Quarterly Activities Report

Quarterly Activities Report

Sydney, Oct 29, 2015 AEST (ABN Newswire) - KBL Mining Ltd ( ASX:KBL) announce the Quarterly Activities Report with significant highlights.

ASX:KBL) announce the Quarterly Activities Report with significant highlights.

Mineral Hill - Transformed to Gold and Silver Producer

- First gold concentrate was produced during September for sale in October

- Currently the open pit ore is being processed through the flotation circuits with latest results achieving 60 to 70% recovery of gold in line with testwork and with commencement of the CIL plant a further 15% recovery of gold and silver into dore is expected

- A total of 561,738 BCM has been excavated from the Pearse open pit to the end of September

- Pearse open pit produced and delivered some 20,000 tonnes of ore to the plant. On average, pit gold grades have been at 6.1 g/t with a range of 4 g/t to 14 g/t

- Construction of the leaching section of the CIL gold plant was completed in October, with first ore processing scheduled in November 2015

- During the quarter, the flotation plant capacity was doubled, a new thickener added and a cleaner circuit installed to improve metal recovery. This created three defined circuits for gold/silver or copper/gold, lead and zinc

Securing the Future

- Within the Southern Ore Zone (SOZ) underground drives have progressed for over 200 metres of strike length in the G Lode, preparing for an upper stoping level between 1025 and 1060 RL. The SOZ decline is now at the deepest point accessed in the field at over 350 metres below surface

- Underground grade control drilling to support mine planning in the G Lode (1060 to 1000 levels) is planned to start in January 2016

- Extensive work was carried out at Jacks Hut, where a copper gold resource has the potential to be the next mining option for Mineral Hill. A total of 11 new holes were drilled, old holes re-assayed and mine modelling commenced

- Applications were made to the Department of Industry, Resources & Energy to allow for infill and extension drilling of the Pearse North deposit which currently has an estimated inferred resource of 203kt @ 2.1 g/t gold and 21.1 g/t silver1

Sorby Hills Project

KBL's immediate priority has been establishing gold production at Mineral Hill, which will be complete by year end. We can then turn our attention to expanding the company through completion of the Sorby Hills feasibility study. Discussions are underway with potential financiers and equipment suppliers to optimise the project value.

MANAGING DIRECTOR'S OVERVIEW

In August 2014 we laid out a plan to our shareholders in which we would raise funds to repay the Capri debt and develop the Pearse high grade/low cost open cut at Mineral Hill while building a gold plant, doubling the flotation plant to three dedicated circuits for gold/silver or copper/gold, lead and zinc. The last months have been intense as we have developed, drilled and mined more than at any time in the history of KBL. The Capri/RIKID debt was paid in March and after several sessions in the Supreme Court the matters were resolved in KBL's favour. Once the funding was available the gold plant and all the above projects moved forward and I am proud to announce we have achieved all the goals with the Pearse open cut in production and the gold plant in commissioning scheduled to treat ore in November.

KBL and its shareholders and stakeholders have endured tough times with Capri/Kidman pushing the stock down from 7 cents to 1.8 cents; the variable performance of underground resources has not helped operations or the share price. Mineral Hill has significant mineral resources on surface and underground, however, the underground resources need tight space drilling for mine planning to reduce dilution and manage the grade. Over the months we ramped up the underground geological activity but it was evident that we could not mine 1,000 tonnes a day of good ore while keeping geological information at a level to have strong confidence in production grades. The next lode to be mined underground will be the G lode which has had parallel drives developed on 1060mRL level and 1025mRL level with a bottom drill access on 1000mRL. The G lode was well drilled at between 12 and 25 metre spacing's but we will ring drill it from 25 up and down for mining planning purposes and to negate the future risk in grade. The resource

grade of G lode is 2.1 g/t Au and 1.3% Cu2 making it a strong future mining area to be prepared.

During the quarter, KBL continued moving the focus of mining operations from maintaining an ore supply from the developed underground base metal deposits at the SOZ to the rich open cut gold/silver Pearse deposit and in turn bringing forward higher value production for the later part of 2015. During the transition, underground development continued in the SOZ decline, on the 1060 mRL and 1025 mRL levels where G and H lodes are being developed. This will provide stoping areas and exploration drilling platforms during the Pearse open pit mining phase.

For July and August, 100% of the ore production was extracted from the underground copper-gold (Cu-Au), polymetallic (Cu-Pb-Zn-Ag-Au) and lead-zinc (Pb-Zn) zones within the SOZ lodes. Geological issues resulted in the overall ore grades from underground being below expectations for both base and precious metals.

In parallel with the underground operations, open cut activities at the Pearse deposit continued at an accelerated rate. Pre-stripping of waste material continued in earnest during the quarter, along with haul road and waste dump construction. Monthly total movements of up to 205,000 BCM per month have been achieved at a low unit cost.

Ore production from Pearse was fast tracked with the open pit delivering suitable grade material to the plant stockpiles for processing to commence on the 31st August. During September, 100% of the ore production feed was from the Pearse deposit, with some 19,728 tonnes mined at average grades of 6.1 g/t gold and 23 g/t silver. To date, the ore production and grades correlate well with KBL's mine models and plans.

