Wapiti Phosphate Scoping Study Update

Perth, May 28, 2015 AEST (ABN Newswire) - Fertoz Limited ( ASX:FTZ) ("Fertoz" or the "Company") released on 14 May 2015 a Scoping Study for a small-scale rock phosphate mine at the Company's 100%-owned Wapiti project in British Columbia. A 20 year project life was determined from an Indicated and Inferred Resource of 1.54Mt at 21.6% P2O5. The project mining model is based on 60% Indicated, 40% Inferred Resources.

ASX:FTZ) ("Fertoz" or the "Company") released on 14 May 2015 a Scoping Study for a small-scale rock phosphate mine at the Company's 100%-owned Wapiti project in British Columbia. A 20 year project life was determined from an Indicated and Inferred Resource of 1.54Mt at 21.6% P2O5. The project mining model is based on 60% Indicated, 40% Inferred Resources.

The base case study resulted in:

Post tax, unlevered NPV10 real (20 years) - C$20.1m

Post tax, unlevered IRR - 82.4%

Capital cost phased over 3 years - C$2.7m

Payback (discounted, after tax) - 2018

Net cash flow pre-tax first 20 years - C$69.8m

Results using a 10% post tax real discount rate, C$ 1:00: A$1.04, flat real commodity price of C$ 250/t.

Managing Director Les Szonyi said "Fertoz has enough Indicated Resource for 13 years of project life and further exploration is planned, once the project is generating free cash, to confirm a 20 year project life can be achieved."

"The Scoping Study has been specifically designed to minimise upfront capital expenditure and achieve near term positive cash flow with a shallow, 7m deep open pit design for the initial 7 years of the project. With fertiliser sales well underway through our FertAg JV in Australia and the likelihood of near term commercial production in North America, Fertoz continues to establish its credentials as an emerging agribusiness."

Cautionary Statement

In accordance with ASX listing rules, the Company advises the results of the Scoping Study referred to in this announcement are based on lower confidence technical and preliminary economic assessments that are not the level of pre-feasibility or feasibility studies. The results and outcomes of this study are not technically sufficient to support Ore Reserves (JORC 2012) or to provide assurances as to the economic viability of any mine development, or that any development will proceed. The production target referred to is partly based on Indicated and Inferred Mineralisation. There is a low level of geological confidence associated with inferred Mineral Resources and there is no certainty that additional exploration work will result in the definition of Indicated Minerals Resources, or that mine development and production will be realised. Approximately 40% of mineralisation included in the study is of the Inferred category.

Next steps and further opportunities

Fertoz is now progressing the final permit approvals and is conducting commercial discussions with potential offtake partners.

There are significant growth options for the Wapiti project beyond the Scoping Study. These options are being assessed by Fertoz concurrently with advancing the project as per this Scoping Study. As well, the Company is advancing certain development aspects to the Feasibility Study level and will update the market as milestones in relation to commencement of mining are reached.

Growth options for Wapiti include, but are not limited to, the following:

1. An extended reach (10m) excavator can be used in Stage 1 mining (compared to a 6m excavator in the Scoping Study). Mining costs for first 7 years have been based on a 6m excavator as this was proven effective during the bulk sample collection in 2014 (constructing a 1m bench and 6m reach for total of 7m). An extended reach excavator would extend Stage 1 mining to 9 years and reduce initial mining costs to C$21.1/t. Preliminary estimates are that an extended reach excavator would increase the Scoping Study NPV to C$22.2m with an IRR of 88.1%;

2. Further exploration is expected to extend the mineable phosphate horizon from 12.5km up to a maximum of 39km. This would increase mine life beyond the current 20 years and reduce Stage 1 costs due to the extended period of Stage 1 mining;

3. The economics are based on selling 0.15mm rock phosphate. In late 2016, at the same time as moving the processing equipment from Stettler to Dawson Creek, additional equipment could be in installed at Stettler to process the 0.15mm phosphate rock into a granule or pellet. Additional products can be added to the process to produce N-P-K conventional fertiliser mixes with numerous trace minerals. With this machinery in place, the Company could produce not only 0.15mm ground rock phosphate for sale to farmers and other fertiliser processing companies from the Dawson Creek facility, but also a conventional fertiliser mix for sale to farmers in western and central Alberta from the Stettler facility, further improving project economics;

4. Project economics could be improved by ramping up to full production of 75ktpa in 2017. This would require bringing forward the capital expenditure of C$2.5m so C$0.5m is spent in 2015 and $2m is spent in 2016. On this basis, the Scoping Study NPV would increase to C$21m with an IRR of 88.0%.

