Triples Lake Wells Potash Project Area on Creasy Transaction

Perth, Dec 2, 2015 AEST (ABN Newswire) - Goldphyre Resources Limited ( ASX:GPH) ("Goldphyre" or "the Company") is pleased to announce that it has tripled the size of its 100%-owned Lake Wells Potash Project in WA through a ground acquisition deal that will see an entity controlled by successful WA prospector Mark Creasy emerge as the company's biggest shareholder.

ASX:GPH) ("Goldphyre" or "the Company") is pleased to announce that it has tripled the size of its 100%-owned Lake Wells Potash Project in WA through a ground acquisition deal that will see an entity controlled by successful WA prospector Mark Creasy emerge as the company's biggest shareholder.

Highlights:

- Goldphyre secures rights to 100% of the potash on an additional 1,000km2 of tenure adjacent to its Lake Wells Potash Project, 500km NE of Kalgoorlie in WA, through an agreement with Lake Wells Exploration Pty Ltd ("LWE"), a subsidiary of WA prospector and investor Mark Creasy's investment company, Yandal Investment Pty Ltd

- LWE to become Goldphyre's largest shareholder with 19.9% stake post proposed capital raising

- The new LWE ground covers 130km2 of lake surface, tripling the size of Goldphyre's Lake Wells Potash Project, where it has already identified an extensive potassium-rich potash brine project

- Lake Wells now covers ~200km2 of the Lake Wells playa system surface area excluding consideration of depth and off-lake (palaeovalley) areas

- Goldphyre will immediately undertake a seismic survey on the new LWE ground and test the continuity of previously identified high-grade potash mineralisation onto the new ground, which will enable it to calculate a maiden Exploration Target for the expanded project by February 2016

- This will be followed by a drilling program to calculate a maiden Inferred Resource estimate by mid-2016, with a Measured Resource estimate set for Q1 2017

Under the agreement with Lake Wells Exploration Pty Ltd ("LWE"), a subsidiary of Creasy's investment vehicle Yandal Investments Pty Ltd, Goldphyre will acquire 100% of the potash rights on a large 1,000km2 ground package held by LWE immediately adjacent to the Lake Wells Potash Project, which is located 500km north-east of Kalgoorlie in WA (Figures 1 & 2, see link below).

This will triple the size of Goldphyre's exploration land-holding, including the ground over which it has rights to explore for potash, to 1,500km2, taking the total area of playa lake system which hosts the previously discovered high-grade potash mineralisation at Lake Wells to approximately 200km2.

Upon completion of the deal, Goldphyre will immediately conduct a seismic program on the LWE ground with a view to incorporating these tenements in a maiden Exploration Target scheduled for release in February 2016. Goldphyre will then conduct a drilling program on its and the LWE ground as part of its strategy to publish a maiden Inferred Resource by the middle of next year.

The expanded Lake Wells Potash Project is a brine-hosted sulphate of potash (SOP) project, which is aiming to supply the Australian domestic demand for SOP. Australia currently imports 100% of all potash consumed, estimated at 500,000 - 600,000tpa including approximately 50,000tpa of SOP.

The Company's existing 100%-owned tenure covers an area of approximately 70km2 of the playa lake surface, with previously announced exploration results demonstrating that potash-rich brines extend to depth and importantly, beneath the surrounding low sand dunes.

Goldphyre has reported high-grade potash from surface to depths of over 135m, with 3 of 17 holes being effectively open ended at this depth, meaning that palaeovalley bedrock was not intersected.

Goldphyre's Executive Chairman Matt Shackleton said the agreement with LWE had the potential to significantly increase the scale and potential of the Lake Wells Potash Project.

"In line with our strategy of developing the depth and grade potential of the palaeovalley running through our project area, this important ground acquisition will add significant further strike potential to the high-grade potash mineralisation we have already identified," he said.

"As we've previously shown, our project has high-grade potash which has been drill defined with very strong grades at over 135m down-hole. This means it has enormous potential to supply brines for an evaporative SOP operation. We also believe pumping brines from depth will ultimately lead to a cheaper cost of production, due to lower energy and maintenance costs compared to trenching or pumping brines over long distances.

"Goldphyre is in the fortunate and unique position of having established infrastructure to hand adjacent to and within the project, with no restrictions on access to the brinehosting palaeovalley. This will eliminate the need for expensive or challenging drilling solutions. By securing this additional strategic ground position we have been able to dramatically expand the footprint of the project, providing an exciting platform to generate strong news-flow next year as we move the project rapidly towards a maiden resource.

"We are also pleased as part of this deal to welcome to our share register one of the country's most prominent resource industry players. Mark Creasy brings a wealth of knowledge and experience to any minerals endeavour, and the Board looks forward to his future involvement in Goldphyre."

TRANSACTION TERMS

Under a Sale and Split Commodity Agreement with Lake Wells Exploration Pty Ltd, owned by Mark Creasy controlled entity Yandal Investments Pty Ltd, Goldphyre has secured rights to 100% of the potash minerals contained on two Exploration Leases with a combined area of approximately 1,000km2. The new tenement areas are contiguous to each other and the Company's existing 100%-owned Lake Wells Potash Project tenure (Figures 1 & 2).