For July and August, production of separate copper, lead and zinc concentrates continued from the sequential flotation process on a campaign basis. As such, 143 tonnes of copper, 709 tonnes of lead and 531 tonnes of zinc metal were produced and sold through metal traders.

Leading up to and during September the plant was reconfigured to allow a gold concentrate to be produced. On the 31st August, the change-over was implemented and production of a high value gold and silver product commenced. During September, some 1,371 ounces of gold and 7,318 ounces of silver was produced in concentrate and stockpiled in readiness for sale in October.

During the initial ramp up period, recoveries were lower than expected as a result of optimising full scale plant operations for both oxide and sulphide ores with respect to grinding, flotation/reagents and filtration . These effects have been partially off-set by the high feed grades, particularly within the fresher sulphide ore. The Pearse flotation tailings are being stored separately in the recently completed tailings compartment within the existing Tailings Storage Facility No. 2 footprint, in readiness for re-introduction into the CIL processing stream.

Recent gold production results received in the second half of October show a step up in recoveries with the average around 60%, with peaks in line with the targeted 70%. The current mining plan has ore supply from the Pearse open pit continuing to be delivered to the ROM over the forthcoming 10 to 12 months.

Overall recoveries are set to increase once the CIL plant is commissioned, with overall recoveries of 85% for gold and 75% for silver. The CIL component of the plant is expected to have ore feed in November with the first gold/silver doré expected shortly thereafter.

During the Pearse mining phase, it is anticipated that underground operations will continue with development access to future production sources, such as the G and A lodes. Exploration drilling programmes will be fast tracked during this period.

Overview

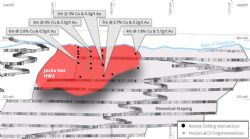

KBL continued to advance near-mine exploration during the quarter with assay results received for the Jacks Hut RC drill program completed in June and July 2015 targeting copper-gold mineralisation less than 100m from surface.

Significant results include:

o 4m at 1.6% Cu & 5.1g/t Au (KMHRC149)

o 7m at 2.7% Cu & 0.2g/t Au (KMHRC150)

o 7m at 1.9% Cu & 0.1g/t Au (KMHRC152)

o 6m at 2.6% Cu & 0.5g/t Au (KMHRC154)

o 5m at 1.6% Cu & 1.7g/t Au (KMHRC156)

The new results and review of historical drilling, assay and geological data have led to the estimation of a near-surface sulphide conceptual Exploration Target comprising 500-550kt @ 1.4-1.6% Cu (at a 1% Cu cut-off). The potential quantity and grade of the target is conceptual in nature. There has been insufficient exploration to define a Mineral Resource and it is uncertain if further exploration will result in determination of a Mineral Resource.

Jacks Hut

Eleven reverse circulation holes were drilled in June and July 2015 for a total of 916m, focussed on defining the Jacks Hut hanging wall system and testing continuity between widely spaced historical (20-40m) drilling in the northern part of the deposit (between 1360mN and 1480mN). The drilling intersected disseminated chalcopyrite +/- pyrite grading to sulphide +/- quartz breccia veining within a broad envelope of chlorite-altered volcanics. Significant mineralised intercepts are presented in Table 2.

After the completion of drilling, KBL engaged consultants, Geos Mining, to undertake a preliminary review of the drilling and geological data and provide a revised Exploration Target estimate, focused on the near surface (to approximately 200mRL or <130m from surface) sulphide component of the considerably larger Jacks Hut system. The potential quantity and grade of this exploration target is conceptual in nature — there has been insufficient exploration to estimate a Mineral Resource and it is uncertain if further exploration will result in the estimation of a Mineral Resource.

The resulting revised Jacks Hut sulphide conceptual exploration target comprises 500-550kt @ 1.4-1.6% Cu (at a 1% Cu cut-off). The target comprises vein-style and stockwork mineralisation on Mining Lease ML 5278, adjacent to the high grade breccia core mined by Triako Resources Ltd which yielded 11.9kt of copper and over 80,000oz of gold.

The new results augment a considerable assay database derived from approximately 18,000 metres of historical drilling (diamond, RC, and percussion) at Jacks Hut hanging wall, main lode (mined out) and footwall. The significant intercepts, location and orientation of historical drill holes deemed to be material to the definition of the exploration target have been included in Appendix 1.

On the back of the considerable historical and recent drilling, KBL intend to undertake additional geological modelling and drilling in early 2016, in particular to gain a better understanding of the controls on high-grade gold within the system. This will allow the Company to undertake a more comprehensive Mineral Resource estimate for the Cu-Au mineralisation and assess the viability of this deposit to support an open pit operation.

SORBY HILLS, WESTERN AUSTRALIA (KBL 75%)

Project and Approvals

The Sorby Hills Project, located in the East Kimberley Region of Western Australia, is a joint venture between KBL 75% (Manager) and Henan Yuguang Gold & Lead Co., Limited 25% (Yuguang). Yuguang was established in 1957; listed on the Shanghai Stock Exchange in 2002 (exchange code: 600531), and is the biggest electrolyzed lead and silver producer in China.

