Company then advised ACG of its intention to conduct due diligence with the aim of making an offer for all the shares and warrants in the ACG. However, the tight timeframes required by the UK Takeover Code and the difficulty in conducting due diligence on various US subsidiaries has resulted in a decision by Atrum not to pursue the purchase of ACG shares and warrants either at a minority or controlling level. The Company is in discussions with ACG in relation to a possible alternative transaction involving ACG."

"Atrum secured the rights to sell up to 100,000 tonnes of anthracite from ACG. We arranged laboratory testing of the anthracite and the results, confirming its premium quality, have been sent to numerous European and North Asian anthracite buyers. The Company is now in discussions with rail and port operators to co-ordinate possible shipments to potential customers."

"During the Quarter, all of Atrum's Groundhog Anthracite Project coal license applications were converted to coal licenses by the British Columbia Government. Atrum now has considerable exclusive coal exploration and development rights and greater certainty with respect to future exploration planning."

Groundhog Anthracite Project

The Groundhog Anthracite Project is located in the Groundhog Coalfield in northwest British Columbia, Canada. Groundhog covers an area of more than 800km2. Groundhog is prospective for high grade and ultra-high grade anthracite suitable for use in the manufacture of blast furnace steel, as well as electric arc furnaces, as a reductant, filter media, and feedstock for chemical production. The Company has devised concept plans for multiple mines for development in the Groundhog Coalfield, beginning with the Groundhog North Mining Complex, feeding a common coal handling and preparation facility (CHPP).

Bulk Sample Project

As noted in the Company's prior Quarterly Report, in May 2016, Atrum was awarded a Bulk Sample and related permits required to support the commencement of mining activities at Groundhog North. These permits allow Atrum to extract a bulk sample of up to 100,000 tonnes of anthracite from Groundhog North. The ultra-high grade lump and fine anthracite produced from the bulk sample are expected to be sold to various international customers for trials in blast furnace and sinter plants, with the potential to provide a portion of the product for beneficiation for specialty industrial users. These customer trials will assist the Company to secure long-term offtake agreements for supply of Groundhog Ultra High Grade 10% ash anthracite.

During the Quarter, Atrum continued with its preparation planning for the bulk sample mining operations. Additionally, internal planning work advanced in relation to implementation of the Special Use Permit also awarded to Atrum, which enables Atrum to establish ground based site access.

Atrum continues to discuss offtake with multiple anthracite consumers, and has received a number of new enquiries from traditional ferrous industry participants, and more recently consumers of specialised anthracite products. The bulk sample will assist customers to assess the suitability of Groundhog Ultra-High grade anthracite in their processes. Potential customers are a key avenue for assisting to fund the development of the Phase 1 mine, and the Company now has several groups investigating the technical details of the Groundhog Project. Given the continuing strong demand for anthracite in the seaborne market, the Company is investigating various ways to accelerate the Company's projects and supply ultra-high grade anthracite that remains in short supply.

Conversion of Coal Applications to Licenses

Late in the Quarter, all of the Company's Groundhog Anthracite Project coal license applications were converted to coal licenses by the British Columbia Government. Groundhog covers an area exceeding 800km2, and now comprises 88 granted coal licences. The additional 42 licences granted this Quarter almost doubles the area available for active exploration to the Company.

Obtaining these new coal licences is another positive development providing considerable additional exclusive coal exploration and development rights in the Groundhog area. They also provide the Company with greater certainty with respect to exploration planning in these areas, which augers well for maximizing the overall potential of the Groundhog Anthracite Project in the future. This is because drilling and mechanical trench sampling are not permitted on license applications but are permitted on full licenses.

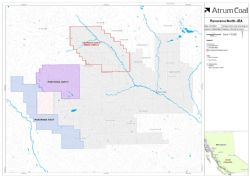

Panorama Projects

Atrum has three projects comprising its Panorama coal block, namely Panorama North, Panorama West and Panorama South, all situated southwest of Groundhog North (see Figure 1 in the link below). These three areas were previously explored in the early 1980's by Gulf Corporation (Canada), however Gulf's exploration efforts concentrated only on surface mapping, trenching and shallow auger drilling. The culmination of this phase of exploration was the declaration by Gulf of significant exploration targets for shallowly emplaced anthracite deposits.

The total area of all three Panorama Projects is 25,127 hectares. Panorama North has a total area of 7,359 hectares. Based on the value of JOGMEC's investment under the recently signed Panorama North Joint Exploration Agreement (discussed below), the implied current value of the three Panorama Projects combined is estimated at approximately A$50 Million.

Panorama North Joint Exploration Agreement

As announced on 29 August 2016, Atrum and its wholly owned subsidiary, Atrum Coal Panorama Inc., entered into a Joint Exploration Agreement with JOGMEC. Partnering with such a respected corporation as JOGMEC will assist Atrum to accelerate exploration at its Panorama North Project.

Historical exploration indicates Panorama North is highly prospective for anthracite. The focus of the next stage of exploration at Panorama North will be to build upon historical exploration and to begin quantifying the resource potential of this area. If successful, the three years of exploration will support future feasibility work, helping to establish Panorama North as another development zone within the Groundhog coalfield.