Scoping Study

The Scoping Study is based on a staged open pit development and the recently upgraded Wapiti resource (refer to ASX announcement "Fertoz upgrades Wapiti phosphate resource" released 12 May 2015.) The Scoping Study includes 3 stages in the proposed design, with an initial 7m open pit for the first 7 years of the project at an average strip ratio of 1.6:1. The Scoping Study conservatively assumes a 75ktpa production rate is reached in 2018, though it is possible this could be brought forward to 2017. The planned mine area contains a low risk resource which is outcropping, homogenous, and has been drilled and bulk sampled by Fertoz. Refer to Table 1 below for the key assumptions and financial metrics.

Mining

The mineralisation at Wapiti is steeply dipping to sub vertical and extends over an estimated strike of up to 39km in length. Only 12.5km of this has been included in the Scoping Study, with the remainder representing potential additional mining opportunities. The relative uniformity and narrow nature of the deposit means that mining will be of a narrow-slot trenching style from the surface. The trench will progress down in slots (benches) with the first bench 1m below the surface. This method allows the first 6 years of production at Wapiti to be completed at less than a 1.6:1 strip ratio which greatly benefits free cash flow. After mining, excavated areas are backfilled and the area is subject to reclamation. This process has been optimised during the previous bulk sample extraction (Figure 1), where Fertoz gained significant experience in local conditions and expected performance of the extraction process for full scale mining.

Mining is planned to take place on a seasonal basis between May and October to maximise productivity and ease of access. Mined material will be transported, stockpiled and sold after it is processed to meet various market requirements. Current permits exist for 17.5ktpa of phosphate rock production and additional permit applications have been submitted to increase production to 75ktpa. It is expected that this amount could be produced and transported off-site within a 5 to 6 month period. To date, Fertoz has mined approximately 2.7kt of rock phosphate for processing and sale from both the Wapiti and Fernie projects. The Scoping Study has been completed on the basis of 75ktpa rock phosphate mined and sold. Whilst there is a compelling economic case for development based on this level of production, there are possibilities to expand production levels beyond 75ktpa thereby enhancing economic outcomes.

Infrastructure

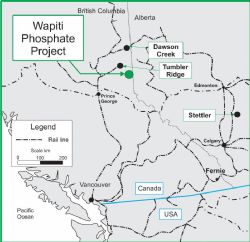

The Wapiti project is located 850km north east of Vancouver, British Columbia (BC), 145km north east of Prince George, 70km south east of Tumbler Ridge (coal mining town) and 180km south east of the rail hub at Dawson Creek (Figure 2 in link below).

Ready access to the Wapiti site is possible via a number of public roads. These are suitable for the transport of heavy equipment and haulage of excavated material. A number of existing trails and roads exist on the Wapiti property. Several of these roads require an extension to facilitate the bulk sampling activities and to support ongoing operations.

In September 2014, a Notice of Work was submitted to construct a new access road which will allow phosphate rock to be transported from site using highway-registered trucks, most likely of B-Train capacity (36-40t).

The operation requires a limited amount of on-site infrastructure to be developed and used to support extraction operations of the bulk sample. Such infrastructure includes, but is not limited to:

- Feed stockpile;

- Overburden stockpile;

- Staging stockpile;

- Haul roads; and

- Camp accommodation.

Production would commence on a reduced scale with 30kt in 2016, 50kt in 2017 and rising to full production in 2018.

Margins per tonne sold are estimated at C$81/t (32% of sales price) for the first 7 years of the project.