The Project consists of nine shallow high grade deposits within a linear north-south mineralised trend extending over a 10 kilometre strike length. To date, the total Resource of the trend, as defined by KBL stands at 16.5 Mt at 4.7% Pb, 0.7% Zn and 53 g/t Ag3, which has the potential to support a multi decade operation.

In late 2013, KBL announced a maiden Ore Reserve estimate for the Sorby Hills DE deposit. The Probable Ore Reserve of 2.4 Mt @ 5% lead and 54g/t silver4 (applying a cut off of 2% lead), underpins the plan for an initial 10 year open cut operation, processing over 400ktpa. In conjunction with the Reserve, a new Mineral Resource estimate for DE Deposit totalled 5.8 Mt @ 3.5% lead, 0.4% zinc and 41g/t silver5 (applying a cut off of 1% lead). The Mineral Resource is inclusive of the Ore Reserve and consists of both Indicated and Inferred Mineral Resources.

While the Company is focused on the Mineral Hill mine for short to medium term production the Sorby Hills project is the focus for development of new long life lead-silver production. A recent gap analysis indicated that there are no significant issues for the project to progress to a full feasibility study.

KBL expects a range of funding options will be available for its share of the development costs due to the robust project economics, the low risk of development and operating parameters, well developed infrastructure, proximity to port, and strong international demand for the off take. The development task will be assisted by the Company's operating experience and expertise already in place with the Mineral Hill operation and the support of its 25% Joint Venture partner, Yuguang with its large lead, zinc and copper smelting facilities in China.

The receipt of environmental approval for the project from the WA Minister for Environment; Heritage in April 2014 has opened the way for the completion of licensing and an accelerated development program.

To view tables and figures, please visit:

http://media.abnnewswire.net/media/en/docs/ASX-KBL-739812.pdf

About KBL Mining Ltd

KBL Mining Ltd (ASX:KBL) is an Australian resource Company listed on the ASX with a focus on producing precious and base metals. KBL's main assets include the Mineral Hill copper-gold-silver-lead-zinc mine near Condobolin in New South Wales and Sorby Hills lead-silver-zinc project in Western Australia. The Company has been operating the refurbished processing plant at Mineral Hill since October 2011 to produce copper-gold concentrates and in 2013 commenced producing a separate lead-silver concentrate. Sorby Hills (KBL holds 75% with Henan Yuguang Gold & Lead Co. Ltd (HYG&L) holding 25%) is a large near surface undeveloped silver-lead deposit close to port infrastructure and a short distance from Asian markets.

KBL Mining Ltd (ASX:KBL) is an Australian resource Company listed on the ASX with a focus on producing precious and base metals. KBL's main assets include the Mineral Hill copper-gold-silver-lead-zinc mine near Condobolin in New South Wales and Sorby Hills lead-silver-zinc project in Western Australia. The Company has been operating the refurbished processing plant at Mineral Hill since October 2011 to produce copper-gold concentrates and in 2013 commenced producing a separate lead-silver concentrate. Sorby Hills (KBL holds 75% with Henan Yuguang Gold & Lead Co. Ltd (HYG&L) holding 25%) is a large near surface undeveloped silver-lead deposit close to port infrastructure and a short distance from Asian markets.

![abnnewswire.com]()

Related Companies

Social Media

Share this Article

ASX:KBL) announce the Quarterly Activities Report with significant highlights.

ASX:KBL) announce the Quarterly Activities Report with significant highlights. KBL Mining Ltd (ASX:KBL) is an Australian resource Company listed on the ASX with a focus on producing precious and base metals. KBL's main assets include the Mineral Hill copper-gold-silver-lead-zinc mine near Condobolin in New South Wales and Sorby Hills lead-silver-zinc project in Western Australia. The Company has been operating the refurbished processing plant at Mineral Hill since October 2011 to produce copper-gold concentrates and in 2013 commenced producing a separate lead-silver concentrate. Sorby Hills (KBL holds 75% with Henan Yuguang Gold & Lead Co. Ltd (HYG&L) holding 25%) is a large near surface undeveloped silver-lead deposit close to port infrastructure and a short distance from Asian markets.

KBL Mining Ltd (ASX:KBL) is an Australian resource Company listed on the ASX with a focus on producing precious and base metals. KBL's main assets include the Mineral Hill copper-gold-silver-lead-zinc mine near Condobolin in New South Wales and Sorby Hills lead-silver-zinc project in Western Australia. The Company has been operating the refurbished processing plant at Mineral Hill since October 2011 to produce copper-gold concentrates and in 2013 commenced producing a separate lead-silver concentrate. Sorby Hills (KBL holds 75% with Henan Yuguang Gold & Lead Co. Ltd (HYG&L) holding 25%) is a large near surface undeveloped silver-lead deposit close to port infrastructure and a short distance from Asian markets.