First Drilling Program at Panorama North Concludes

Subsequent to quarter-end, on October 6th, exploration drilling under the JOGMEC Agreement commenced at Panorama North. This quick start to exploration enabled Atrum to undertake a limited program of about two weeks' duration intended to produce early results confirming the prospects for anthracite coal in select drill areas. It also provided an opportunity for Atrum to further develop relationships with the Aboriginal Groups whose traditional territories overlap the Panorama North tenure.

Atrum employed two drill rigs which completed almost 1200 metres of fully cored diamond drilling in four holes. Shallow coal seams were intersected, including a seam with total vertical thickness of 2.30 metres, occurring at 12 metres depth. Two seams within the boreholes have similar geophysical signatures to the Duke E seam which is the primary economic target at Groundhog North. With field work concluded on October 21st, the cores will now be sent for further laboratory testing and analysis.

With the encouraging results from this initial program, the Company and JOGMEC intend to commence discussions regarding a 2017 drilling program, covering a wider area. Reengagement with our Aboriginal partners in this process will also be undertaken.

Anthracite Market Update

Global anthracite markets remain undersupplied, and market prices for anthracite are strengthening. Current prices for imported anthracite are approximately US$165/t for lumps and US$125/t for fines as illustrated in Figure 3 (see the link below). Recent metallurgical coal price increases are expected to put upward pressure on seaborne anthracite pricing. The benchmark coking coal price for premium hard coking coal price for the October quarter, widely reported in the coal industry, more than doubled from the previous level to US$200/tonne FOB Queensland which increases the value of anthracite as a coke replacement product.

CORPORATE

Acquisition of Shares and Takeover of Atlantic Carbon Group PLC On 4 August 2016, Atrum announced it had entered into an agreement related to the proposed acquisition of a 26.68% interest in Atlantic Carbon Group PLC ("ACG"). ACG is an unlisted public company registered in the United Kingdom and operates three high grade and ultra-high grade anthracite mines in northeast Pennsylvania, USA. On 15 August 2016, Atrum issued an ASX release providing further background on ACG.

The acquisition was subject to conditions including, inter alia, further due diligence, funding and Atrum shareholder approval. At an Extraordinary General Meeting held 29 September 2016, the required shareholder approval was granted.

On 20 September 2016, the Company announced that it had approached ACG in relation to making a possible takeover offer for all of the shares issued by ACG. Under the UK City Code on Takeovers and Mergers, following an application to the UK Takeover Panel, Atrum had until 5pm on 26 October 2016 (UK time) before it was required to either announce its intention to proceed with the takeover offer (and announce the terms of the offer) or announce that no offer would be submitted.

Due to the time constraints of the UK City Code and the difficulty in sourcing information from regulators in relation to ACG's US subsidiaries, the Company announced on 27 October 2016 that no offer will be submitted for all of the shares of ACG and that it has terminated the agreement to purchase a 26.68% minority stake. As of the end of October, the Company is in discussions with ACG in relation to a possible alternative transaction involving ACG.

Option Secured for 100K tonnes of Anthracite from ACG

On 11 August 2016, Atrum announced it had entered into an option agreement with ACG wherein ACG would make available up to 100,000 tonnes of anthracite to Atrum to sell to potential customers in Europe, South America and Asia. Net profits generated by the sale will be split on a 50/50 basis. This agreement allows Atrum to start selling anthracite into target export markets prior to development of the flagship Groundhog Project and while these markets are undersupplied and anthracite prices increasing.

To view the full report, please visit:

http://abnnewswire.net/lnk/O03ZSU0A

About Atrum Coal Limited

Atrum Coal Limited (ASX:ATU) is a metallurgical coal developer. The Company flagship asset is the 100%-owned Elan Hard Coking Coal Project in southern Alberta, Canada. Elan hosts large-scale, shallow, thick, hard coking coal (HCC) deposits with a current JORC Resource Estimate of 298 Mt (70 Mt Indicated and 228 Mt Inferred). Comprehensive quality testing of Elan South coal on samples from the 2018 exploration program, combined with review of substantial historical testwork data for the broader Elan Project, has confirmed Tier 1 HCC quality.

Atrum Coal Limited (ASX:ATU) is a metallurgical coal developer. The Company flagship asset is the 100%-owned Elan Hard Coking Coal Project in southern Alberta, Canada. Elan hosts large-scale, shallow, thick, hard coking coal (HCC) deposits with a current JORC Resource Estimate of 298 Mt (70 Mt Indicated and 228 Mt Inferred). Comprehensive quality testing of Elan South coal on samples from the 2018 exploration program, combined with review of substantial historical testwork data for the broader Elan Project, has confirmed Tier 1 HCC quality.

The initial focus for development is the Elan South area, which is located approximately 13 km from an existing rail line with significant excess capacity, providing direct rail access to export terminals in Vancouver and Prince Rupert. Elan South shares its southern boundary with Riversdale Resources Grassy Mountain Project, which is in the final permitting stage for a 4.5 Mtpa open-cut HCC operation. Around 30km to the west, Teck Resources operates five mines (the Elk Valley complex) producing approximately 25 Mtpa of premium HCC for the seaborne market.

| ||

|