LWE grants to Goldphyre 100% of the rights to explore for, extract, process and sell all potash minerals contained within brine within the boundaries of the two Exploration Leases. LWE further agrees to assist Goldphyre secure a Mining Lease(s) at the appropriate time, and to transfer that lease(s) to Goldphyre at Goldphyre's request.

Goldphyre will issue 19.9% of its issued ordinary shares to LWE, which will carry a voluntary 12-month escrow period. The 19.9% interest is calculated post any capital raise which is to be undertaken within 6 months from the completion date. Further, Goldphyre will issue to LWE 6,860,000 options with an expiry period of 5 years, exercisable in two equal tranches at 10 cents and 15 cents. The Company will seek from the Australian Securities Exchange a waiver from Listing Rule 6.18 with respect to the issue of ordinary shares to LWE.

TECHNICAL DISCUSSION

The LWE tenure consists of two tenements, E38/2742 and E38/2744. The western tenement E38/2742 has good access around the salt-pans and abuts the 100% held Goldphyre tenure (Figure 3, see link belo).

The Prenti Downs Road runs north through the tenement and the road-train accessible Lake Wells station road extends past the airstrip and into the heart of the project area. E38/2742 captures the interpreted trend of a substantial palaeovalley system drill tested in July 2015 by Goldphyre. That drilling tested encouraging potash results from pit sampling and recorded robust potash results over significant widths and depths. Pit sampling on E38/2742 has recorded similar, encouraging potash grades to those drill tested in the July 2015 drilling.

Historical air-core (AC) drilling has also been recorded at Lake Wells and several widespaced drill traverses are located on the newly acquired LWE tenure. The lithologies recorded in the historic drilling on LWE tenure are similar to lithologies encountered on the Goldphyre tenure, being transported sands, grits, lake clays and laterite overlying weathered Archaean mafic, ultramafic and granitoid rocks.

The LWE eastern tenement E38/2744 (Figure 4, see link below) captures the interpreted east-west extension of the palaeovalley system recognised to the west, with surface expression consisting of a series of playas on which some historic reconnaissance AC drilling has been completed.

The deepest historic hole in this area was LWAC054, which penetrated to a depth of 140m. The historical drilling recorded similar lithology types to that observed in the Goldphyre July 2015 drilling, with lacustrine clays, sands, saprolite and weathered granitoid observed.

NEXT STEPS

The next phase of work for the Company will culminate in the release of a maiden Exploration Target for the Lake Wells Potash Project, including the expanded project area following the LWE acquisition.

One of the key parameters in understanding a brine resource is the drainable porosity, or specific yield, of the brine saturated sediments. Generally, loosely consolidated sands and grits demonstrate very high drainable porosity, meaning that a large proportion of the brine contained within them is extractable.

In order to better understand this parameter at the Lake Wells Potash Project, Goldphyre will begin targeting the coarser grained sediments, including sand units anticipated to lie throughout and at the base of the saturated palaeovalley sequence.

The results of the recently completed seismic survey across the project, which the Company is aiming to release in the coming weeks once analysis is complete, will allow more accurate targeting of drill holes seeking to evaluate the depth potential of the coarse grained, transported sediments.

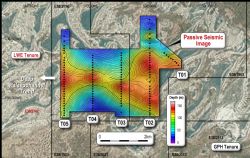

Preliminary interpretation of the seismic survey as shown in Figure 5 (see link below), indicates a significant, deep palaeovalley trending WNW-ESE extending onto the LWE tenement E38/2742 tenement in an area with poor drill coverage.

One historical, end-of-line hole (SDNI27) reached 120 metres in depth and recorded a sequence of saturated grits, sands and clays overlying tillite, wache & sandstone (sedimentary rocks of possible Permian Age), terminating in weathered Archaean granitoid. This suggests a substantial palaeovalley lies to the west and north of this drilling, and is a priority target area. This interpretation may be correlated with the Geoscience Australia WASANT palaeovalley interpretation (Figure 1 & 3) and surface playa expression.

To view the release including figures, please visit:

http://media.abnnewswire.net/media/en/docs/ASX-GPH-745113.pdf

About Australian Potash Ltd

Australian Potash Limited (ASX:APC) is an ASX-listed Sulphate of Potash (SOP) developer. The Company holds a 100% interest in the Lake Wells Potash Project located approximately 500kms northeast of Kalgoorlie, in Western Australia's Eastern Goldfields.

Following the release of a Scoping Study in 2017, APC has been conducting a Definitive Feasibility Study (DFS) into the development of the Lake Wells Potash Project. The Company is aiming to release the findings of the DFS in H2 2019.

The Lake Wells Potash Project is a palaeochannel brine hosted sulphate of potash project. Palaeochannel bore fields supply large volumes of brine to many existing mining operations throughout Western Australia, and this technique is a well understood and proven method for extracting brine. APC will use this technically low-risk and commonly used brine extraction model to further develop a bore-field into the palaeochannel hosting the Lake Wells SOP resource.

A Scoping Study on the Lake Wells Potash Project was completed and released on 23 March 2017. The Scoping Study exceeded expectations and confirmed that the Project's economic and technical aspects are all exceptionally strong, and highlights APC's potential to become a significant long-life, low capital and high margin sulphate of potash (SOP) producer.

| ||

|