Processing

After mining on site, pre-crushed material is transported as broken rock to a manufacturing facility that will be established close to existing infrastructure. At this facility, rock is crushed to reduce the phosphate rock from 40mm (crushed rock) to approximately 0.15mm (ground material). Initial processing of bulk samples is planned to be conducted at Stettler where 1kt of rock phosphate from Fernie is currently stored. A Raymond mill will be purchased to grind the 40mm rock down to 0.15mm. Stettler (Figure 2) is the centre of a major farming area in Alberta. There is a further 9kt of bulk sample available for collection at Fernie for processing at Stettler under the current Fernie Bulk Sample Permit. Extension of the bulk sample amount or permitting for a small-scale mine are growth options for Fernie which will be reviewed by the Company during 2015.

The Scoping Study assumes that the Raymond mill will be moved to Dawson Creek (Figure 2) in 2016 (118km from Tumbler Ridge) where production from Wapiti East will begin. Dawson Creek has the advantage of being a proximal rail hub to Edmonton, Calgary, Prince George and Vancouver. It also has a trained workforce, industrial facilities, spare parts and industrial land.

The crushed rock phosphate from the Wapiti mine will be transported by road to the Raymond mill at Dawson Creek. From here, the product can be trucked or railed to customers (farmers and other third party fertiliser manufacturers).

Once the Raymond mill has been moved to Dawson Creek, additional processing equipment can be installed at Stettler to process the 0.15mm rock phosphate railed from Dawson Creek into other phosphate products. With this machinery in place at Stettler, the Company could provide ground rock phosphate for sale to farmers in the local area and other fertiliser processing companies, and also a more conventional fertiliser N-P-K mix. As well, rock phosphate from Fernie could be transported for processing at Stettler under an expanded Bulk Sample Permit or Small Scale Mining Permit. There is also the potential for a separate processing facility to be constructed at Fernie however this is not addressed in this Scoping Study. There is also the potential for the Company to supply Fernie rock phosphate to other organic fertiliser facilities in northern Montana and Washington State.

Permitting and timetable

Fertoz currently has permits to extract 17.5ktpa of rock phosphate at Wapiti. In November 2014, the Company submitted a Small Mine Application to the British Columbia Ministry of Mines to extract up to 75ktpa of phosphate rock from its Wapiti project.

The Company is expecting to receive approval for its Small Mine Application at Wapiti in 2015. The next steps in the process are to:

a) Complete a survey of the mine lease - target date June 2015; and

b) Complete benefits agreement with the First Nations - target date August 2015

Discussions are continuing with the First Nations as part of the mine approval process.

The fertiliser season in Canada typically runs from April to September while the best time to mine product at Wapiti is from May to October. The Scoping Study assumes that 10kt of phosphate rock will be sold in 2016 and 30kt of phosphate rock inventory is built up in 2016 for processing and sale from April to June of 2017.

The proposed timetable for the Wapiti development is shown in Figure 3. A key focus of the timetable was to minimise costs in 2015 by collecting the remaining 9kt bulk sample from Fernie and processing it at Stettler using contractors. Sales from the total 10kt Fernie bulk sample are expected to be realised at the start of 2016 generating C$1.8m in revenue for Fertoz. Major processing equipment purchases are not required until 2017 when the production ramp-up to 75ktpa is planned. Some of the Fernie bulk sample located at Stettler may be suitable for screening and supply to local farmers - this is currently being assessed.

Capital costs

Capital costs have been estimated using a combination of firm quotes (processing equipment, jaw crusher, industrial site) and industry experience. Total capital required is estimated to be C$2.7m which will occur over the initial 3 years of development (or two years under an accelerated production regime). Table 2 provides a detailed capital cost estimate.

Fixed costs

The Scoping Study assumes that the annual fixed costs associated with the mining operation include camp set-up, site preparation, equipment mobilisation, insurance, environmental analysis, geotechnical assessment, quality assurance, administration and community liaison. Other fixed costs include a full time Chief Operating Officer in Canada, Sales / Business Manager, marketing, administration and associated costs with the processing facility.

Total fixed costs are expected to be C$300k in 2015, C$550k in 2016, C$600k in 2017 and C$616kpa from 2018 onwards when it is expected there will be two teams operating at Wapiti to extract 75ktpa in 5 months.

Phosphate pricing

The Scoping Study assumes an estimated realised price of C$250/t based on consultation with Sunalta Fertilizer Ltd (Fertoz distributor). This is the expected price for bulk product in Alberta with a minimum P2O5 content of 19%. A distribution fee of 20% is payable on the sale price.

This compares to market prices which vary from C$285/t (20t lots) to C$700/t (1t bagged material) for phosphate rock ranging between 16% and 27% P2O5 with 2% to 3% phosphate availability. The product could also potentially be micronized to less than 10 microns, which attract prices of over C$2,500/t. Fertoz sold an initial 26t at a discounted price of C$200/t in late 2014 within the Stettler farm area between Edmonton and Calgary, Alberta. Fertoz has since confirmed pricing to be at least C$250/t for the Wapiti ground rock phosphate. Pelletised products attract a higher price, as does ground rock phosphate that is bagged and/or micronized. All of these options are available to the Company but have not been included in the current Scoping Study.

Laboratory results from the 2t bulk sample collected at Wapiti East in October 2013 demonstrated low heavy metal impurities from Wapiti. The results achieved a 10% phosphate availability, which makes the Wapiti East product particularly attractive to the organic fertiliser market as a direct application product. The result can be compared to other known phosphate areas such as North Carolina, USA and Sechura, Peru which typically demonstrate 6% to 7% phosphate availability and exhibit good agronomic effectiveness on suitable soils and crops (Sinclair, New Zealand Journal of Agricultural Research 1998).

The Wapiti project is ideally located; close to the major farming regions of eastern British Columbia and western Alberta. Farms in these areas are a mixture of broad-acre and intensive agricultural operations, with farmers fertilising their ground through either broad-acre spreading or directly into seed rows. The area has numerous third-party distribution points - often a series of silos with various fertiliser components. Farmers travel up to 200km to collect their bulk fertiliser from these silos.

Fertoz is aiming to have Wapiti rock phosphate as a feedstock for these third-party distributors so that farmers across British Columbia and Alberta can access Wapiti rock phosphate directly or via third-party agents and distributors. Discussions with third party producers are ongoing and the Company has supplied samples of ground Wapiti rock phosphate to other fertiliser manufacturers for test purposes.

The combined US/Canada organic goods market is worth US$34.5bn, or 48% of the global organic food market. The value of the Canadian organic food market has tripled since 2006, far outpacing the growth rate of other agri-food sectors. It is estimated that 58% of all Canadians are buying organic products on a weekly basis. Currently, there are more than 3,700 certified organic farms in Canada. Organic farms are found in every province in Canada producing fruits, vegetables, hay, crops (i.e. wheat, oats, barley, flaxseed and lentils), animal and animal products, and herbs. More than half of all certified farms are found in Western Canada. Organic growers typically use organic phosphorus sources, like Wapiti rock phosphate, to provide phosphorus for crop development. (FiBL IFoam Organic World 2014).

To view all tables and figures, please visit:

http://media.abnnewswire.net/media/en/docs/ASX-FTZ-860018.pdf

About Fertoz Ltd

Fertoz (ASX:FTZ) is an Australian-based phosphate exploration and development company with a range of projects in British Columbia, Canada as well as Queensland and the Northern Territory. The Company is focused on becoming a fertiliser producer as quickly as possible, initially focusing on the Canadian/USA markets.

Fertoz (ASX:FTZ) is an Australian-based phosphate exploration and development company with a range of projects in British Columbia, Canada as well as Queensland and the Northern Territory. The Company is focused on becoming a fertiliser producer as quickly as possible, initially focusing on the Canadian/USA markets.

Fertoz plans to develop its exploration assets in Canada in order to identify any potential Direct Shipping Ore (DSO) projects. It intends to seek joint venture partners to assist in funding the exploration projects in Australia.

Phosphate is a commodity necessary for feeding the world, and Fertoz is ready to capitalise on this growing demand.

| ||

|